361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

July 1, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

It was a great week to have a line (or a beak) in the market. I hope you were as successful as this Kingfisher…

And the 1st half of 2013 is in the books…

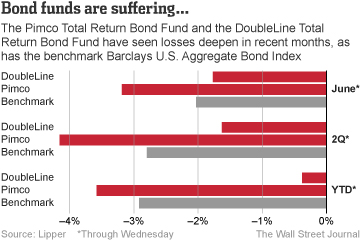

Equity investors finished June with the first down month in 8 for the S&P500. Bond investors took a Tommy Boy two by four across the face. And yes, it did leave a mark. Two months ago the “Great Rotation” from bonds to equities was nowhere to be seen. Today the panic out of fixed income funds is happening at the highest levels seen since 2008. As we noted last week, inflection points in major rotations are volatile, scary, and unpleasant. This helps to explain the seven 100 basis point moves in the S&P500 in the month of June, which marks the most volatility in 12 months. If you enjoy volatility like we do at 361 Capital, it was a fun month. If you run an all-weather, 100% long, stock and bond portfolio, then it was a month to forget.

End of the quarter means one thing is for certain… the earnings reporting season is only 2 weeks away! JPMorgan and Wells Fargo will kick off the earnings gauntlet on Friday July 12 (sorry Alcoa, but most investors don’t own your stock). For the next 2 weeks there will be a ginormous amount of data to digest from the U.S. corporate sector. The always over-followed and analyzed monthly jobs data will be released on July 5 which could be fun for the markets given that most investors will be unplugged from their desks. Friday’s move in the markets will be more about what investors are looking for in the data rather than what the data actually is. In the last 2 weeks, stocks have followed bonds every move. This tells me that equities are sick and tired of bonds MASSIVELY underperforming and that risk investors now want a healthy fixed income environment. So maybe a weaker unemployment number would be better than a stronger one? It’s America’s birthday this week. Let’s not Fear the Taper, let’s barbecue it!

For Fixed Income investors… In other words, “Sell Every Rally”…

“Don’t jump ship now,” Mr. Gross wrote. “We may have reached an inflection point of low Treasury, mortgage and corporate yields in late April, but this is overdone.”

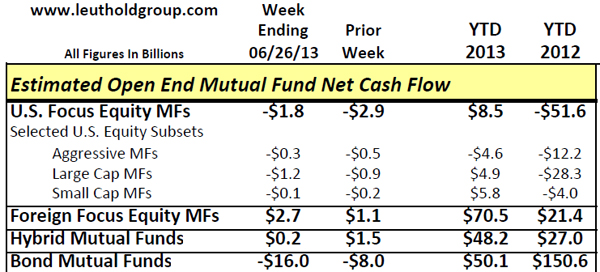

And while you are not panicking, the June bond fund outflows are nearly equal to the entire 2013 inflows…

This is the fourth consecutive week of large net outflows from bond mutual funds. Last week’s outflows were stronger than initial estimates, and this week’s net cash outflows may be the largest of the past four at an estimated $16 billion. Bond mutual funds are on course to tally net outflows around $40 billion in June, the largest monthly outflows since October of 2008.

(Leuthold Group)

So maybe equity investors are set up for a Win/Win scenario on the future economic data points…

Last Tuesday, the big package of stronger data (durable goods orders, Richmond, Case-Shiller, consumer confidence, and new house sales) helped rally the S&P +15 points, despite increased odds of tapering (gold plunged -$50). Then on Wednesday, the weak GDP report (only +2.8% nominal GDP) helped rally the S&P another +15 points on decreased odds of tapering (bond yields declined). So, it can be argued we’ve slipped into a WIN/WIN situation in which stronger data are good, and weaker data are “good” because they decrease the odds of tapering.

(ISI Group)

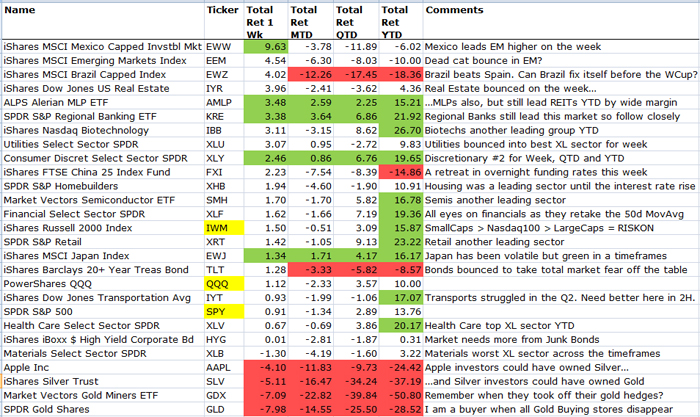

It was a bounce week for equities and bonds. Gold, Silver, and Apple investors became fewer…

The equity portfolio managers having the best 4th of July are those OVERWEIGHT Banks, Biotech, Retail, and Small Caps with not a spec of exposure in the Emerging Markets, Apple, or Gold Miners. Only a demented crystal ball could have accurately predicted these returns 6 months ago…

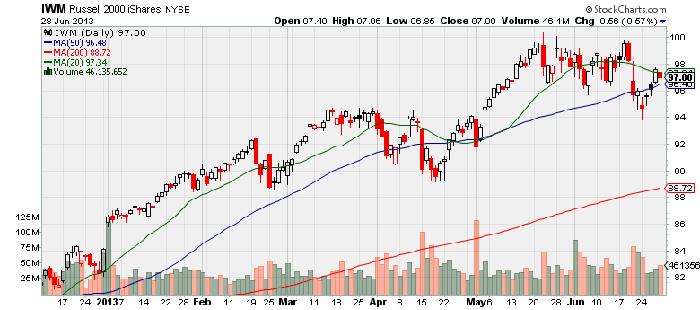

Two important RISKON measures of the market close to retaking their 50d moving averages are the Small Cap and Financial Indexes. If the IWM and the XLF can lead the market higher, it is likely the other major indices will follow. And if they fail, well…

And as always, we continue to monitor the Junk credits closely. With a 5% pullback from the highs, value is much more apparent, but it could be tough fighting the tsunami of cash being withdrawn from the sector…

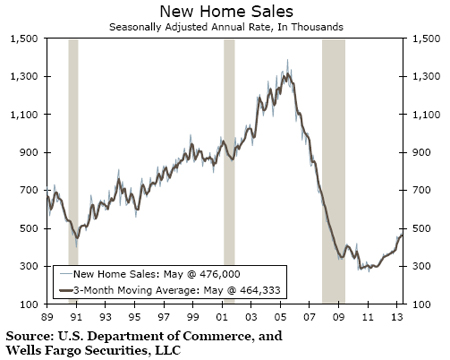

Another sector of stocks to watch closely is housing. Stocks have rolled over on the interest rate rises. So far the new home sales have not slowed down, but investors are betting that will soon change. Stay tuned…

The pace of new home sales rose to a 5-year high in May. Not only was that a faster pace than consensus expectations, but the 2.1 percent monthly gain comes with news that previously released sales data were actually better than first reported. The sum of the revisions to new home sales figures for the prior 3 months was a net 35,000. The price of a median new home is up 10.3 percent on a year-over-year basis. Pending sales of existing homes jumped 6.8 percent, the largest monthly increase in three years.

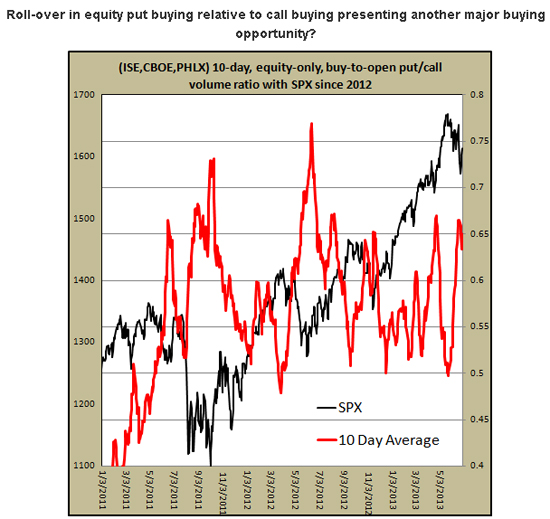

Several different measures of equity risk became oversold a week ago which setup a nice bounce last week for many to take advantage of. Here is a chart showing the excitement in Put option buying during June…

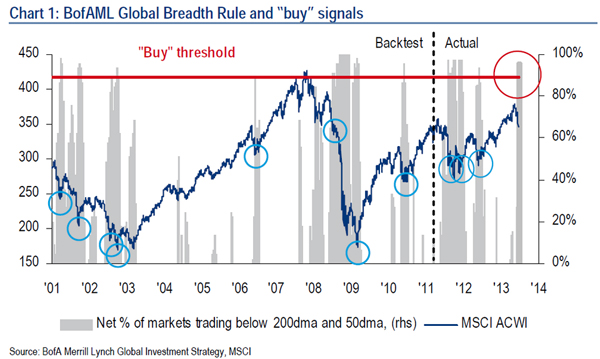

Meanwhile Merrill Lynch threw up the BUY signal as the total % of Global Equity Markets became extremely oversold…

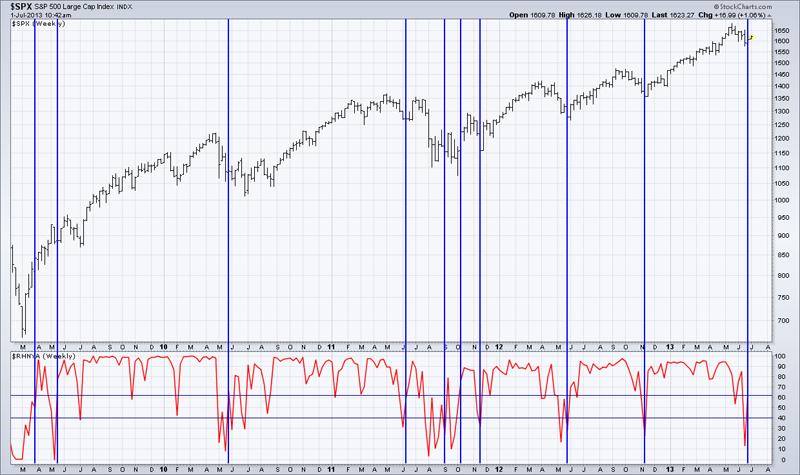

If you are a fan of the late Marty Zweig, his rarely fired, but highly accurate ‘Thrust Indicator’ also put up a BUY signal last week…

This market breadth based indicator looked for acceleration in 52 week highs from a recent oversold condition. In roller derby terms, think of it as trying to catch that sling-shooting outside teammate being whipped around a banked corner.

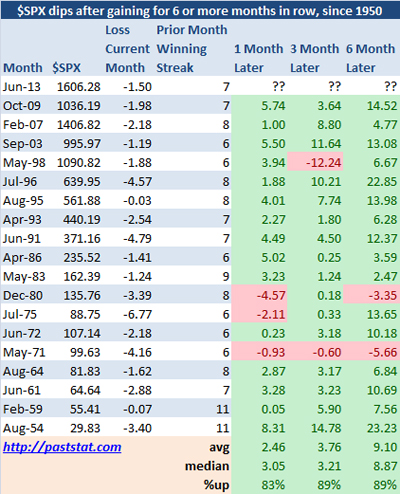

In the U.S., equities have had a great run. History shows that 6+ month runs are typically followed by further gains…

Now for a few of the ugliest charts for Q2 2013…

You would think that there would be some mean reversion trading opportunities here, but when it comes to analyzing an entire asset class that had a massive 10 year run, trading the downtrend has been the easiest way to make money.

But owners of Gold might have hope…

“TIPS are probably the worst asset class in the United States.” (Jeff Gundlach, DoubleLine)

(BusinessInsider)

Brazil and the Emerging Markets have been especially painful for those investors seeking higher growth rates…

Comments like this from Emerson Electric are not helping Emerging Market investors… “conditions have slowed in China over the last month, as liquidity constraints have created operational challenges for small and mid-sized companies, which has begun to affect broader Southeast Asia as uncertainty builds in the region”.

If you are a State Pensioner or Taxpayer of these States, you have to plan now for significant cuts to future pension benefits, much higher taxes, slower economic growth, and real estate appreciation, etc., etc., etc. The pension math just doesn’t add up to making 8% portfolio returns in a world of nonexistent to negative fixed income returns…

PROMISES are easy to make, but difficult to keep. This is especially the case with pensions, where an 18 year old worker can be promised a benefit that still might be paying out 80 years later. Many states have offered pensions to workers who can retire at 50 or 55 and who might spend longer as a retiree than as a worker… States have been allowed to account for these promises by assuming a high return on their assets – 7.5% or 8%. In effect, they are guaranteeing such returns to their workers, since it is very hard (legally) to reduce pension benefits for existing employees. But they cannot earn such a guaranteed return on this planet – they must buy risky assets. In effect, they are acting like a hedge fund; making a bet on equities with borrowed money, leaving future taxpayers to foot the bill if things go wrong. This paper has argued that pensions are debt-like and future liabilities should be accounted for with a bond yield. Moody’s shifted in April to this method, using a high-grade taxable bond index. This ends up with yields of 5-6%, which look a little high to me, but the point is moot; it makes the figures look bad enough. Instead of being 74% funded, state schemes are only 48% funded; they are less than half full… For credit purposes, Moody’s compares this adjusted net liability (the shortfall) with state revenues. Here are the worst ten.

Net liabilities as % of revenues:

- Illinois 241.1

- Connecticut 187.7

- Kentucky 140.9

- New Jersey 137.2

- Hawaii 132.5

- Louisiana 130.2

- Colorado 117.5

- Pennsylvania 105

- Massachusetts 100.4

- Maryland 99.5

And you thought the potholes were bad in these States now, just wait…

States and cities across the nation are starting to learn what Wall Street already knows: the days of easy money are coming to an end. Interest rates have been inching up everywhere, sending America’s vast market for municipal bonds, a crucial source of financing for roads, bridges, schools and more, into its steepest decline since the dark days of the financial crisis in 2008. For one state, Illinois, the higher interest rates will add up to $130 million over the next 25 years — and that is for just one new borrowing. All told, the interest burden of states and localities is likely to grow by many billions, sapping tax dollars that otherwise might have been spent on public services.

(DealBookNYT)

Good news for the States… The field of education is now moving at 500 miles per hour…

Think different. It was more than an advertising slogan. It was a manifesto, and with it, former Apple CEO Steve Jobs upended the computer industry, the music industry and the world of mobile phones. The digital visionary’s next plan was to bring radical change to schools and textbook publishers, but he died of cancer before he could do it. Some of the ideas that may have occurred to Jobs are now on display in the Netherlands. Eleven “Steve Jobs schools” will open in August, with Amsterdam among the cities that will be hosting such a facility. Some 1,000 children aged four to 12 will attend the schools, without notebooks, books or backpacks. Each of them, however, will have his or her own iPad. There will be no blackboards, chalk or classrooms, homeroom teachers, formal classes, lesson plans, seating charts, pens, teachers teaching from the front of the room, schedules, parent-teacher meetings, grades, recess bells, fixed school days and school vacations. If a child would rather play on his or her iPad instead of learning, it’ll be okay. And the children will choose what they wish to learn based on what they happen to be curious about.

(Spiegel)

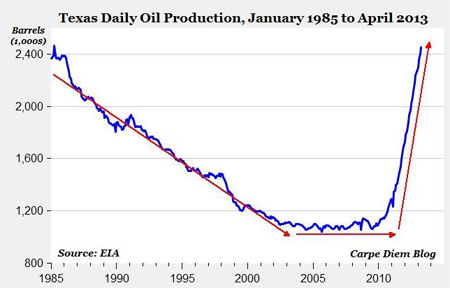

Remember all of the books and prophets on ‘Peak Oil’?

@Mark_J_Perry: Amazing Chart: Texas Oil Output Has Doubled in Only 30 Months, One of Most Remarkable Energy Stories in US History?

Nothing has gotten done with tax reform on the Hill. I expect that a complete overhaul will now be successful since the committee is splitting burgers and pints off campus…

@laurennfrench: Dave Camp and Max Baucus convene a beer and burger summit at the Irish times to talk tax reform

As you are running around the world this summer, try these travel tips to get connected to The Matrix…

- @Perform: You can get the WiFi password for many establishments by checking the comments section of FourSquare.

- @lIIusions: When you’re at an airport, add “?.jpg” at the end of any URL to bypass the expensive WiFi and access the Internet for free.

If you were 15-30 years old in the Summer of 1988, I know where you were the night Def Leppard came to town. Still one of the best tours ever…

(Def Leppard Hysteria Concert via YouTube)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/07/02/361-capital-weekly-research-briefing-47/ […]

… [Trackback]

[…] Here you can find 85849 more Information on that Topic: thereformedbroker.com/2013/07/02/361-capital-weekly-research-briefing-47/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2013/07/02/361-capital-weekly-research-briefing-47/ […]

… [Trackback]

[…] Here you can find 2673 additional Info to that Topic: thereformedbroker.com/2013/07/02/361-capital-weekly-research-briefing-47/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/07/02/361-capital-weekly-research-briefing-47/ […]

… [Trackback]

[…] Here you will find 66659 additional Information to that Topic: thereformedbroker.com/2013/07/02/361-capital-weekly-research-briefing-47/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/07/02/361-capital-weekly-research-briefing-47/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/07/02/361-capital-weekly-research-briefing-47/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/07/02/361-capital-weekly-research-briefing-47/ […]