361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

March 25, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

Let us hope that the Google Trend charts for Cyprus, Yoga Pants and Dongles all peak in March 2013…

Looks like Cyprus and the EU will reach some deal on Sunday. This cartoon still might describe best how the government is paying for the deal…

@davidelliot: An armed bank holdup in #Cyprus.

As for investors and traders, few are worried about a systemic risk from Cyprus…

Laurence D. Fink, chief executive officer of BlackRock Inc. (BLK), the world’s largest asset manager, said the financial stability of Cyprus will be resolved and U.S. equities will rise 20 percent this year as the economy rebounds. “It has some symbolism impact on Europe, but it’s not a really major economic issue,” Fink said of Cyprus in a Bloomberg Television interview in Hong Kong today. “It’s a $10 billion issue. It does remind us of the frailty of Europe. It does remind us that the European fix will be multiple years.” (Bloomberg)

@bclund: Sitting around telling a group of young traders war stories from way back during the “Cyprus Crisis” of earlier this week. $$

@EddyElfenbein: If you’re ever on Cypriot Wheel of Fortune, my advice is to buy a sigma. That appears to be roughly 30% of the language.

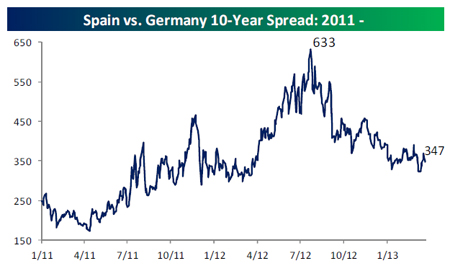

And the market reactions were rather muted on the week. If depositor worries were to raise their heads in any country, it would have been Spain. But the debt markets barely flinched…

(Bespoke)

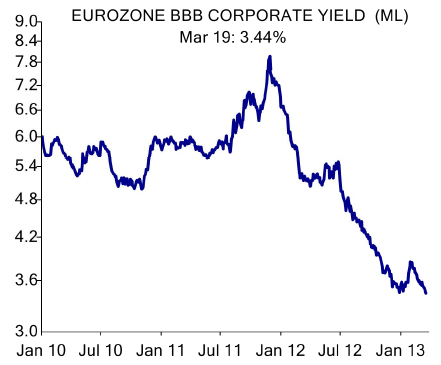

And BBB rated Corporate Euro yields continued to fall…

(ISI Group)

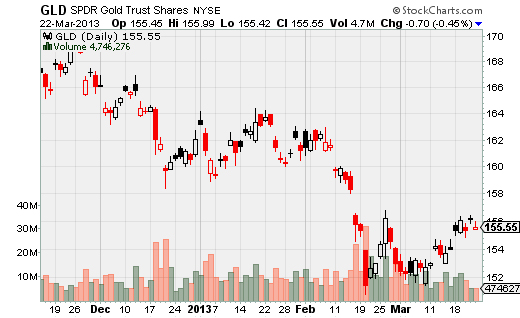

Also surprising was the very weak bounce in Gold which lives for +5% moves on global financial events…

More interesting was the continued selling in 2 strong stocks after weaker than expected earnings.

Both FedEx and Oracle have been solid stocks to own for large cap growth investors. Usually the market will support strong names like these after a weak quarter, but not this time.

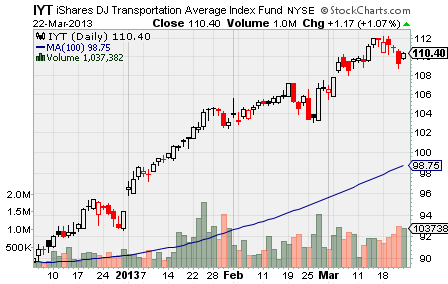

The Dow Transports put in a down week in part due to FedEx, but still worth keeping an eye on…

And Goldman Sachs was a leading financial stock, but now it is helping to pull the group lower…

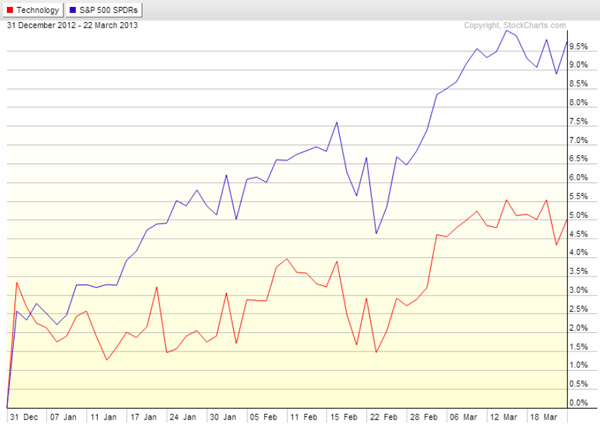

Meanwhile, this is the most watched chart among Tech and Large Cap Growth Stock investors…

If Apple does make a bottom, it will help the XLK close this wide performance gap with the S&P500…

For the week, the economic data remained strong in the U.S. and showed more signs of weakness in Europe…

- French, German, and Eurozone preliminary manufacturing PMI data declined

- In the UK, the new 2013 UK budget would show increased austerity

- U.S. March Philly Fed survey was better than expected – Markit PMI manufacturing number was better than expected

- The FOMC decision saw no surprises

- FedEx missed Q3 earnings expectations and cut its 2013 guidance

- Oracle missed consensus estimates in its Q3 and gave poor guidance for Q4

- Nike saw better profits and better margins in its Q3

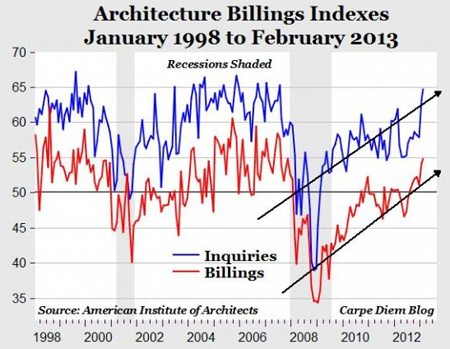

In a further sign of positive trends for commercial building activity, the Architects Billing Index moved to levels not seen since 2007…

In the residential market, both Kaufman & Broad and Lennar reported solid earnings. Comments from the Lennar call…

Stuart Miller, Chief Executive Officer of Lennar Corporation, said, “Our first quarter results clearly reflect continued improvement in the marketplace. Current market conditions are driven by strong demand resulting from low interest rates and attractive home prices, which have led to very affordable monthly payments, compared to increasing rental rates. Supply continues to be limited by low home inventories and fewer competing homebuilders. Accordingly, pricing trends have been positive, as shown by a 13% increase in the average sales price of homes in our backlog at quarter-end, compared to last year.”

Even The New York Times highlighted the issues around residential housing capacity constraints…

“As desirable as the long-awaited improvement may be, the unusually low level of homes for sale is creating widespread problems for buyers and sellers alike, leading to bidding wars and bubblelike price jumps in places that not long ago were suffering from major declines” (NYT)

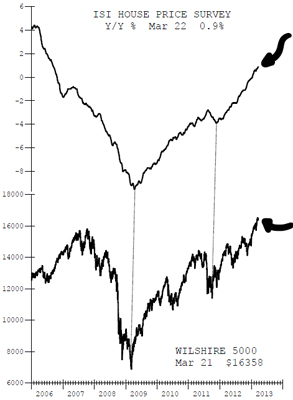

Don’t forget that rising home equity is good for EVERYTHING financial…

“Home equity is the biggest source of wealth, so if equity is increasing that has a very large effect on household spending and consumer psychology”. (WSJ)

Including the stock market…

(ISI Group)

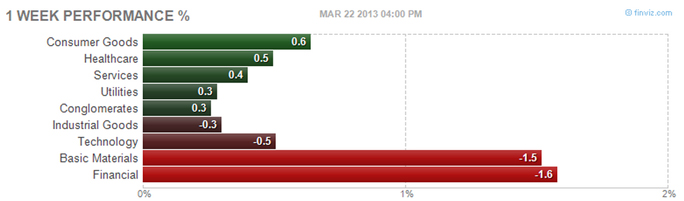

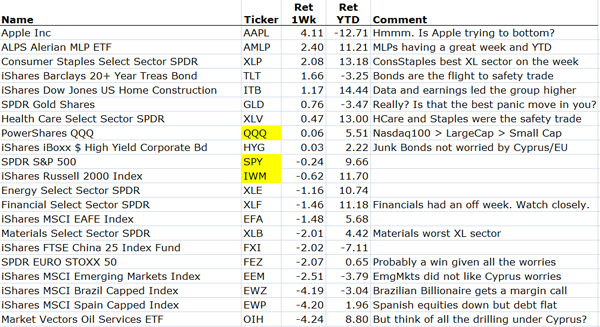

For the week the market paused, with Financials and Materials being the most worried about the Cyprus uncertainty and weakness in the Emerging Markets. Consumer Staples and Health Care were the sectors to hide in. Clear to see it was a RISKOFF week. This will likely flip in the short term if Cyprus can reach a deal with the EU and depositors.

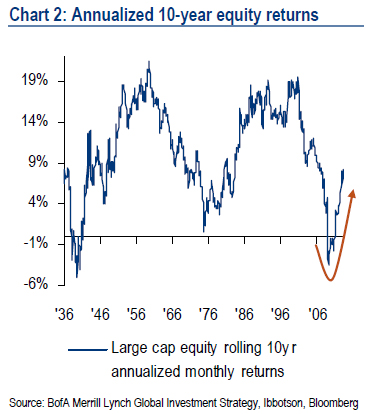

Looking longer term, here is a great chart on 10 year rolling returns for equities…

Always good to remind ourselves that we just lived through a period of negative 10 year returns. Will the next peak return to the high teens?

The Managed Futures category is a newer one for Mutual Fund investors. Here is a good paper on why investors are considering the strategy…

Managed futures have historical performance characteristics that make the strategy highly relevant in a market environment of relatively low returns and generally rising asset class correlations. The strategy has long had a reputation as an “all-weather” investment choice, a characterization bolstered by its strong performance in the period of the dot-com collapse of 2000-2002 and during the brunt of the financial crisis in 2008. Yet it remains an asset class unfamiliar to many investors—and one with an aura of risk despite its track record. (ForwardInvesting)

Meanwhile CalPERS is looking at leaving all active management…

In the latest sign of the apocalypse for active management, the largest pension fund in the United States is mulling a move to an all-passive portfolio. The California Public Employees Retirement System’s investment committee is evaluating whether the fees it pays its active managers are worth it or if paying less fees for passive management will lead to better long-term results, according to sister publication Pensions & Investments. The pension fund, commonly referred to as CalPERS, oversees about $255 billion in assets, more than half of which already is invested in passive strategies. (InvestmentNews)

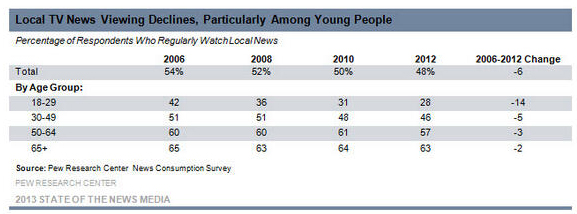

This sharp demographic shift is not good news for local TV stations…

The 18-29 age group is falling rapidly as young people go to internet apps and Twitter for the timeliest and most personalized news that interests them.

Albany, NY v Sacramento, CA for the Tonight Show?

Call it the Jimmy Fallon tax credit. Quietly tucked into tentative state budget is a provision that would help NBC move “The Tonight Show” back to New York, the Daily News has learned. The provision would make state tax credits available for the producers of “a talk or variety program that filmed at least five seasons outside the state prior to its first relocated season in New York,” budget documents show. In addition, the episodes “must be filmed before a studio audience” of at least 200 people. And the program must have an annual production budget of at least $30 million or incur at least $10 million a year in capital expenses. In other words, a program exactly like “The Tonight Show.” (NYDailyNews)

Two tweets that illustrate best why American kids/grandkids will be less prosperous than their parents

- holowesko: There used to be 16 workers in the US for every one person on Social Security. Now it is three. (Sen M Warner)

- @harmongreg: Mother-in-law just told me she takes husband to Dr just to get his toenails cut. Costs $159 but it’s all good since Medicare pays for it.

Best March Madness Financial tweet of the week…

@harvardlampoon: America, we are sorry for messing up your brackets and also your financial system and everything else.Special Thanks to…

UBS for adding the 361 Managed Futures Strategy to their Mutual Fund Platform making this strategy available to advisors and their clients.Joshua Brown, The Reformed Broker, for posting the Weekly Research Briefing each week to his popular blog.

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] There you can find 52369 additional Information on that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] There you will find 76817 additional Info to that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] There you can find 38166 additional Information on that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Here you can find 68831 additional Information to that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2013/03/26/361-capital-weekly-research-briefing-29/ […]