Let’s start here with George Soros, from a speech he delivered in June 2010:

“I have developed a rudimentary theory of bubbles along these lines. Every bubble has two components: an underlying trend that prevails in reality and a misconception relating to that trend. When a positive feedback develops between the trend and the misconception, a boom-bust process is set in motion. The process is liable to be tested by negative feedback along the way, and if it is strong enough to survive these tests, both the trend and the misconception will be reinforced.”

It’s likely that you’ve been exposed to this weekend’s market conversation / freak-out du jour – “Is biotech a bubble?” If you haven’t yet, you will be, as TV producers scour the financial web for things to make segments about on Monday. Either way, more and more people are going to weigh in – many of them completely unqualified – and they’ll cloud the issue even further. One of the things I’ve tried to do on this blog is cut through the clutter for readers and present them with a good framework with which to think about a given topic.

Everyone, myself included, can and will get things wrong in the markets. The goal should be to get less things wrong as time goes on and to avoid getting things wrong for the wrong reasons – easier said than done but a highly attainable goal worthy of pursuit.

No one has all the answers, but many people don’t even have the right questions to begin with. I think having the right questions is an underrated starting point.

Back to the biotech sector…let’s start with the positives (many of which have been cited by Elliot Turner here): Time-to-market for biotech drugs has been dramatically shortened thanks to technology and the maturation of these companies’ management teams. In addition, new drug FDA approval has exploded – according to Bloomberg BusinessWeek, 2013 was “a year of 27 clearances at the FDA that included several under a new ‘breakthrough therapy’ designation prioritizing reviews of promising medicines. That followed a record 2012 in which 39 novel drugs were approved, the most in 15 years.” Also, aging populations mean almost guaranteed growth for the sector’s products while the dwindling R&D efforts and pipelines of traditional pharma companies mean a steady drumbeat of takeovers as far as the eye can see.

Okay, we can acknowledge the bull case with a straight face and no fingers crossed behind our backs. It’s legit. “But is it already more than priced in?” is the question.

Is the biotech sector in a bubble?

Yes. Full stop.

Below are the questions I’ve used to arrive at this answer (with some supporting data / links). You can ask them of yourself and possibly come up with a different answer:

Is there a kickass origin story for the rally?

How it all began: From 2009 through 2011 there was no public market capital for anything even remotely risky and so young biotech companies were forced to sell out to larger drug companies on the private market. This was fine with them as valuations on the private market were actually much better – my friend Adam Feuerstein from TheStreet.com explained to me that if a biotech was going public circa 2011, it meant their science wasn’t good enough for an acquisition exit.

In the meanwhile, as sluggish global growth persisted, investors began to favors secular growth stories in the stock market – companies that didn’t need GDP growth to accelerate. This favored Big Biotech, your Celgenes and Amgens and the like. Unfortunately, there weren’t enough reputable biotech franchises to go around thanks to a handful of mega-mergers (buyouts of Genzyme, Genentech, Pharmasset, Amylin, Human Genome, Illumina etc) and the aforementioned dearth of public offerings. Institutions took the handful of good-sized biotech stocks that were leftover to all-time highs. Sure, fundamentals are important, but scarcity is even more important when the fever strikes.

Have the gains been astronomical?

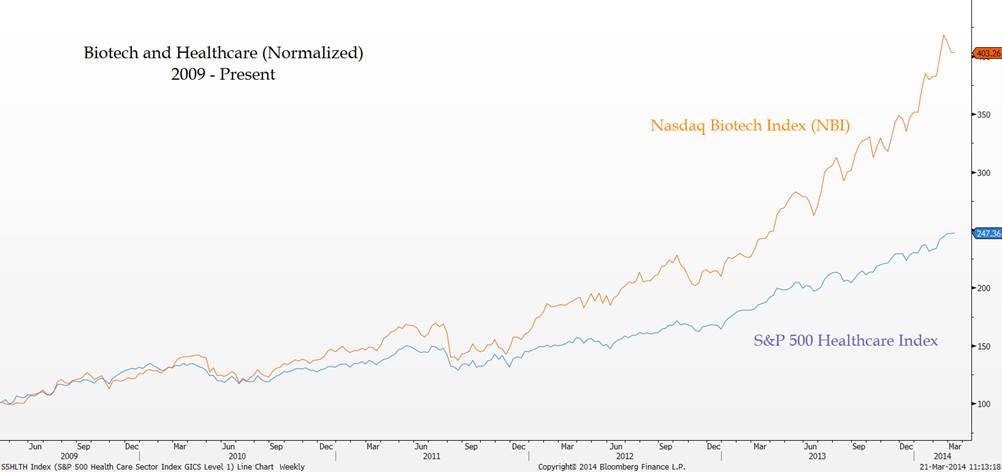

Yes. The S&P 500’s biotech stocks are up more than 400% from the March 2009 bottom versus a gain of roughly 180% for the rest of the market. And this does not even include the hundreds of small- and mid-cap biotechs that have gone up even more. The Nasdaq Biotechnology Index, which does include some of these smaller names, is up 14% year-to-date or a sevenfold return over the broader market. Last year it was up 66% or double the S&P 500’s return, which is to say the gains are accelerating in both absolute and relative terms.

Are there egregious examples of unbridled enthusiasm for lottery-esque opportunities?

There’s a biotech company called Intercept Pharmaceuticals (ICPT) that announced some positive data from a drug trial in January of this year and promptly exploded by 281%. The stock is now up some 500% year-to-date and every aggressive trader on earth has it on their screen. In addition, they’ve driven up dozens of other similar companies in the hopes of being in “the next ICPT”. Stop me if you’ve heard this one before from other bubbles in other sectors. Actually, don’t stop me, I’m not done.

Outrageous gains are not limited to smaller biotech stocks. Gilead Sciences bought out Pharmasset for $11 billion to get their hands on Sovaldi, a hepatitis C drug. Gilead’s stock price has tripled in the less than three years following that acquisition with $85 billion in market value added! Sovaldi is hitting the market this year and is expected to generate $2.5 billion in sales annually. Awesome – but $85 billion in additional market cap awesome? To be clear, Gilead has tacked on the market cap of Goldman Sachs, Union Pacific or United Health Group in two-and-a-half years.

Is capital flowing to the sector like ambrosia and honey from the mythological Horn of Plenty?

This year so far, there have been roughly 50 initial public offerings and half of those have been early-stage biotech companies. The average gain for these new biotech offerings through the middle of March is over 50%. Anyone with a protein compound under a microscope and a clean suit can go public right now. You actually might not even need the compound, just the idea for one.

Also, the deal activity is a runaway train. According to PricewaterhouseCoopers, last quarter was one for the ages: M&A in the life sciences sector spiked 24% and 31 companies were bought for a total of $37 billion.

Have valuations lost all connection with reality?

With a few exceptions, yes – broadly speaking and throughout the sector, they absolutely have. Without getting into the weeds on a case-by-case basis (of course we can always find exceptions), here’s the big picture via Brendan Conway of Barron’s this weekend:

The price-earnings ratio of the SPDR S&P Biotech ETF is a rich 33 times trailing earnings, versus the S&P 500’s 17, says Morningstar. But Morningstar removes unprofitable firms from the tally. Add them back in and tally the losses against the prices, and the P/E multiple would be a negative 19, according to ETF.com’s Matt Hougan–if such a thing were possible.

I could cite some really extreme examples and then a bull could find some cheaper examples to offset them. So let’s think about the averages here. I’ll acknowledge that, individually, any of the companies I’m lumping in as bubbly could be working on a world-changing drug that more than justifies its current lofty price. Unfortunately, this will not be the case for most or even many of them.

Are these extreme changes in valuation wreaking havoc and bringing distortion to other parts of the market?

My friend Jon Krinsky informally crunched the numbers this weekend and shared with me that, since 2012, biotech stocks began a full-scale invasion and colonization of the health care sector. He looked at the percentage of biotech market cap weighting in the health care sector SPDR (XLV) by year and then compared health care stocks with their constituent biotechs:

% weighting of XLV that biotech makes up

March 2010 – 11.62%

March 2011 – 9.6%

March 2012 – 10.65%

March 2013 – 14.44%

March 2014 – 19%

Are we saying crazy shit to make ourselves feel better about the frenzy?

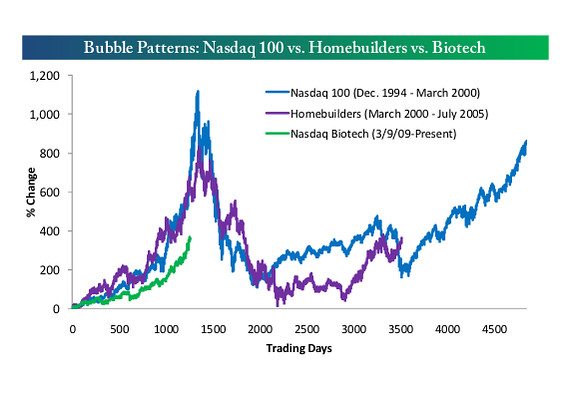

A little, if we’re going to be honest. Here’s someone referencing Bespoke Investment Group data earlier this month saying it’s not so crazy because biotech hasn’t yet eclipsed the dot com bubble of 2000 or the home building bubble of 2005:

the 361% gain in the Nasdaq Biotechnology Index NBI since hitting a trough — along with the rest of the market — in March 2009, pales in comparison with some other recent bubbles.

For one, the Nasdaq 100 made a leap of 1,118% during the period from December 1994 to March 2000 that included the dot-com bubble. That’s over a period of 1,935 days, only slightly longer than the current 1,822-day biotech rally.

There’s at least one more bubble to examine, the note says. The housing runup of the early 2000s brought with it an 835% gain for homebuilders in the S&P 1,500, Bespoke points out. That rally was similar in length to the dot-com bubble, lasting 1,954 days.

Dude, really?

That’s like saying O.J. Simpson wasn’t so terrible because, while he probably killed his ex-wife and her lover with a knife, at least he didn’t eat them or have sex with their corpses. There are other examples of excuse-making for the sector – too many to cover here. Lots of people are making money and no one wants it to end, so I get it. I’ve been guilty of this kind of rationalization in the past as well.

Josh, are you just being a hater?

This is the last question I’ll rhetorically ask, and it should always be a question we ask ourselves when discussing market trends. “How much of my reticence to accept the prevailing wisdom is due to my having missed out?” In this case, it is inapplicable. We’ve been invested in the biotech space for years. I’ve been an unabashed biotech bull in public ever since, well, I’ve been in public. Here’s me in May of 2012 calling biotechs a stealth bull market, as one example. Even now we’re highly exposed to the health care sector which is itself laden with these stocks. I’m not hating, just keeping it real.

One last thing I will say – yes it’s a bubble, but SFW? Greenspan coined the phrase “Irrational Exuberance” to describe the stock market in 1996 and it took four years and hundreds of percentage points of additional upside before it mattered. What am I, the Bubble Police? Don’t let my calling it what it is affect your investing. If you’re disciplined and think you’re a big boy or girl and know how to get out in time, knock yourself out. If you’re playing small for fun and using “f*** you money” in the sector, go for it, what do I care?

But if and when the hot money moves on and these stocks come hurtling back down toward the earth’s atmosphere, don’t be mad if I say “Told ya so.”

slots machine https://slot-machine-sale.com/

free slots instant play https://beat-slot-machines.com/

online free slots https://download-slot-machines.com/

all slots casino https://411slotmachine.com/

2022 mlb draft bonus slots https://www-slotmachines.com/

battle slots download https://slotmachinegameinfo.com/

dissertation help galway https://buydissertationhelp.com/

dissertation help reviews https://dissertationwriting-service.com/

best dissertation help service https://help-with-dissertations.com/

writing dissertation and grant proposals https://mydissertationwritinghelp.com/

dissertation proposal sample https://dissertations-writing.org/

dissertation writing courses https://helpon-doctoral-dissertations.net/