“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is most adaptable to change. In the struggle for survival, the fittest win out at the expense of their rivals because they succeed in adapting themselves best to their environment.”

A lot of people think the above quote comes from Charles Darwin, it’s been sourced as coming out of his Origin of Species but it’s not actually in there. No, this quote was a summation of Darwin’s work from a management professor at LSU in the early 1960’s and then at some point it started being attributed to Darwin himself.

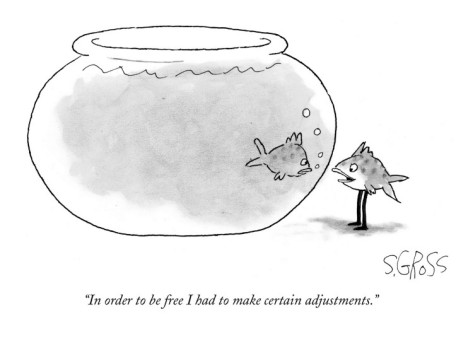

But, for investors, the point remains. Change – or rather the willingness to change – is how you survive in investing. It’s how you get better and how you don’t make “The Big Mistake.”

It’s not an accident that the greatest pure money manager of all time, Peter Lynch, was nicknamed The Chameleon.

He earned the Chameleon moniker because he perceived the changing environments he found himself in and adapted his style accordingly. He was less concerned with being right in academic debates or fighting over “what should happen” and more concerned with making money. FYI, Lynch compounded at an average annual return of 29% and beat the S&P in 11 out of 13 years. He took the Fidelity Magellan Fund from $20 million in 1977 to more than $14 billion when he retired in 1990 – a 2700% gain from start to finish. He didn’t even get the benefit of the next decade’s go-go bull market to pad that record even further.

Lynch remains untouched by anyone – whether they managed money before his career, during it or in the 25 years since. No one even comes close.

What made him special? He made changes in a diverse variety of market environments without obsessing over one metric or another like a dying man clutching a religious totem to his chest.

Lynch had six basic “stories” or types of stocks he liked to play and he leaned toward whichever ones were offering the best opportunities at a given time. He didn’t walk around wearing a sign on his chest that said “Value Investor” or “Momentum Trader” or ” Growth At a Reasonable Price Guy” or “Turnaround Player” and he certainly didn’t care to be put into someone else’s style box. Lynch knew that no approach worked best all the time.

How many guys admit that out loud today in 2013? How many managers have the guts to tell a reporter or an anchorman “To be honest, our area of expertise is not working in this environment, we’re biding our time.” You shall hear that approximately never.

Not many people can do that. It’s hard. But I find it essential. I’ve already tried this the other way – the “stick to your guns” approach – and you can’t imagine the war stories I’ve accumulated. The good news is that I don’t have much of an ego left anymore…

This is why it’s so hard for blowhards to make money – they invest so much emotionally and propound their predictions with such force that they can’t change their minds. They get entrenched because pride doesn’t let them admit a mistake and there is too much public scrutiny. They become attached to the hip with a trade or a thesis, there is no escape other than to stick it out.

Show me a PhD in love with his own theories and I’ll show you someone who’s about to blow up when the environment changes. Show me someone so confident in their system that they actually blame the market when it goes against them and I’ll show you a madman with no understanding of complex adaptive systems. Show me someone who’s already pounded their fist on the table for a certain outcome too many times to go back on it and I’ll show you a tragic Homeric hero going down with his ship.

Most of us are lucky – our careers don’t depend on us having one opinion and maintaining it forever, regardless of new or disproven evidence, in the public eye. Most of us are allowed to say “here’s what I think, but I could be wrong.” Most of us get to admit small defeats and lapses in judgement. Most of us get to make small adjustments as things change without the stigma of highly public, failed predictions.

We should be thankful to be free.

And pity those who aren’t so flexible, those who’ve dug themselves in.

That’s gotta suck…

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2013/05/21/adaptation/ […]

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2013/05/21/adaptation/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2013/05/21/adaptation/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/05/21/adaptation/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/05/21/adaptation/ […]