The image above is of the street-facing windows and facade at the New York Yacht Club, poured and molded concrete in the shape of a ship’s stern. It’s one of the many landmarks on 44th Street, a few blocks away from my office, and the site of this Thursday’s DoubleLine Lunch with Jeffrey Gundlach for the fourth year running.

I took a bunch of notes from the event and have assembled them in a logical order below along with some slides, just as I’ve done for you the past three years (see 2011 here, 2012 here and 2013 here for reference).

Without further ado, here’s what I took away from the event:

Jeffrey began today with a Samuel Morse anecdote about how he contributed to the invention of the telegraph (aka Morse Code) but did not exactly invent it…

The idea behind opening with the Morse anecdote was to demonstrate how many attempts it took for Morse and his colleagues to figure out a code that people could understand and then a transmission mechanism that would allow electrical impulses to travel far distances. Morse’s earliest telegraph language involved a highly complex (and nonsensical) system in which dots and dashes were converted not to letters but to numbers. The numerical code would then need to be transposed to an alphabetical cypher for the person on the receiving end to be able to understand the message. It is not until one of Morse’s art students at NYU, Alfred Vail, gets involved that the electro-mechanical issues get solved and then the language that would become true Morse Code is born.

Jeffrey is setting the stage with this allegory to explain why Fed policy (and its transmission mechanism into the real economy) has not been nearly as successful as advertised.

Jeff’s view is that, while markets seem to be big fans of Fed policy, the large problems surrounding healthcare costs, social security liabilities and the demographic cliff (fewer workers, higher percentage of the population relying on the entitlement system) have not even been touched. He also believes the exit from QE is probably not a foregone conclusion, he is very skeptical of what he refers to as a “circular financing scheme.”

Morse’s telegraph is demonstrated for the first time publicly as it sends a message across a distance of twenty feet, then one thousand feet, then ten miles. The first ever long distance message Morse transmits is the phrase “What hath God wrought” from the biblical Book of Numbers. The telegraph leaves the the US Capitol and is received by Vail at the railroad station in Baltimore, Maryland. Vail transmits the same message back to Washington. Jeffrey jokes that “thus, Twitter was born!”

Jeff’s point is that “If QE works, it is the most important invention since Morse Code. It solves the biggest conundrum of the new millennium.” He is obviously not a believer that debt monetization can really work as a long term solution.

On to the slides:

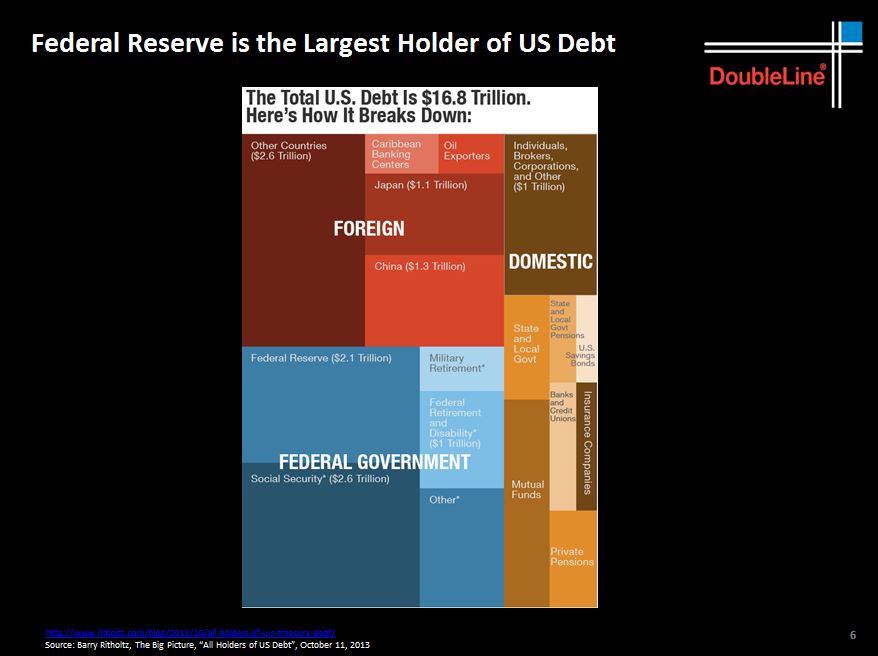

Below, an overview of who “owns” our debt:

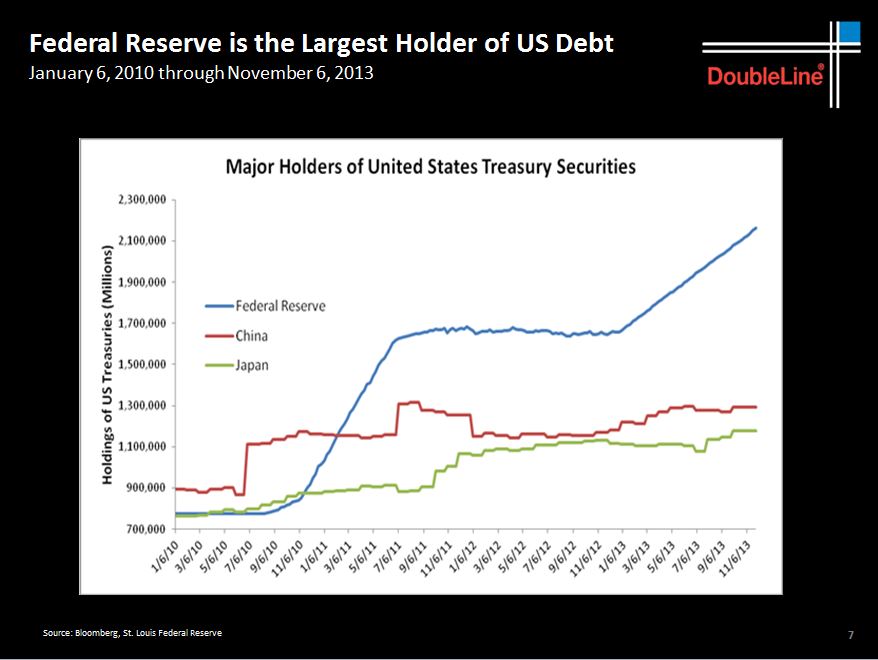

Jeff explains how twenty years ago, the big fear was “Who is going to buy all our debt when the Japanese lose their appetite for it?” The Japanese were quickly replaced by the Chinese, whose appetite for treasury bonds seemed insatiable up until recently. Now, of course, the Fed has supplanted virtually all other buyers – and by a long shot (see the blue line below):

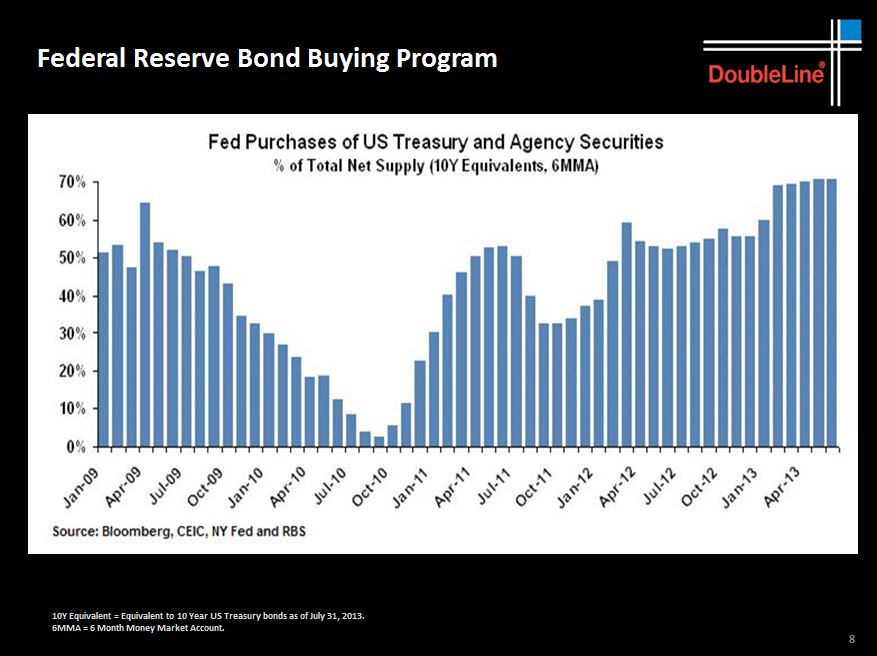

As you can see below, the Federal Reserve’s stimulus programs have made it the largest purchaser of treasury securities and agency mortgage backed bonds – the central bank is now 70% of the market for these instruments.

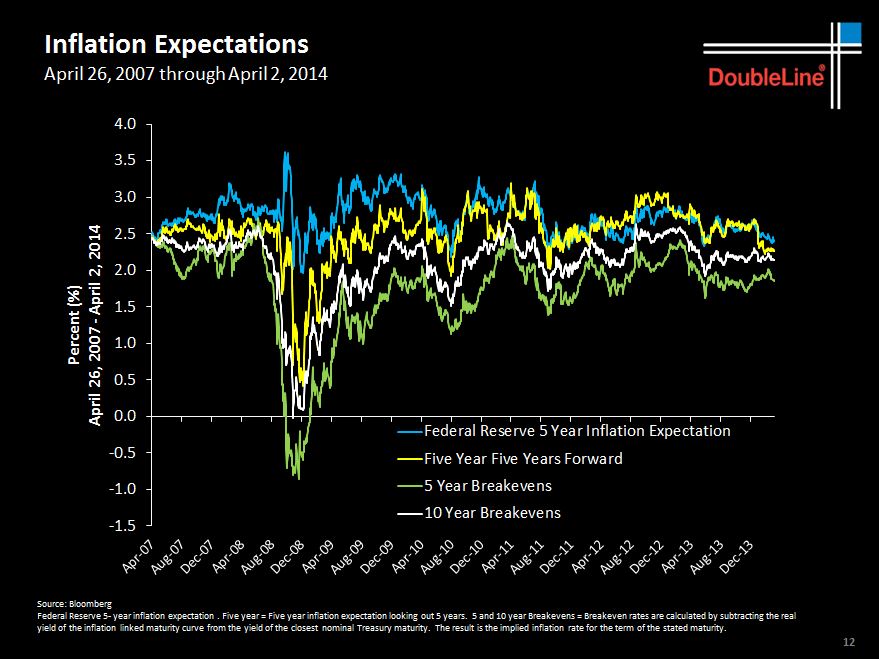

The reason this has been able to continue for so long is that inflation has been utterly absent. In fact, as you’ll see below the four major indicators of inflation are actually at lower levels than where they were when QE began in September of 2011. This is the opposite outcome from all the dire predictions of hyper-inflation of that era.

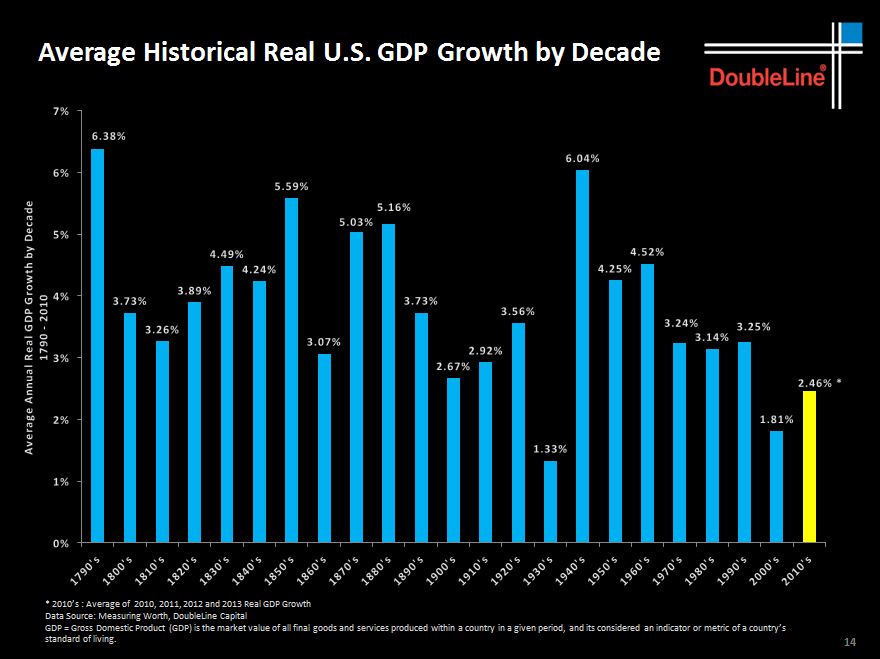

Can the good old days of rapid, steady economic growth return? It sure would solve a lot of our problems…

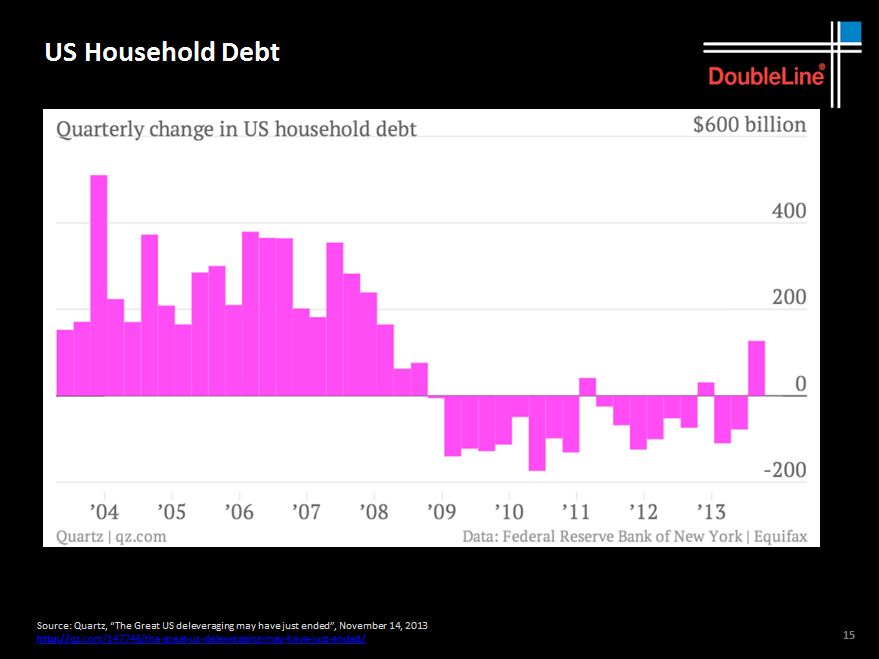

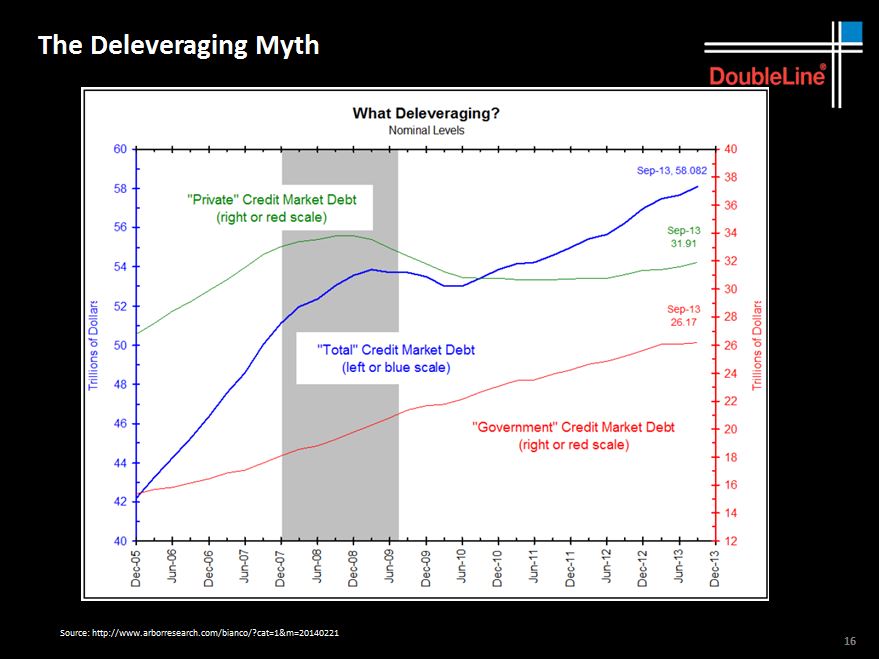

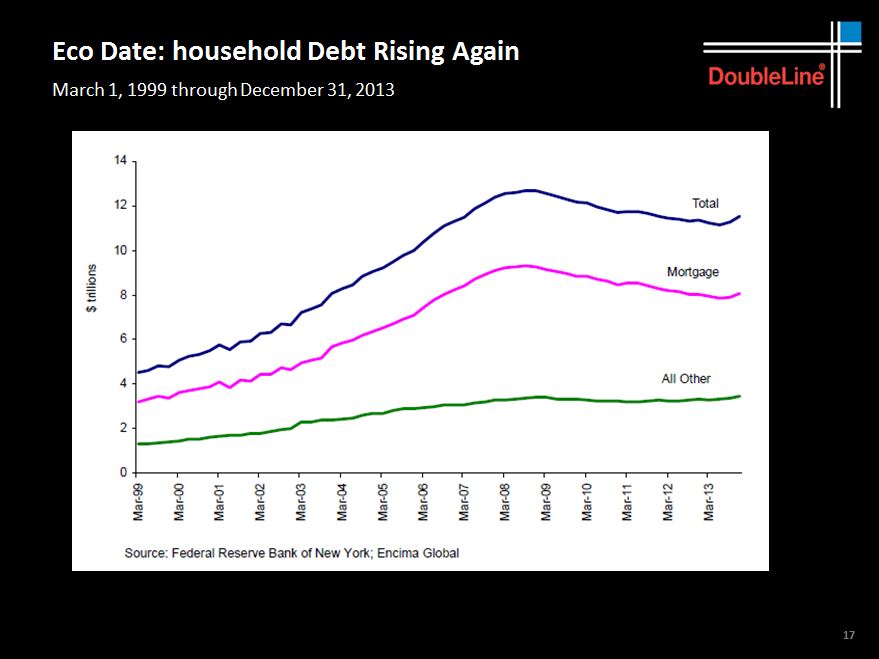

Optimists are pointing to the fact that the consumer deleveraging cycle has bottomed and that consumer credit has actually just begun expanding last quarter for the first time since the crisis…

…unfortunately, the truth is that deleveraging is a myth. Jeff says the only thing that’s really happened is that debt has been transferred from the private sector to the government’s balance sheet. In fairness, he admits that mortgage refinancing has helped, but that mortgage writeoffs – which have also helped – are not great for future growth because the households who are associated with those writeoffs now have credit that’s been destroyed. See the green line below, which incorporates mortgage debt:

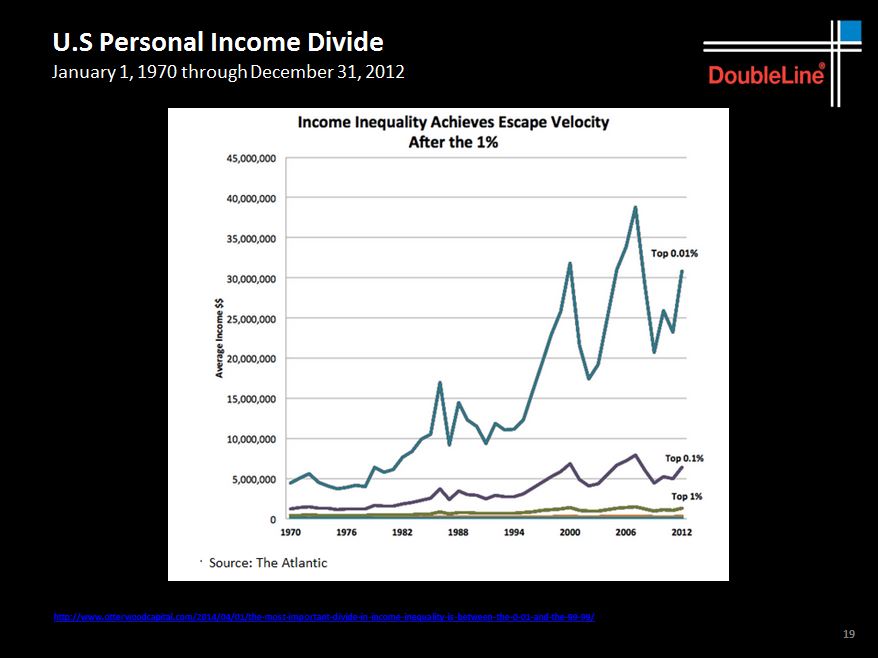

In the meanwhile, it is not even up for debate that the Fed’s stimulus programs have been almost exclusively beneficial to the top 1% – and that even within the top 1% it is uncanny to see just how imbalanced the Federal Reserve’s benevolence has been. The incredible boost for the top .01% relative to the .1% and the 1% is goes a long way toward proving the faults of the Fed’s transmission mechanism of stimulus into the real economy. Owners of capital are gaining a vastly more obvious advantage.

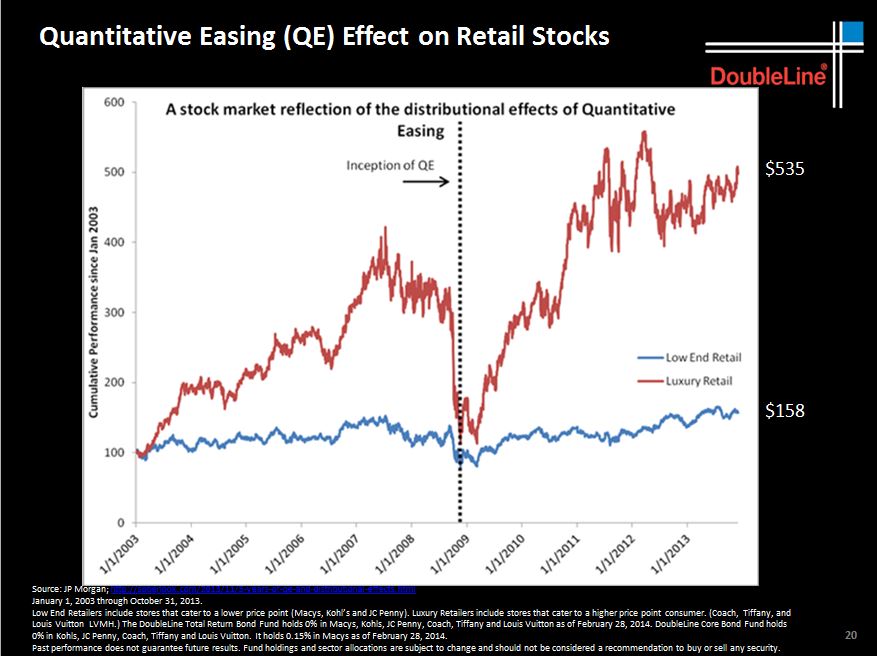

One more on income inequality being a direct effect of quantitative easing – check out that separation between the shares of luxury retailers (Tiffany, Coach, Ralph Lauren, Nordstrom) vs the shares of low-income retailers (Wal-Mart, Target et al) since the opening bell of stimulus. This one’s a doozy:

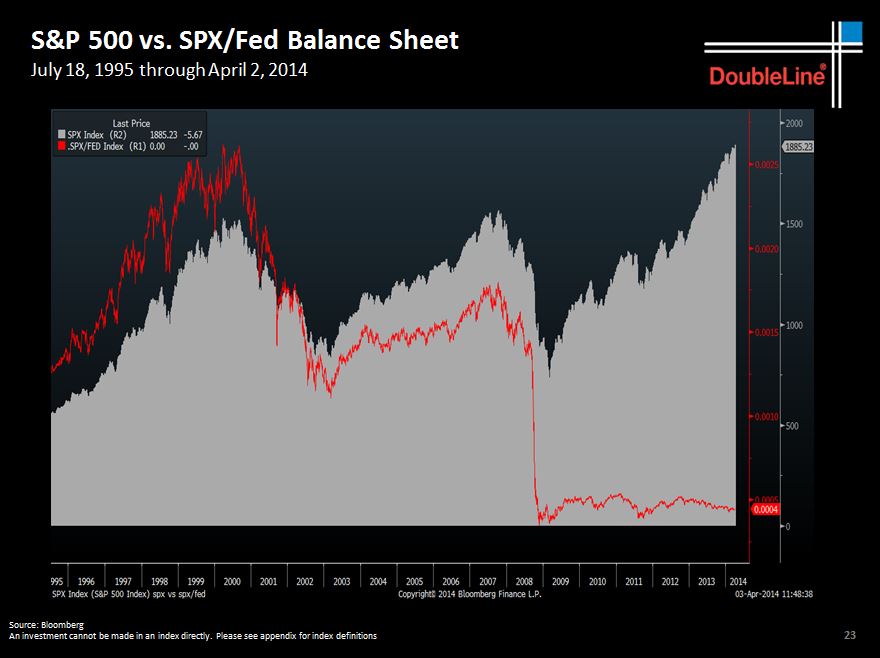

The gray area chart below is the S&P 500. The red line, which has flattened out since the crisis, is the S&P’s market capitalization divided by the Federal Reserve’s balance sheet. It’s almost a one-for-one relationship. Jeff says he can’t explain exactly how money goes from the Fed taking on more debt to the stock market’s assets ballooning, but he can’t imagine how it could possibly be a coincidence.

Here’s margin debt at a new all-time peak – a chart that greatly worries Jeffrey given its implications for what happens when prices cease to rise. He thinks that when this borrowing-to-buy-stocks trend rolls over, its going to roll hard and fast. (Josh: did this process already get underway this week?)

Jeff looks at the gold market. He’s not a big gold guy, but says that if you’ve held it this long (and through this much pain), “for god’s sake don’t sell it here!” He thinks the holders who remain are the quintessential, proverbial “strong hands” and that gold miner equities are completely underpriced for the potential of the metal running back up again. He’s more positive on commodities now in general, given how uninterested the investment community seems to be.

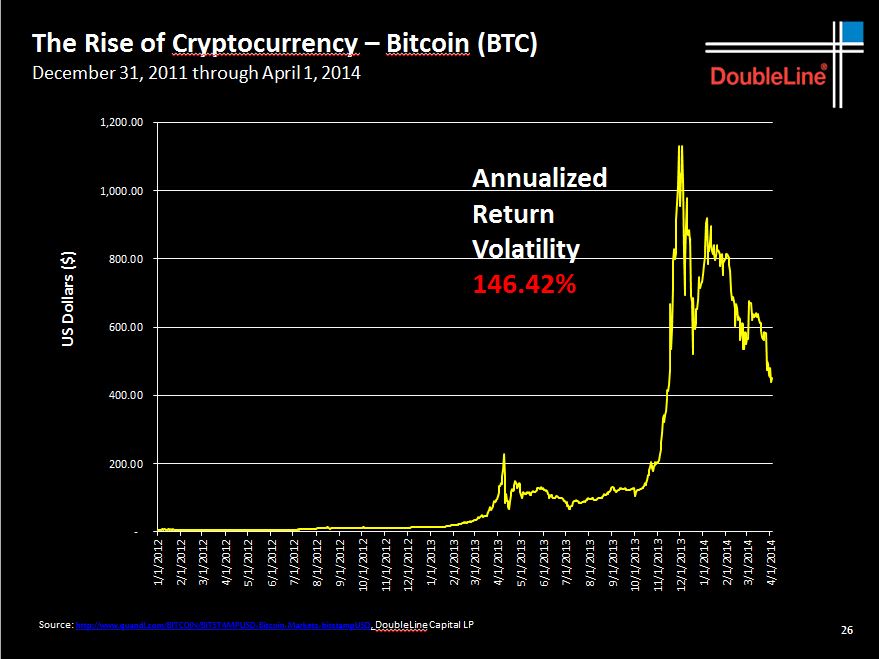

He didn’t spend much time on Bitcoin but noted that what makes it exciting to speculate on is precisely what rules it out as ever becoming a real medium of exchange. “How could anyone use it as a currency with 150% annualized volatility?” He notes that while it is reasonable to believe in a future of electronic payments and digital currencies, it is not unreasonable to believe that Bitcoin becomes an also-ran. He relates a story from Jim Bianco about how Alta Vista was the first search engine, before Yahoo, Google or any of the others, and how it almost made it. Almost.

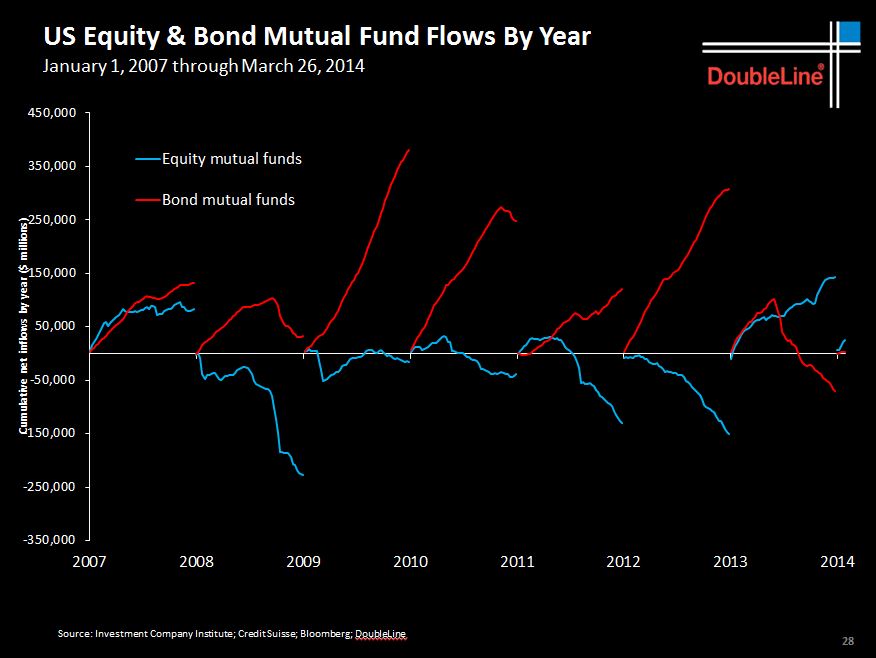

This is a pretty telling chart demonstrating how bad investors are at timing asset classes with their flows. Witness the inflows chasing bonds (red line) while the equity funds (blue line) saw nothing but outflows until it had already almost tripled in price. The big outflows didn’t begin to show up until well into 2013. Stocks have gone nowhere since while bonds have begun to outperform again – now that everyone’s been selling. Pretty damning stuff:

Jeff has long-regarded China as a leading indicator of sorts for US stocks but notes that this relationship had broken down sometime in 2012. As far as Chinese stocks as an investment in and of themselves, he notes that it looks as though a bottom might be at hand. Jeff is a follower of Tom Demark, the famous market-timer, and mentioned that Demark does not believe the Shanghai Composite will break below 2000. Jeff says better to let it prove itself though, no rush to make that bet. “If it’s cheap at 2000, it will still be cheap at 2200.”

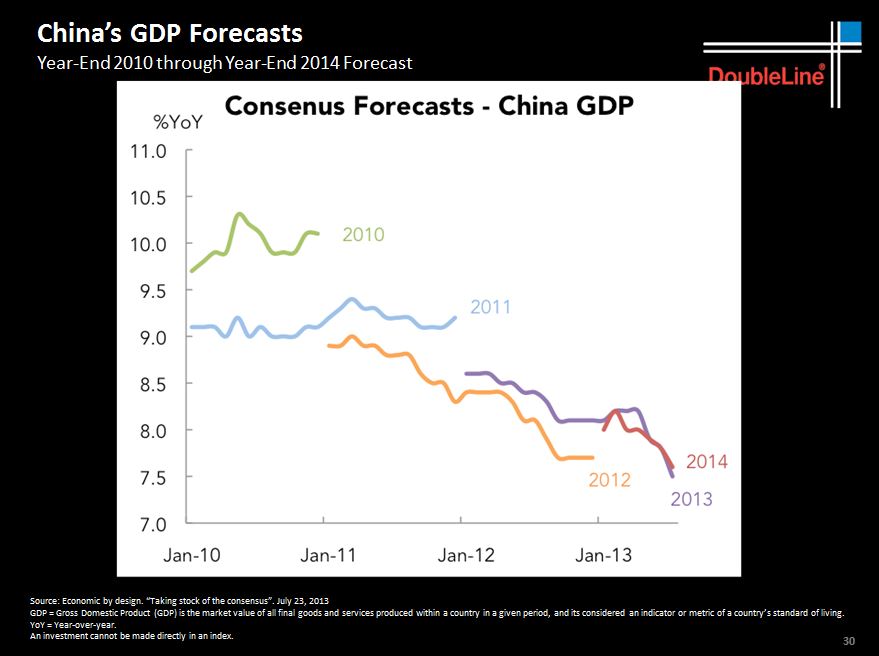

Below you’ll see that China’s economy is still the real risk here, hence Gundlach’s caution vis a vis betting on Chinese equities. The economic growth rate slowdown for China has been consistently underestimated by Wall Street’s forecasters – they begin every year looking for too high a growth rate for China and then spend the rest of the year racheting their expectations lower. This is poisonous for Chinese stocks. Better to have low expectations that are continually exceeded.

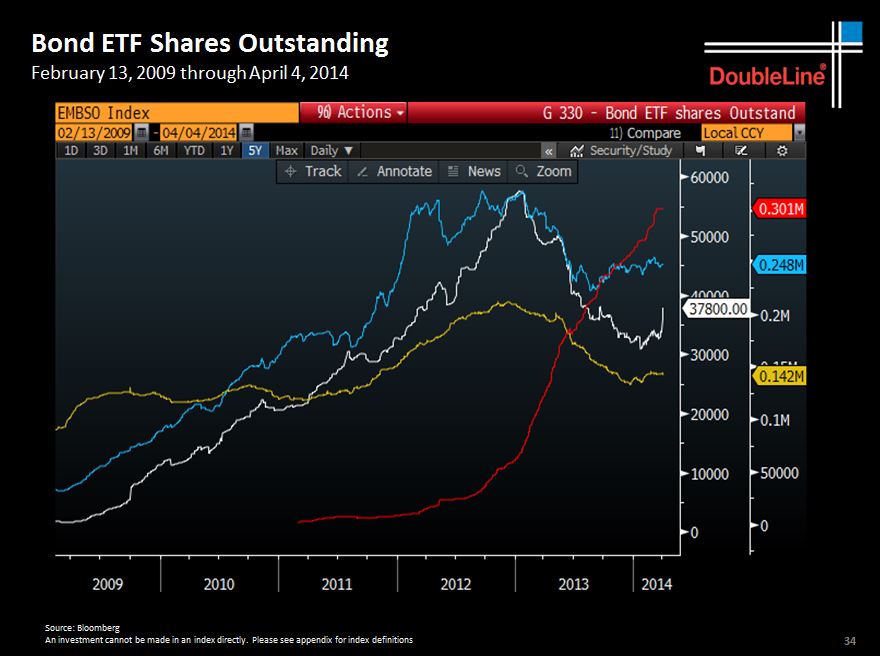

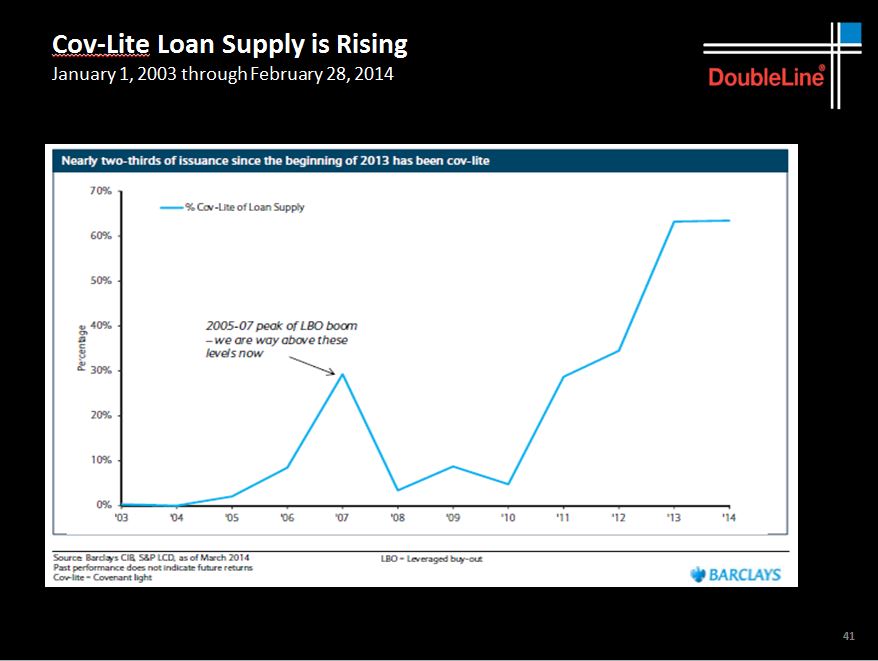

Jeff is highly concerned with one particular bond bubble that is still ongoing. Below are all major categories of bond ETFs. The red line that began from nothing and has now zoomed to the top is bank loan ETFs, remarkably. He notes that the typical bank loans trade settles in T-plus 10 (meaning trade date plus ten more days, more than twice as long as a stock trade) and that this will mean an illiquidity catastrophe should demand for these products go the other way. The bank loan complex is not equipped to deal with rapid changes in flows, like the creation-redemption process needed for ETFs as one example. He mentions anecdotally that a hedge fund friend of his is looking to short Eaton Vance, one of the purveyors of these big bank loan investment products.

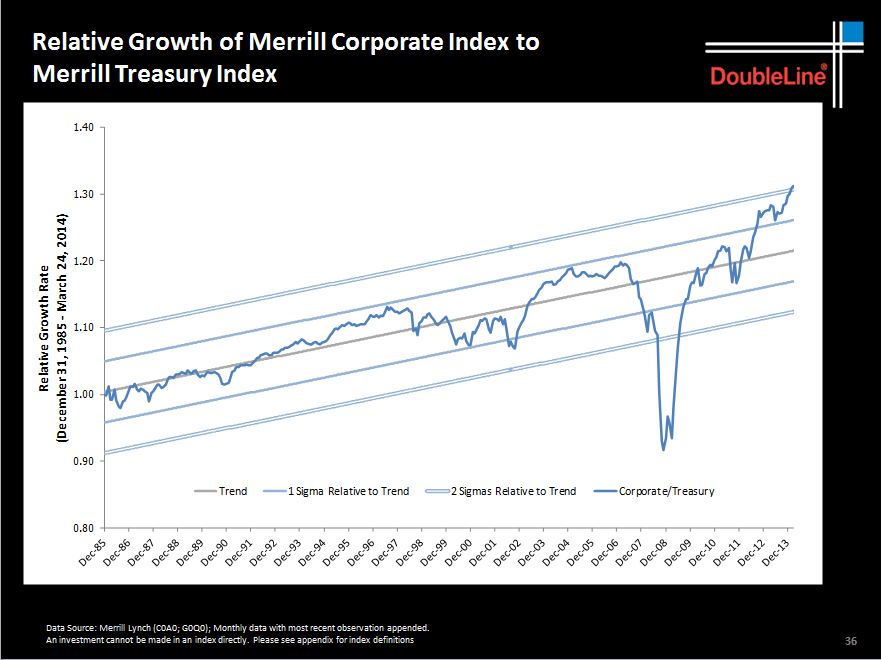

This is the returns on investment grade corporate bonds relative to returns on treasury bonds. The fat gray trendline up the middle is the average performance spread between these two. As you can see, we are now two sigmas (standard deviations) above the average. Jeff says “Investment grade corporates are now the most expensive they’ve ever been in history.” Ditto for high yield corporates, not pictured below:

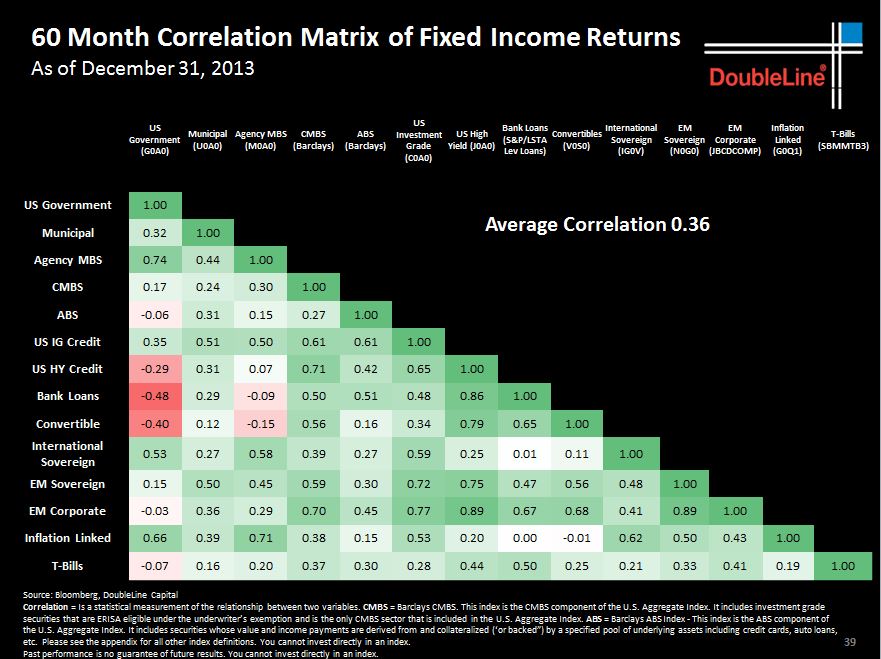

Save this awesome slide on fixed income correlations – what an amazing reference!

Cov-lite loans are exploding in popularity. The chase for yield has led to creditors to get much looser about the protections they’re demanding from borrowers. This is never a good sign, but it’s happening because defaults have been incredibly low. So far. (Josh: see BAML’s take on cov-lite loans here)

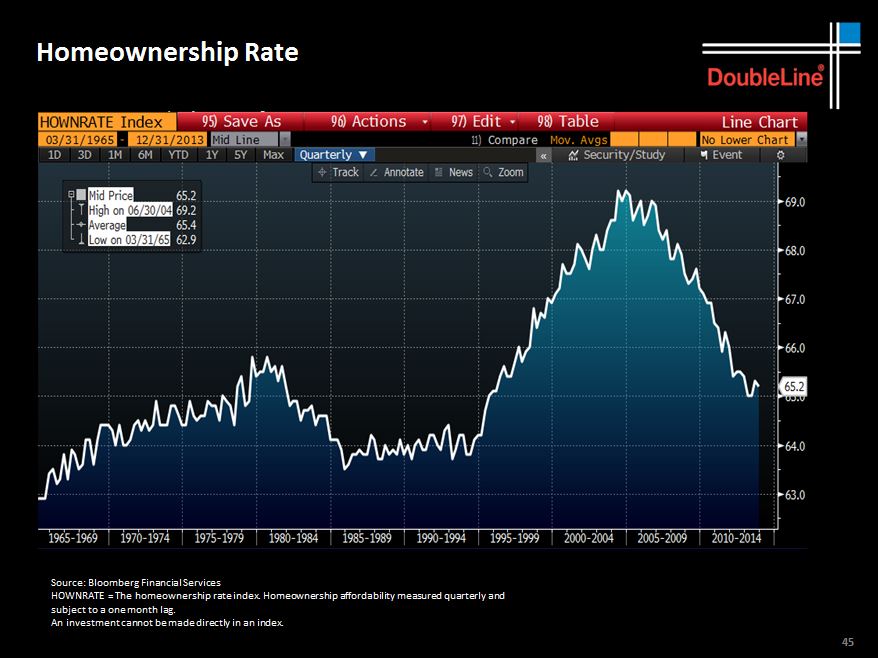

By far the most bearish and damning portion of Jeff’s presentation was the housing market wake-up call. He blazes through several slides, from mortgage applications to new home starts to pending sales to show that the housing recovery over. Virtually all of these measures have experienced notable declines since taper talk began last summer. And the improvement in these metrics has always been overhyped – we’re nowhere near what you’d consider a strong housing market for past recoveries. Jeff talks about the fact that millennials are not like boomers – there’s no rush to move away from their parents and grow their hair long, they’re increasingly comfortable staying home. Thanks to demographics, he thinks multi-generational households are a trend of the future, not a temporary thing. He also cites urbanization and a preference for renting as two more reasons we are not ever going back the old home ownership rates of yore.

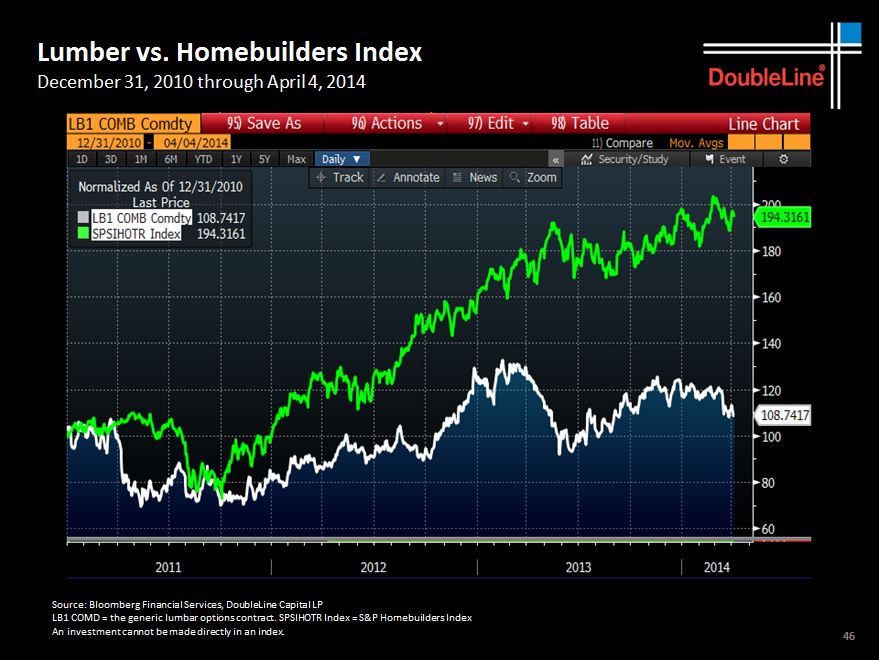

One other slide on housing: Here’s lumber prices versus the boom in homebuilders’ stocks. “This is simply not corroborative of the housing recovery story you’re being told.”

Some miscellaneous stuff not captured in the slides before I wrap up:

1. DoubleLine’s favorite area of the bond market right now is dollar-denominated emerging markets debt. Jeff notes that, eventually, smart pension funds with long-term liabilities at high rates will get comfortable with the near-term volatility for EM bonds and begin to buy them in size, recognizing the almost perfect match. This may not happen for awhile. “I like them a lot.”

2. He is a buyer of FCG, the ETF that owns all the natural gas producers. He thinks the companies are undervalued relative to the potential for natural gas usage adoption.

3. “There is no part of the US bond market that isn’t expensive relative to Treasurys.” That said, he continues to believe that mortgage backed securities still offer the best value relatively speaking.

4. On people saying it is impossible to make money on bonds as rates go up, Jeff says “Anytime you hear people in the investment business say the word ‘Never’, that means it’s about to happen.” Ditto for the term ‘Impossible’. He gleefully points out that the long bond is up 10% year-to-date while stocks are negative. The most consensus this January among asset allocators was out of bonds, into stocks.

5. “I am shocked about how little concern there is about deflation.” He believes the inflationists will eventually be right, but only because deflation risk will continue until the point where policy really goes wild to try to fight it. He does believe that food price inflation in the future is probably a given as well, but was not specific on the timing.

Lastly, and I think this sums up Jeff Gundlach’s gritty view of the markets and economic reality of today pretty well:

6. re: the deficit improvement – “If someone puts you in a 300 degree oven, the 200 degree oven afterwards is going to feel pretty good in comparison.”

***

One last thing I’d like to mention in closing, on a personal note…

Before the presentation, I had a chance to chat with Jeffrey Gundlach about my new firm and he gave me some important advice about culture. DoubleLine was built around a core of loyal, likeminded individuals who had followed Gundlach from their prior employer in 2009. I mentioned the challenge of staffing and finding the right people as our firm grows, and Jeff’s advice was not to downplay the importance of this. Hiring the right people who fit into the culture you’re building is paramount and it becomes really hard to undo mistakes or remove the wrong people once they’ve become apparent. I’m very fortunate in that my new firm has also been built around a core of loyal, trustworthy and caring professionals. Our guiding principle and crux of all decision-making comes down to “What’s best for the client?” and this is something that is innate to all of us – from my experience in the industry, it cannot be taught or faked.

DoubleLine has more than doubled in headcount since its founding but bringing in the right personnel is clearly still a priority. As an entrepreneur and CEO of a fast-growing investment management firm, I admire that focus and hope to continue to emulate it.

I hope these notes from the event have been helpful, thanks for reading!

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Here you can find 85851 additional Information to that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

… [Trackback]

[…] There you can find 37536 additional Information on that Topic: thereformedbroker.com/2014/04/13/notes-from-the-doubleline-lunch-with-jeffrey-gundlach-spring-2014/ […]

buy cialis now

USA delivery

cialis sale 20mg

Generic for sale