361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

August 5, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

“Adapt or die.” – Brad Pitt, Moneyball

If you are overweight Long Bonds in 2013, then this will be your room for the year…

And the fund outflows from the Bond kings continue…

Bond king Bill Gross‘s $261.7 billion Total Return Fund at Pacific Investment Management Co. suffered a $7.5 billion net outflow last month, according to data from fund tracker Morningstar Inc. on Friday. It is the third straight monthly outflow for the Fund, on the heels of nearly $10 billion in redemptions in June. Clients have yanked $15.6 billion from Gross’s Fund in 2013 through July. Jeffrey Gundlach’s $37.9 billion DoubleLine Total Return Bond Fund suffered $580 million net outflow in July, according to Morningstar. Gundlach is founder and chief investment officer at asset management firm DoubleLine Capital LP.

(WSJ)

Of the money fleeing bond funds, only about 20% is being reinvested into equity funds. So cash is building in the system…

Investors gave $6.61 billion in new cash to stock funds over the weekly period, meanwhile, marking the fifth straight week of inflows into the funds. Those cash gains were up from inflows of $5.37 billion in the prior week… Despite stock market volatility, funds that hold U.S. stocks attracted $4.65 billion. Of that sum, $3.72 billion flowed into U.S. stock ETFs, including inflows of $2.82 billion into the SPDR S&P 500 ETF Trust. Emerging market stock funds also gained $589.8 million in new cash from investors over the week, the most in four weeks even as the MSCI world equity index fell 0.83 percent over the period. Investors also poured $643 million into funds that hold European stocks, the most in seven weeks.

(Reuters)

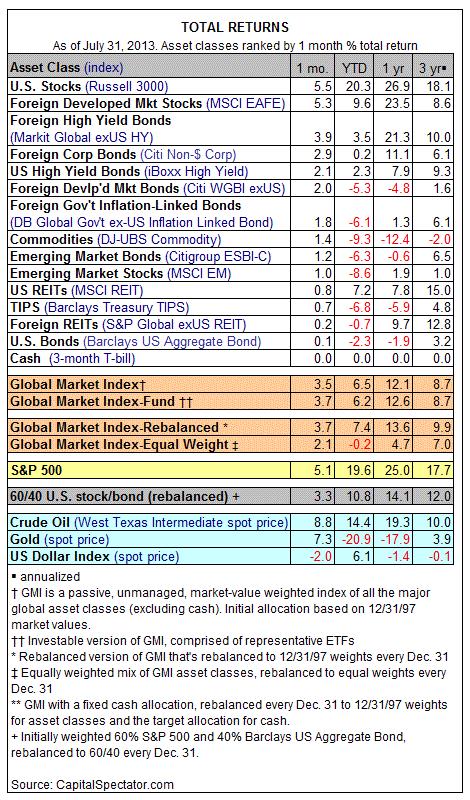

If you are an asset allocator, you need to be overweight U.S. Equities to put up solid year to date gains…

@BeschlossDC: This is what Detroit was in 1917…

This is Detroit today…

“The Van Gogh must go. We don’t need Monet – we need money.” (Mark Young, president of the Detroit Lieutenants and Sergeants Association, which represents about 500 mid-level managers in Detroit’s police department, said art should not outweigh workers, whose pensions and benefits are likely to face big cuts as Detroit restructures.)

(Reuters)

And Muni investors are looking to reallocate assets away from new bond deals…

A Michigan county’s decision to postpone a $53 million bond sale highlights the difficulty fiscally strapped issuers everywhere may face in the wake of Detroit’s record bankruptcy filing, investors said. Portfolio managers say they are more cautious now about buying bonds from local governments in Michigan and may demand higher interest rates to lend them cash. Genesee County, Mich., on Thursday shelved an offering after potential buyers wanted much higher yields than the county was willing to pay, said people familiar with the offering.

(WSJ)

Fixed income money remains interested in buying home rental income streams instead…

The buy-to-rent market is only a fraction of what it could be, according to a research report from Morgan Stanley. And, the investment bank sees four possible ways to get in on the action. “We believe today’s ~$17B institutional BTR industry can continue growing and perhaps reach over $100B over the next several years,” said the latest Morgan Stanley (MS) housing research report.

(HousingWire)

It was a busy week for economic data points and interpretations. An important one came from the Federal Reserve Board…

Global markets rose Thursday after the Federal Reserve gave no indication on Wednesday it was preparing to wind down its bond-buying program that has propelled investors into stocks. The FOMC downgraded their assessment of current growth to “modest” and added comments on the risk of inflation being too low. Both of these changes were viewed as dovish, or accommodative, and cheered global equity markets.

(FusionMarketSite)

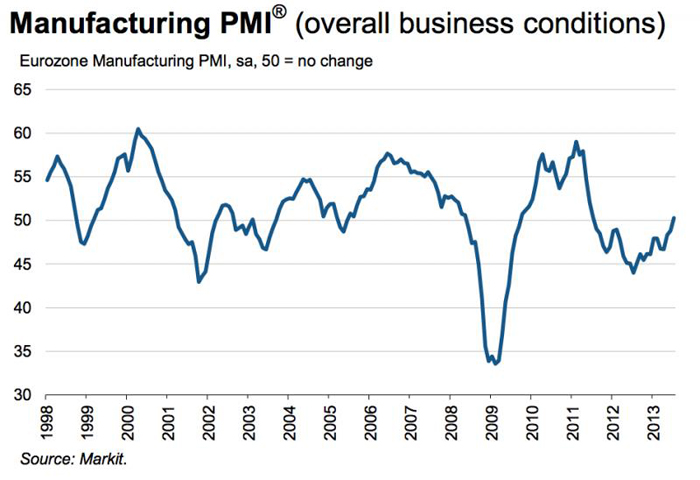

But probably the highlight of the week was the upside surprise in the European PMI data…

“Eurozone manufacturing made a positive start to the third quarter, with welcome signs of growth returning to the sector. The PMI rose to a two-year high, as rising export demand and stabilizing domestic markets took growth of new orders and output to rates, albeit still modest, last scaled in mid-2011. This hopefully places the sector nicely to provide a positive spur to the third quarter GDP numbers and help the euro area exit recession.” “Manufacturing output rose again in Germany, Italy, the Netherlands, and Ireland during July, while there were welcome returns to growth for France and Austria. The breadth of the expansion will hopefully aid in its sustainability. Even the downturn in Greece showed signs of easing, while Spain saw its second-weakest contraction for over two years.”

(Markit)

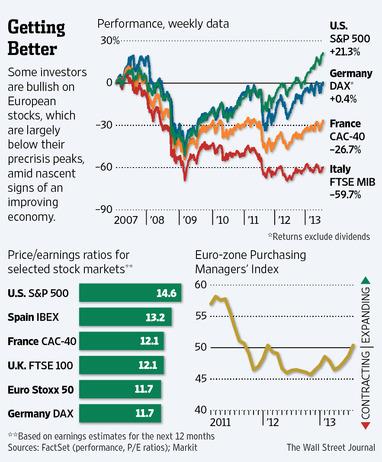

A reminder why European stocks are performing… They are cheap, cash flowing, and now the data is turning higher…

Why are investors giving the Old Continent a new look? Some favorable winds are blowing. Despite a healthy rally over the past year, European stocks are still relatively inexpensive. The companies behind them generate plenty of cash and pay solid dividends. And Europe itself is less of a worry than one might think: European companies, especially big ones, generate a greater proportion of sales outside Europe than their U.S. peers do overseas. In short, if Europe’s economy even stabilizes, bulls say, European stocks are a good way to benefit from the earnings power of big, developed-world companies—at a better price than U.S. shares and without the stomach-turning volatility of Japan.

Back to the U.S., Jobless Claims fell to a new low of 326k for the week, and like clockwork, the market followed (inversely)…

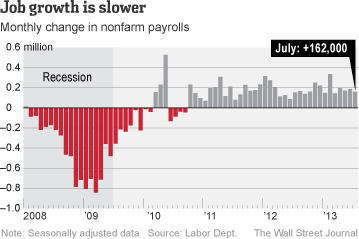

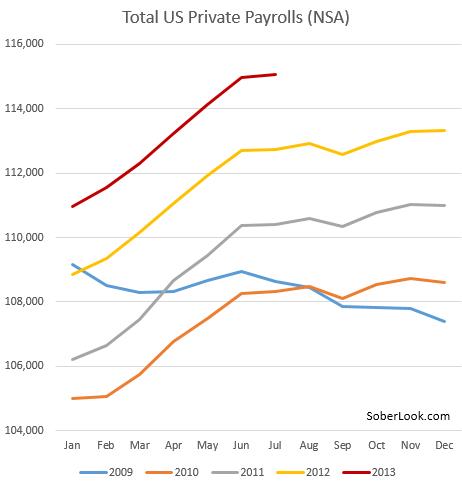

Friday’s monthly jobs data also showed gains, but the market wanted more from higher earners…

Nonfarm payrolls added 162,000 jobs after adding a downwardly revised 188,000 (from 195,000) in June. The Briefing.com consensus expected 175,000 new payrolls. The report proved to be a disappointment as not only did payroll growth come in below expectations, but the average workweek dropped to 34.4 hours from 34.5 and average hourly earnings declined 0.1%. Altogether, aggregate wages fell 0.3%, which will put substantial downside pressure on retail sales growth. Although stocks moved lower initially, the S&P erased almost all of its early losses as participants fell back on the Federal Reserve’s pledge to provide support to the markets for as long as economic data continues to paint a lukewarm picture. (Briefing.com)

(WSJ)

Summary from Goldman on the July jobs data…

“The below consensus but still fairly strong NFP print is probably the best outcome for a continued melt up in stocks”.

(SoberLook)

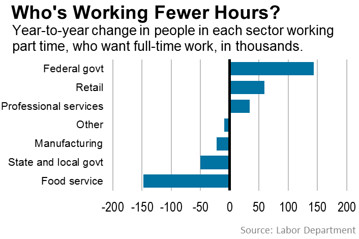

It is surprising to see that the largest increase in Part Time jobs is coming from the Federal Government. Now you have proof that someone in D.C. read the per employee cost of ObamaCare for a full time employee…

(WSJ)

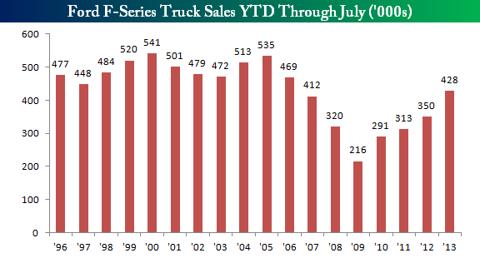

One of the better series of Economic data is following sales of the workhorse F-series pickup truck…

Looking at stocks, MidCaps were the heroes last week. This is a good sector to follow as it is widely used as a beta adjuster by hedge funds and institutions looking for quick exposure. Interestingly enough, there was a widely distributed rumor of a big player selling Bonds and buying MidCaps last week…

Looking at the S&P500 equal weight shows that breadth is breaking out to new highs…

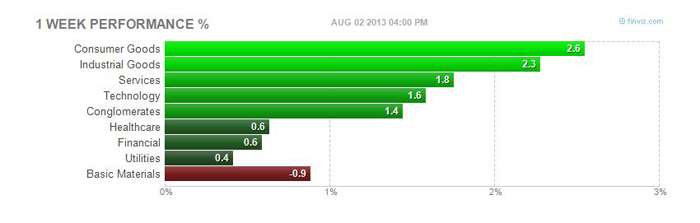

And a sector analysis continues to show that cyclicals and RISKON sectors are outperforming the defensive ones…

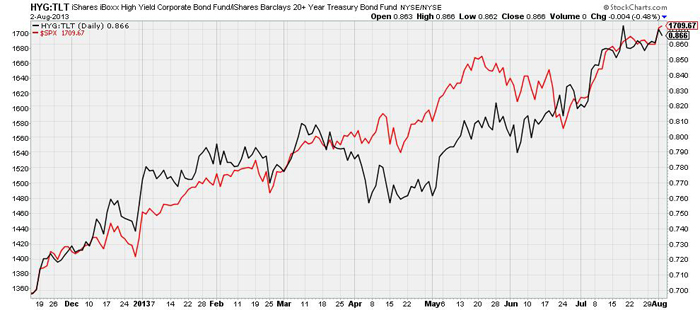

While junk bonds are falling in price, relative to Treasuries, they are still performing well. But that duration risk has been tough for any income investor…

Still watching the Emerging Markets? Are they finished underperforming yet?

Facebook is definitely done underperforming and it has benefited the Nasdaq100…

Shares of Facebook surpassed their initial offering price of $38 on Wednesday morning, a key milestone for the firm around 14 months after its deeply flawed IPO. The firm’s shares have been on a tear since its excellent Q2 report, and press reports this week suggested Facebook would start to further expand its growing advertising business by offering 15-second television-style spots in user news feeds. (TradeTheNews)

For the week, every sector gained except for those dealing in raw commodities…

Always interested in how the talented Will Danoff is sailing his aircraft carrier, the USS Contrafund…

Fidelity’s infamous Contrafund, managed by Will Danoff, cut its stake in Apple in the first half of the year while boosting his stake in Tesla in the quarter. Meanwhile, Google became the Fund’s largest position due to the reduced stake in Apple.

(Benzinga)

Another talented investor continues to disagree with the Fed’s actions…

It is extraordinary to us that the world’s most powerful central banker, in the midst of a gigantic and powerful monetary policy experiment consisting of zero percent interest rates and trillions of dollars of money-printing, expresses puzzlement that markets act how they want to act rather than pursue the script set out for them by the Ph.D-approved models of the exquisitely educated and experienced Fed. Sadly, 2008 demonstrated conclusively that the major central banks, most energetically the Fed, possess only the most rudimentary understanding of the modern financial system…

The truth, of course, is that stock prices are at these levels only because the government printed trillions of dollars to bid them up. The economy is not performing well, and when inflation kicks in, everyone will realize that they have been hoodwinked by the oldest trick in the book: debase the currency and fool the people into thinking that they have more than they actually do, that they owe less than they promised to pay, and that everything from savings to work is based on shifting ground, rather than any stable or enduring standards of value. How did it come to this? The answer is simple: arrogance, hubris, and academics masquerading as leaders and experts.

(ZeroHedge)

How to become a millionaire? Start with a billion dollars and buy a newspaper…

The sale, for $70 million, would return the paper to local ownership after two decades in which it struggled to stem the decline in circulation and revenue. The price would represent a staggering drop in value for The Globe, which The Times bought in 1993 for $1.1 billion, among the highest prices paid for an American newspaper. At the time, The Globe was one of the nation’s most prestigious papers in a far more robust newspaper environment. But like other newspapers, it began to lose readers and advertisers to the Internet, and revenue plummeted.

(NYTimes)

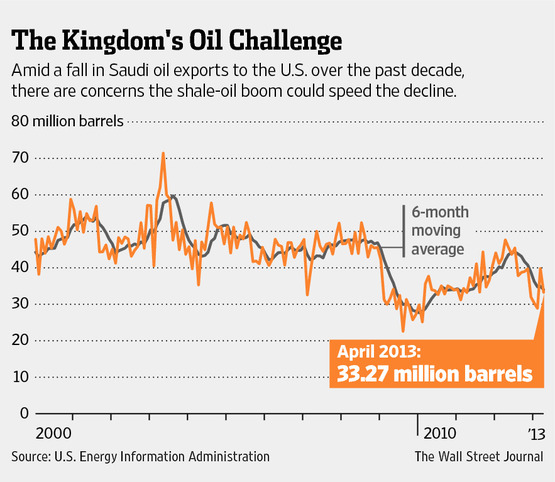

Fracking shale in the U.S. is beginning to be a thorn in the side of OPEC…

Saudi billionaire Prince Alwaleed bin Talal has warned that the kingdom’s oil-dependent economy is increasingly vulnerable to rising U.S. energy production, breaking ranks with oil officials in Riyadh who have played down its impact… Saudi Arabia, the world’s biggest oil exporter, is now pumping at less than its production capacity because consumers are limiting their oil imports, Prince Alwaleed said in the letter. This means the kingdom is “facing a threat with the continuation of its near-complete reliance on oil, especially as 92% of the budget for this year depends on oil,” said the prince.

(WSJ)

“The harder I work, the more I make,” he says matter of factly. “I like that.”

Kim Ki-hoon earns $4 million a year in South Korea, where he is known as a rock-star teacher—a combination of words not typically heard in the rest of the world. Mr. Kim has been teaching for over 20 years, all of them in the country’s private, after-school tutoring academies, known as hagwons. Unlike most teachers across the globe, he is paid according to the demand for his skills—and he is in high demand. Mr. Kim works about 60 hours a week teaching English, although he spends only three of those hours giving lectures. His classes are recorded on video, and the Internet has turned them into commodities, available for purchase online at the rate of $4 an hour. He spends most of his week responding to students’ online requests for help, developing lesson plans and writing accompanying textbooks and workbooks (some 200 to date).

(WSJ)

Tweet of the week for New York cable subs…

@bySamRo: Pray TimeWarner and CBS work this out because if I miss one millisecond of Two Broke Girls god knows I will FREAK out.

If only Breaking Bad was on CBS then this would have been settled up REAL quick…

@beckyquickcnbc: Strange bedfellows: Warren Buffett & Keith Richards @ #BreakingBad premiere in NYC. #RollingStones $BRKa

(Twitter)

The rest of the month of August will be relatively quiet with the lack of earnings and major economic data, plus Europe going on vacation for the month. So if you are off somewhere (fishing) and needing something bullish to contemplate, here is something to consider…

Three Bullish Frameworks

- First, the S&P has made little progress over the past 13 years, 2000-2013. Oddly, the last big stall also lasted 13 years, 1969-1982. The S&P then went on an 18-year tear from 100 to 1500, 1982-2001.

- Second, the unemployment rate gap, which is the difference between the natural rate as defined by CBO, now 5.5%, and the unemployment rate, has always been greater than zero prior to recessions, i.e., a tight labor market. Today’s labor market has about the same amount of slack as it had in 1982! That’s the same year the S&P took off after a 13-year stall. These two frameworks are fundamentally intertwined.

- Third, both the Rule of 20 and Graham & Dodd’s valuation formula both imply a P/E of 18x.

(ISI Group)

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

The information presented here is for informational purposes only, and this document is not be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] There you will find 84923 additional Info to that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/08/06/361-capital-weekly-research-briefing-51/ […]