361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor. 361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

361 Capital Weekly Research Briefing

March 11, 2013

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

On the week: Bulls 5, Bull Fighters 0

The U.S. equity markets posted its best week of the year and the first week of 5 positive days as confidence and risk appetite returned with a vengeance. Driving the interest in equities was a very solid week of U.S. economic data, demand for European bond auctions and open market purchases, and some hope for progress in Washington D.C. checkbook balancing.

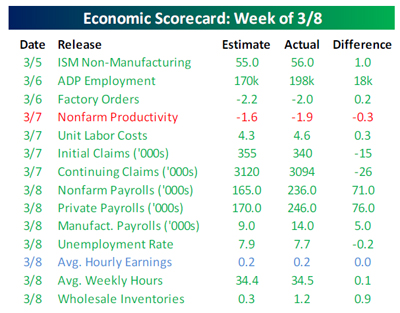

The big surprise last week was in the broad-based improvement in the economic data even while worries of the payroll tax increase and sequestration cuts were pressuring estimates lower.

The better than expected ISM manufacturing from February clearly hinted that this week’s gains in ISM Non-Manufacturing and Employment data would also top estimates.

(Bespoke)

Under the hood of the jobs data, it was important to note that it is being driven by private payroll growth. And within private payroll, Construction was the game winner…

Employment increased a respectable 236,000 in February and the unemployment rate fell two ticks to 7.7%. The 246,000 increase in private jobs was broad-based, but a notable contribution came from the 48,000 increase in construction employment, as the housing rebound appears to finally be making itself felt in the labor market.

(JPMorgan)

The 10 year Treasury yield closed at 2.05% showing that fixed income investors became a bit more nervous last week…

But even though job growth is accelerating, the Fed says that there “is still a ways to go” before they are likely to raise rates…

Top Fed officials have made it clear that the labor market’s health is their primary worry right now, and it is the main factor in determining how long they will continue their controversial bond-buying program, which is aimed at spurring more spending and investment. The central bank has said it wants to see “substantial progress” in the job market before pulling back, which likely would require several more encouraging employment reports like Friday’s.

“To me, there is still a ways to go,” Charles Evans, president of the Federal Reserve Bank of Chicago, said in an interview with The Wall Street Journal… Mr. Evans is in a camp of activist Fed officials pushing for the central bank to stick with its programs. He said, “We need job growth of around 200,000 per month over a six-month period. But that’s not all. We also need to see output growth above trend, reinforcing that job growth. Together, these ought to lead to a steady decline in the unemployment rate.”

(WSJ)

An improving economic backdrop with low chance for Fed tightening plus an oversold bond market explains why these two bond giants are BUYING treasuries…

- @PIMCO: Gross: We like Treasuries here. 91% on 5-year produces nearly 2% return with roll-down (assumes #Fed stands pat until 2015).

- Gundlach said he started buying benchmark 10-year U.S. Treasury notes in the last month after yields popped above 2 percent, because he sees value there relative to other asset classes, including stocks, which he said are “overbought.” “I bought more long-term Treasuries in the last month than I’ve bought in four years. I am a fan of Treasuries now. I wasn’t a fan of Treasuries in July,” said Gundlach, chief investment officer and chief executive officer of DoubleLine Capital. (Reuters)

A slow week for Mergers & Acquisitions… unless you work for Carl Icahn…

- It was a quiet week for M&A news, with few notable deals. Private equity firm KKR reached a deal to acquire Gardner Denver for $76/share in cash, in a total deal valued at $3.74B. Teen retailer Hot Topic agreed to be acquired by Sycamore Partners for $14.00/share in cash, in a deal valued at $600M. (TTN)

- Icahn figures that once the $9 a share (nearly $16 billion) special dividend is paid, the stock would be valued at $13.81 a share for a total package of $22.81. Icahn’s math, which hasn’t been released publicly, may be a little aggressive, but it’s not hard to come up with an $11 value on Dell after a $9 a share dividend, which would make his proposal far better for Dell holders. (Barron’s)

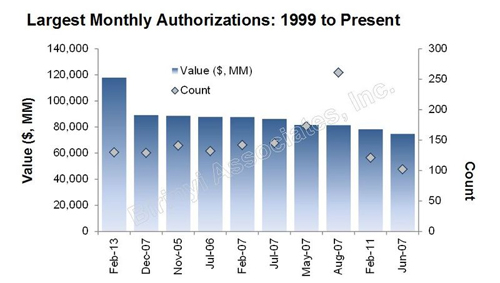

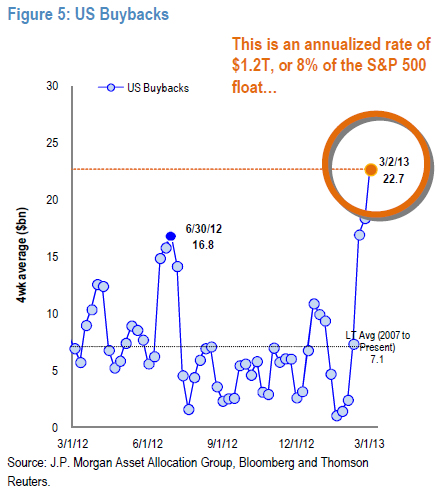

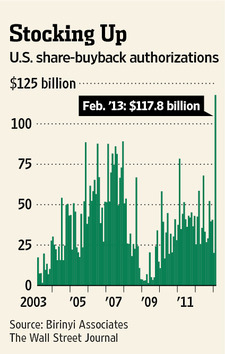

And Lazlo Birinyi created a stir by pointing out the recent ramp in Stock Repurchase activity…

Both JPMorgan and The Wall Street Journal added their voices to the importance of recent stock buybacks…

While we do not always know if announcements will translate into shares bought and even reduced supply, it is more important to note the confirmation of confidence in free cash flow generation by Executive Teams and Boards of Directors to recommend and approve this use of capital. We know that executive office confidence in the future has been lagging the economy. Maybe this rush of announcements indicates that things really do look better from the top office and from that big long directors’ table.

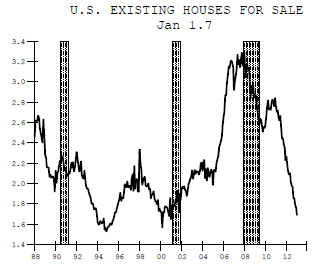

There are great analysts and there are great stock pickers. Ivy Zelman is both. So when Ivy is the most bullish on housing in 20+ years in the business, you should study the sector…

“…I’m always scared, I’m never complacent. But I have to say where the inventories are in the United States right now is a significant constraint. We have 30-year low inventories; mortgage financing is by far the best it’s been in the history of our country. Rent inflation is making people reconsider going out and considering buying. But most importantly, it’s the confidence, you know; think of sentiment like a battleship. And the inventory cleared, the blight goes away and consumers feel better. Now it’s this urgency to find a house. There are realtors blanketing neighborhoods asking people to sell their homes.”

(CNBC)

A chart of housing inventories…

(ISI Group)

Credit Suisse also highlighted the strength in housing last week as being ‘unprecedented’ in their survey’s history…

The momentum seen in January accelerated in February, with agents widely citing increased buyer urgency due to the combination of persistent inventory shortages (driving prices higher) and signs of mortgage rates moving higher. Most encouraging is that the breadth of strength is unprecedented in our survey’s history (dating back to ’05), with every one of the 40 markets we survey indicating rising home prices and only three of the 40 markets failing to reach a level of 50 or higher on our buyer traffic index (readings above 50 point to traffic exceeding expectations)… Strongest trends were seen across California, Florida, Austin, Las Vegas, San Antonio, Seattle, Denver, and Phoenix. Atlanta, Detroit, San Antonio, and D.C. saw the largest improvement sequentially. (Credit Suisse)

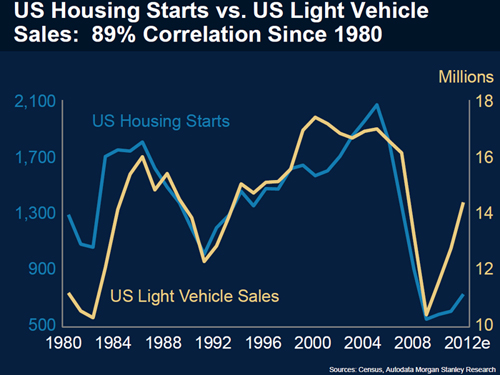

If you are looking for another confirming indicator of the housing market…

Auto credit has been very easy to get as the residual/collateral values of autos are very high right now. Given the move higher in residential real estate prices, banks/lenders will start opening the residential mortgage spigot to more than the trickle that it is flowing at currently.

And the shortage of housing stock in the U.S. will continue to drive the economy higher (just as it added 48,000 jobs in March)…

Construction employment increased by 21,000 jobs in February, following gains of 24,000 in January, 37,000 in December, 29,000 in November and 23,000 in October. Over the last six months, the construction sector has added 134,000 jobs, the highest six-month increase in construction employment since the first six months of 2006. Since last fall, construction hiring in the U.S. has averaged more than 1,000 new jobs every business day.

(AEI)

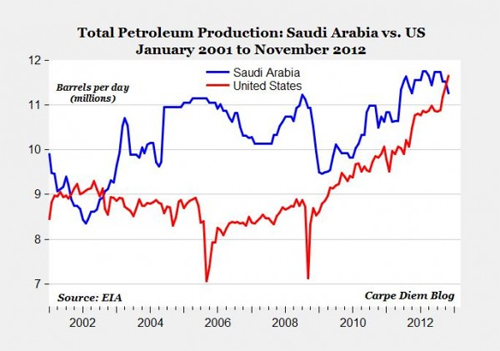

Also pushing the U.S. economy is the energy industry. As of the last data point, the U.S. is now producing more than Saudi Arabia…

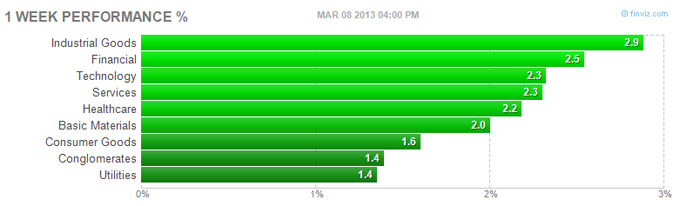

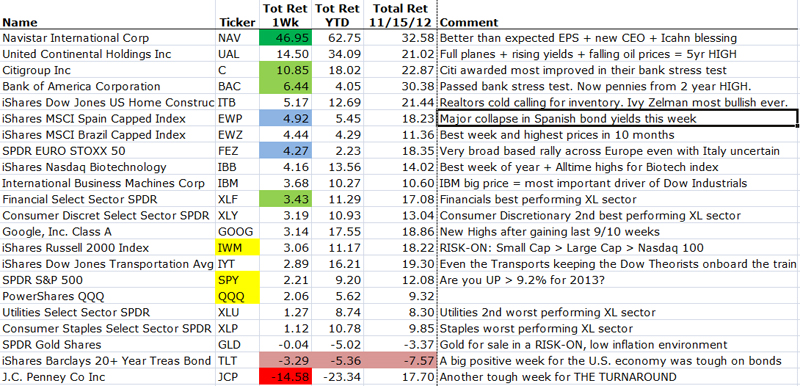

For the equity markets, every major sector gained on the week. It was RISK-ON across the board with Small Caps > Big Caps, Consumer Discretionary > Staples and Financials near the top of the rankings.

Included below are the returns from 11/15/12 which was the last recent low in the major indexes…

Howard Marks has a good P.R. person and seems to be everywhere right now…

“I can tell you from talking to institutions that, after 13 years of having their hearts broken by the stock market, they still are still leery of stocks even with the recent rally,” Marks says. “You can see that in their low stock allocations, compared with the period of 2000 and before. But imagine a couple of more years of good performance for stocks, which well could happen, and the love affair will really be rekindled.”

(Barron’s)

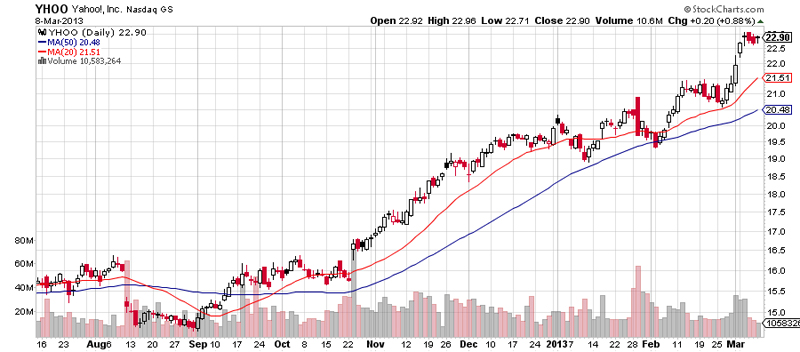

Yahoo is UP almost 50% in 5 months under its new CEO. If I was a long time employee with a slug of equity, I’d be happy to work in a coat closet under the stairs while wearing a purple blazer and bright yellow tie. Nice turnaround Marissa.

Recent U.S. Federal tax law changes will soon make Puerto Rico the #1 relocation choice for entrepreneurs and hedge fund owners…

Under the Puerto Rican law, any capital gains accrued after a person moves there would be tax free. Dividend and interest income paid by U.S. companies would still be subject to U.S. federal taxes, though would not be taxed locally. In addition, new residents can benefit from another new law that taxes business income earned in Puerto Rico at 4 percent. That law could potentially apply to hedge fund fees earned by a resident for services rendered for U.S.-based clients, said Gabriel Hernandez, one of the framers of the Puerto Rican tax law and head of the tax division of BDO Puerto Rico PSC. Hernandez now gets a call every day from wealthy individuals involved in Internet, software or financial companies who are interested in moving to the island, he said. He declined to name any of the business people who have relocated or who are currently contemplating such a move.

(Bloomberg)

Tweet of the week…

@uberfacts: Bill Gates has given away approximately $28 billion and has saved about six million lives since 2007.

Quote of the week…

“Without pension reform, within two years, Illinois will be spending more on public pensions than on education.” – Illinois Governor Pat Quinn who this week laid out his vision for reforming the pension system, which has the highest funding gap in the country.

(FinancialTimes)

Speaking of education, if you want to amp up your children’s vocabulary, just set this classic game down at your dinner table…

No need for the paper, pencil or timer, just shake it up, set it down during meals and get ready to be surprised on how quickly your youngest kids will move from building 3 letter words to 5-6 letter words. They will inhale the vocabulary of the older siblings and adults at the table as they learn how everyone else sees, spells and describes words.

Finally, some Harvard economist humor to end with…

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]

… [Trackback]

[…] Here you can find 52798 additional Information on that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]

… [Trackback]

[…] There you will find 61369 additional Info on that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]

… [Trackback]

[…] Here you can find 34292 additional Info on that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]

… [Trackback]

[…] There you will find 53067 additional Info on that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2013/03/12/361-capital-weekly-research-briefing-36/ […]