I had dinner with a friend who works with advisory clients just like I do but he’s at one of the big wirehouses. His entire book of business is allocated toward active strategies – SMAs, mutual funds, in-house wrap accounts, hedge funds, funds of hedge funds, etc. Philosophically, we are miles apart in terms of the right way to invest, although I know he cares deeply about his clients and takes pride in his craft just as I do.

Anyway, of all the arguments against betting on (and paying up for) active managers, the one where I had him stumped was Persistence. It’s a killer. It’s even harder to overcome than that old “70% of managers underperform their benchmarks” stat that always gets tossed around. To which he’d reply “Well, 30% did beat the benchmark and I want to invest with those guys.”

Personally, I believe in active management and I’m among those who think that superior research, trading and discipline can produce above average returns. I love analyzing and trading stocks, talking about stocks, investing in stocks and reading about the exploits of those who do it exceedingly well.

But as a professional asset allocator, I won’t typically pay up for active management in most asset classes because the data says I’m going to be at a disadvantage for doing so. Especially in US stocks. It’s not that managers can’t outperform the market, it’s that they can’t do it for long. Further, the cost involved – from turnover taxation and internal expenses – makes it so that the benefit from better-than-average returns is practically neutralized when all is said and done.

Veteran mutual fund manager and stock-picker Bob Olstein told the New York Times the other day that investors should be looking for managers who can outperform the stock market:

..he says the rise of index funds is part of a trend toward sloppy investing — a willingness to follow the herd, to rely on momentum in a rising market.

“It’s like saying mediocrity is O.K. — that it’s more than O.K., it’s the best that anyone should hope for,” Mr. Olstein says. “It’s saying a guy like me can’t beat the market — that he shouldn’t even bother trying. That’s wrong! It really ticks me off. I can beat the market. I have beaten the market.”

Bob Olstein is a good manager and he has outperformed the S&P 500 by 2.4 percentage points, annualized, since the launch of his fund in 1995. He hasn’t been able to beat the market in every year or time period (because that’s not humanly possible) and so his record is one that beats and misses in streaks. Whether or not he has a good or a bad year relative to the index is not really under his control, regardless of how hard he works during that 12 month time period.

But the key point here is about persistence – how could an investor have possibly known, back in 1995, that Olstein’s fund was going to beat the substantial odds against it and stay around long enough to amass this track record? How many other fund managers in 1995 believed wholeheartedly that they too would beat the market for the next two decades? Hundreds? Thousands? Almost none of them have.

And so Mr. Olstein is inadvertently giving investors bad advice. More money has been lost or misallocated by ordinary investors chasing superior returns than has been left on the table by those settling for average returns.

At the end of the day, paying a high cost for stock-picking mutual funds is not worthwhile over the long-term for the majority of investors. And the American public has figured this out. Their mutual funds were almost uniformly demolished in the 2008 crash. The thinking has become “Why do I need to outperform the S&P by 200 basis points in a large cap stock fund if the manager’s going to get crushed during the next sell-off anyway?” Bob Olstein, for example, rode big bets on housing and banks right off the cliff to a 43% loss in 2008 – much worse than the overall market – thus negating several years of alpha in a relatively short period of time.

Active management works, it just doesn’t work for most people. And when you look at the dollar-weighted returns for investors in mutual funds rather than the time-weighted returns tracked in the media, the picture is even bleaker. High-cost, mean-reverting investment vehicles paired with the rearview mirror-guided timing of average investors is a deadly cocktail.

This is why 98 cents of every new dollar going into equity mutual funds this past year went to Vanguard. This is why the outflows are flying out of Fidelity’s active funds as though someone shoved a giant vacuum hose into their AUM vault. This is why the ratings for financial television have never been lower.

What investors have realized is that it’s nearly impossible to select managers who are going to outperform beforehand (just about no one can actually do it) based on any dataset available. Morningstar studied this in 2010 – of all the metrics they track, there were no predictive factors for future outperformance save for one: Low cost. In addition, they also determined that their vaunted star system, largely predicated on past relative performance versus peer funds, meant nothing for future returns.

And then there is the random nature of performance itself – the data shows that buying into managers who have just demonstrated the ability to outperform offers absolutely no benefit. A top fund this year is almost as likely to be a bottom fund in subsequent years as they are to remain on top. The chances of a bottom-dwelling fund becoming a winner are about the same, unless the fund is shutdown due to an inability to retain assets (no one allocates to underperformers, even if, intellectually, they know that last year’s performance is not predictive).

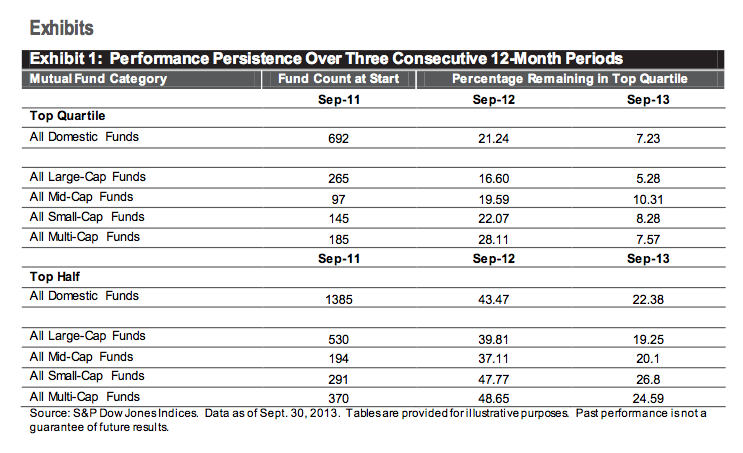

I’m going to show you the SPIVA® December 2013 Scorecard, which just came out this past week. The organization, whose acronym stands for S&P Indices Versus Active, “measures the performance of actively managed funds against their relevant S&P index benchmarks.” The results show that, of the 692 domestic equity mutual funds that were in the top quartile (25%) of performers in September 2011, only 7.23% are still there. The other 93% of September 2011’s “Best Funds” have fallen back into one of the bottom three quartiles.

See below:

This happens as a result of reversion to the mean and it is inexorable in almost all cases.

And the longer the study goes, the worse these numbers become. For instance, from the same Scorecard: Of the 710 domestic equity funds that comprised the top quartile in September 2009, only 2.11% remain. In other words, persistence of outperformance over the last five years is statistically non-existent.

The most damning statistic about active management is that true investment talent is rare and, even when found, it is usually fleeting. Managers have great runs during which skill and luck combine and the stars are in alignment. It is at that moment that the manager is able to raise virtually unlimited assets from performance-chasing investors as the word gets out and the ads go live.

This is almost always followed by a period of underperformance.

In fact, it is so rare that a high profile manager can continue to deliver the goods, that the few who do become legendary. An investment strategy that is based on finding the legendary managers beforehand has a very low chance of success and a very high chance of excess costs, turnover and frustration.

Sources:

SPIVA Persistence Scorecard December 2013 (PDF)

Beating the Market, as a Reachable Goal (New York Times)

Vanguard raked in almost every dollar that went into U.S. equity funds this year (Investment News)

Fund Expenses More Important Than 5-Star Status (New York Times)

[…] or risk-adjusted measures, is well documented (e.g., The Persistence Scorecard – June 2014, Persistence is a Killer, In Search of Persistence, and Ten Market Cycles). It does not happen. Due to the many underlying […]

[…] or risk-adjusted measures, is well documented (e.g., The Persistence Scorecard – June 2014, Persistence is a Killer, In Search of Persistence, and Ten Market Cycles). It does not happen. Due to the many underlying […]

[…] Scorecard” has just been published, which Joshua Brown writes insightfully about in “Persistence is a Killer.” The scorecard once again shows that only a small fraction of top performing domestic equity […]

… [Trackback]

[…] Here you can find 74123 additional Information to that Topic: thereformedbroker.com/2013/12/22/persistence-is-a-killer/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/12/22/persistence-is-a-killer/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/12/22/persistence-is-a-killer/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/12/22/persistence-is-a-killer/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/12/22/persistence-is-a-killer/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/12/22/persistence-is-a-killer/ […]

… [Trackback]

[…] There you will find 57191 more Information to that Topic: thereformedbroker.com/2013/12/22/persistence-is-a-killer/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/12/22/persistence-is-a-killer/ […]