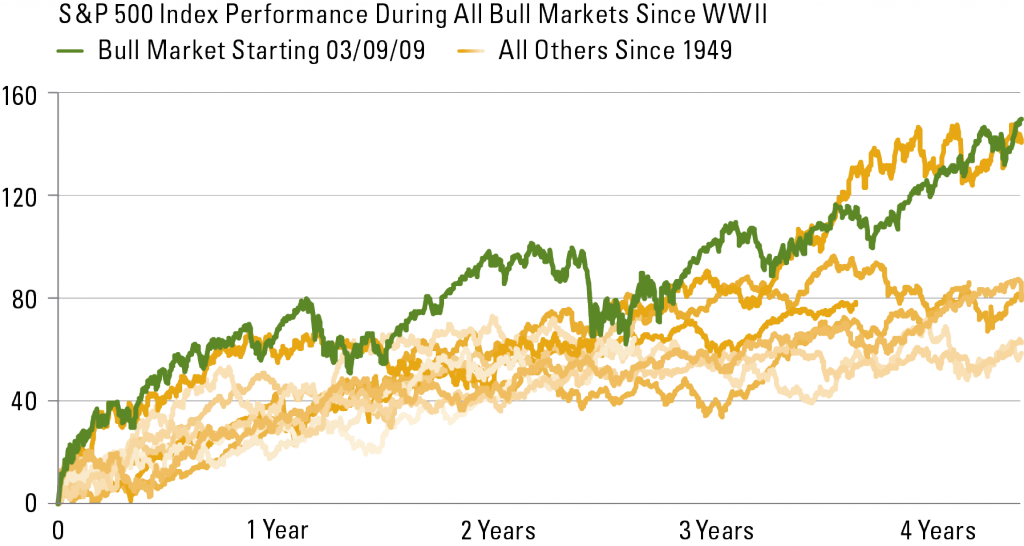

Jeff Kleintop of LPL Financial reveals the current bull market for US stocks to be the strongest since WWII in a great chart, and lays out the litany of negatives that have conspired against it (and have so far been vanquished):

The S&P 500 has continued the strongest bull market since WWII [Figure 1] despite all the shots fired at the market this year:

- Fiscal cliff tax increases;

- Sequester spending cuts;

- High oil prices;

- Italian election debacle;

- Cyprus bank bailout;

- Weakening Chinese economic growth;

- Federal Reserve communicating the intention to end quantitative easing (QE);

- Downward revisions to earnings growth estimates;

- Rising interest rates;

- A rise in geopolitical risk from North Korea, Egypt, and Syria; and

- Bouts of defensive sector market leadership and weak trading volume.

The chief strategist makes the point that there are no shortage of negatives lying in wait for the markets in the second half – but that so long as economic growth tracks above 2% these negatives should merely offer buying opportunities for long-term investors.

Follow Jeff on Twitter @JeffreyKleintop

(assume every disclaimer under the sun applies, past performance, indexes aren’t investable, don’t walk beneath ladders, etc)

… [Trackback]

[…] There you will find 97587 additional Info on that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] There you can find 26769 more Info to that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] There you can find 70639 more Info to that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]

… [Trackback]

[…] Here you will find 50947 more Info on that Topic: thereformedbroker.com/2013/07/23/chart-o-the-day-strongest-bull-market-in-65-years/ […]