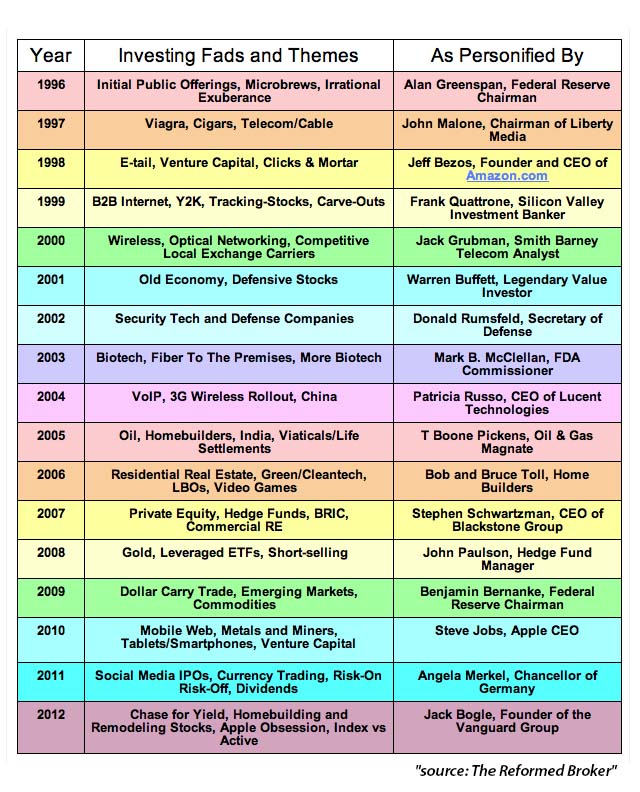

Another year in the books and I’ve updated my Investing Fads and Themes by Year guide accordingly. It begins with 1996 because that was my first summer working on The Street and my earliest exposure to the market.

Another year in the books and I’ve updated my Investing Fads and Themes by Year guide accordingly. It begins with 1996 because that was my first summer working on The Street and my earliest exposure to the market.

So what was 2012 about?

Well, there four major themes this year for investors.

First and foremost, there was Apple Obsession. During most days throughout the year it was the primary topic of discussion on every website and all over television. Apple’s market cap swelled above $620 billion this summer, making it the most valuable company of all time this summer (eclipsing the honor once held by Microsoft in 1999). It has since seen about $150 billion or so lopped off that market cap thanks to two consecutive quarters of missed earnings, a f***ed up map app and encroaching competition from Samsung. But this sell-off from 700 per share down to 500 has only made the stock more talked about, not less, as shareholders who’ve been accustomed to a one-way trip higher are now on very unfamiliar ground.

Also, the single biggest winning trade this year was in the homebuilders and home remodeling stocks. Housing starts began lifting off and never stopped. In the meantime, every foreclosure that’s been bought from a bank has needed thousands in repair and other aesthetic work done. Can’t rent a home out otherwise, especially one that’s been tenant-less for a long time. Homebuilding stocks like Toll, Lennar and Pulte Homes led the markets all year – the XHB index ETF is up a whopping 55% year-to-date! In addition, home improvement plays like Home Depot and Lowes also had a fantastic year, up 60% and 40% respectively.

The Chase for Yield went absolutely bonkers this year, investors poured money into bond funds at a startling rate. Bond mutual funds have taken in $242 billion this year (through early december), while bond ETFs have had inflows of over $50 billion – that’s on top of the $45 billion haul for fixed income ETFs in 2011. With lackluster yields in treasurys of any maturity, this year investors went for corporates and high yields, REITs and even emerging markets debt. The flows in were endless, each week brought fresh cash into the space. So long as rates are expected to stay low, this trend looks as though it wants to barrel right on through into 2013.

Finally, can we talk about the Index versus Active debate for a moment? Because like Kate Upton, the Vanguard Group was very clearly one of this year’s biggest winners. An old idea that originated with Jack Bogle’s Vanguard back in 1976 enjoyed a major resurgence as the hyper-correlation of the risk-on, risk-off era saw investors fire their active managers and go straight for index funds with their cash. Vanguard’s low-cost, plain vanilla mutual and exchange-traded funds took in more than $130 billion in new money this year! Slow to have gotten into ETFs, Vanguard has been able to play serious catch-up thanks to internal expense ratios on products that wholesalers at rival companies refer to as “not-for-profit.” The index king is now the number three ETF manager by assets at $236 billion, nipping at State Street’s heels as we speak. it should be noted that investors have plowed into passive funds even as they’ve yanked an unholy sum of cash from the world of active management.

So those were the big stories of the year that investors and traders bought into. Below is my updated guide to the Investing Fads and Themes by Year, 1996 – 2012. Enjoy!

See Also:

Last year’s version here (1996 – 2011)

[…] 2012 […]

The Ships’s Voyages

I think technological know-how just causes it to be even worse. Now there is a channel to never ever care, now there won’t be a prospect for them to find.

… [Trackback]

[…] Here you can find 53635 more Info to that Topic: thereformedbroker.com/2012/12/19/investment-fads-and-themes-by-year-1996-2012/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/12/19/investment-fads-and-themes-by-year-1996-2012/ […]

… [Trackback]

[…] Read More here to that Topic: thereformedbroker.com/2012/12/19/investment-fads-and-themes-by-year-1996-2012/ […]

… [Trackback]

[…] Here you will find 24170 more Information on that Topic: thereformedbroker.com/2012/12/19/investment-fads-and-themes-by-year-1996-2012/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2012/12/19/investment-fads-and-themes-by-year-1996-2012/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/12/19/investment-fads-and-themes-by-year-1996-2012/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/12/19/investment-fads-and-themes-by-year-1996-2012/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2012/12/19/investment-fads-and-themes-by-year-1996-2012/ […]