What could go wrong?

The Fed is DJing the hottest dance party ever and everyone is getting down. Well, not everyone, but you get the idea. Anyway, if there’s anything that could derail us it’s an ordinary, cyclical recession. The kind we used to have before Greenspan decided they were no longer necessary. Today I’d like to talk about the relationship between earnings recessions and economic recessions. Because we’re beginning to have the former, which typically leads to or coincides with the latter. Don’t get mad, that’s what the data says.

This is important because stocks should not continue to climb under these circumstances. Note that I said should not, not will not. Seth Klarman of the Baupost Group would agree with me. Here’s what he told his investors in a letter the other day (via Distressed Debt Investing):

“The overall market environment seems increasingly risky to us, as securities prices are rising despite weak and generally deteriorating global fundamentals. U.S corporate earnings are expected to be lower this quarter. Higher markets in the face of eroding fundamentals can be a toxic combination. A market rising for non-fundamental reasons (i.e., QE and ECB bond repurchases) is always one that demands a healthy dose of skepticism”

Back to the dancefloor…someone’s just whispered fire. But that whisper is being echoed across the financial web, transmogrifying with each utterance from whisper to scream. The whisper is a recession prediction, attached to which is a probability of 100%. What’s worse is that it comes to us originally from a Fed researcher and it’s an empirically driven call, not an opinion.

Now, predicting recessions is typically a sucker’s game – no one alive has a consistent record of doing it in a timely fashion and by the time NBER weighs in with the official start date, you’re typically two thirds of the way through anyway and stocks are already rebounding.

That being said…

The evidence of an impending recession has been piling up of late and to pretend otherwise because you’re afraid of the word would be rather silly. In addition, just because the evidence is piling up, that doesn’t mean we can’t avoid one in the short term. Of course that’s possible – especially with the Fed in full-on business cycle perversion mode.

But the odds of being able to avoid one continue to get slimmer. And whatever happens with this Fiscal Cliff mess, the plain fact is that it is guaranteed to do one thing: bring us closer to contraction than expansion no matter who gets the upper hand in the final negotiated bipartisan mercy-fuck.

Tax hikes and government spending cuts separately, with GDP growth running at sub-2%, will typically push us into recession. But combined? They virtually guarantee it. Raise your hand if you think the Cliff is resolved without both of those things being in the mix…didn’t think so. But don’t worry, the Fed can always cut rates to offset this change in fiscal policy. Oh wait…

See what I mean? Add in the international stuff and its hard to see how US housing’s newfound relative stability alone can save us.

But what is this aforementioned evidence, you ask, that has been piling up? Let’s walk through some of the important stuff together:

First, let us discuss the Cliff that no one else seems to want to acknowledge – The Earnings Cliff! This is a very real phenomenon that is very dangerous for both stocks and the economy as a whole – corporations facing a deceleration in earnings growth or an outright drop in year-over-year profits DO NOT INCREASE SPENDING AND HIRING. They just don’t. That is why earnings recessions make for a pretty good economic indicator, we can argue about whether it is a leading or a coincident indicator some other time.

And please keep in mind that earnings and interest rates are the only thing that matter in the weighing (not the voting) over the long term. So, I’ll spot you that interest rates are on our side – fine. And then you’ll say, “but Josh, we’re coming off of a record year for S&P 500 earnings!” And I’ll agree, but then I’ll remind you that this is not such a great thing.

Because this so-called record earnings period has been manufactured the way the late 1990’s New York Yankees used to manufacture runs – grinding down pitchers with sacrifice flies, bunts, smart base-running and a good eye for pitches at the plate. It got the job done for Joe Torre & Co and this same type of thing has gotten Corporate America back into the profit World Series. S&P 500 companies are not hitting RBI-driving home runs, they’ve been grinding out profits thanks to conservative spending, ultra-low borrowing costs, employee lay-offs and huge increases in technology-led productivity. “Well, what’s wrong with that?” you’ll ask. Nothing, only the rag has been wrung and all good things must end. This one already has now that sales growth has vanished and all the costs that could be cut have been cut already.

I want to show you something, it comes from Barry Knapp and his team at Barclays (via PragCap). It is very not good and it concerns the state of US earnings prospects…

Barclays Capital (Barry Knapp, Eric Slover, Adam Sussi): – The early weakness in corporate earnings continued right into the last big week of the 3Q12 reporting season. With 70% of companies having reported, it is clear that even with the heaviest negative preannouncements in our series since mid-2006 and the weakest quarterly expectations since the Great Recession, the bar was set too high this quarter. We had expected weak macro-economic trends to pressure optimistic forward growth rate expectations this reporting season; indeed, since Alcoa’s release (October 9, 2012), 4Q12 expected earnings growth has fallen to 7.2% from 10% and expected 2013 growth has dropped 90bp to 10.4% from 11.3%.

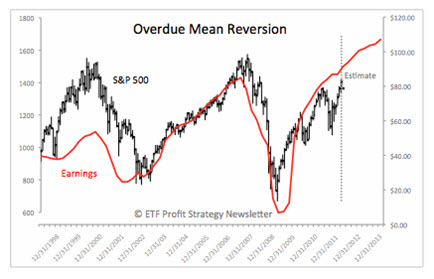

Why does this decline from record earnings into deceleration matter? Well, it’s very simple – all major market tops have coincided with a “record earnings” peak.

And just to illustrate this point a bit, here’s a chart from Nasdaq.com:

See that red line above pointing to $110 a share in S&P earnings next year? How confident do you feel about that estimate with global GDP growth grinding lower and the knowledge that more than half of US large cap profits come from overseas? Yeah, that’s what I thought.

So at this point, you may be thinking, “But, surely not every company is reporting weak earnings or guidance, right?” Yes, this is obviously true, we’ve got a fairly dynamic economy and our companies have exposure to every business category under the sun. But! But the companies with good results this earnings season and good guidance are being met with major investor skepticism about whether their prospects are truly as good as they themselves think. Paul Vigna quotes a recent report on this phenomenon from Morgan Stanley’s bearish strategist Adam Parker at MarketBeat:

“Don’t over-react to first day’s performance,” says Parker, who has an 1167 year-end S&P 500 price target, the most bearish view among big bank strategists. “Stocks that are beating and guiding up outperform the first day after results, but in the subsequent three days have lagged both the market and those stocks missing and guiding down—an interesting development likely born of doubt about future estimate achievability.”

Translation: Those initial pops after good reports simply are not sticking. The market’s failure to maintain optimism even after a good report is not a good sign, unless you think “the market” is dead wrong and overly pessimistic. I’m not sure that’s been a winning bet in past periods of weakening global macro environments. Think 2007 – globally-levered industrials and materials companies were highly upbeat but the narrowing of stock market leadership in October of that year disagreed, market breadth said “Bullshit.”

Now your next question is probably “Well, can we get back to peak earnings in the next year?” I’m not sure that’s in the cards. Let’s look at Apple – Apple’s earnings growth outlook cut of 25% the other day may have been the icing on the cake for the rest of the S&P’s earnings estimate malaise. Apple is a 5% weighting for the index overall and is a very good barometer for overall consumer discretionary spending in general. If things are sluggish there, what does that mean for everyone else?

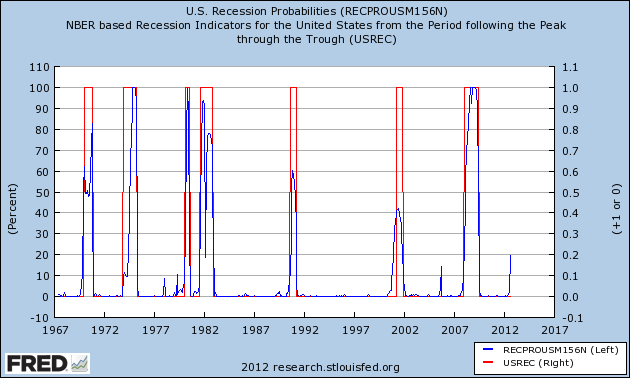

And now we come to the money chart, the one that everyone is blogging about and buzzing about on their sites and behind the scenes. Understand that I talk to all the financial bloggers offline and I’ve never seen one chart shared with as much reverence and velocity as this one.

Jeremy Piger published it first at the St Louis Fed on October 30th, very quietly while everyone was dealing with the impending Frankenstorm that is in the process of costing me my marriage. It got picked up by the bloggers (Cullen, Barry, Weez etc) but probably should have made more of a splash.

Because it is indicating a 100% chance of recession:

Do you see the percentages on the left side of the chart? 20% is the line in the sand. We’ve never hit that level and NOT had a recession. In 2006 we got close (18%?) but that particular Great Recession would be a year and half in the making. Note that we’re back at that 20% line again. And I can’t think of anything that keeps the leading indicators from going through it to the upside – the Fiscal Cliff stuff could only speed its ascent.

And in case you’re wondering, Obama’s victory last night does absolutely nothing to alleviate the issue, in fact one could make the case that it exacerbates the gridlock we’re all concerned about.

And so between the leading economic indicators as followed by the Federal Reserve, the political realities affecting fiscal policy and the undeniable presence of the Earnings Cliff, we have all the alarm bells we should need to at least admit that the probability is greater than 50% a recession is on the horizon. Our working assumption is that we’re in one sometime before Spring 2014, within the next 18 months. By the way, this would line up neatly with historical precedent, I’ve talked about the average length and median length of expansions and contractions in the 20th Century, if you’re interested check out Economic Expansions 101.

So the question becomes, “What do I do?”

Depending on your time horizon or investing style, you may not necessarily have to do anything.

What we’re doing is kicking out low conviction holdings and a lot of our higher beta stocks and funds. We’d love to be wrong, see a massive economic expansion and just buy ’em back. But the typical recession means a 30% peak-to-trough drop in equities from peak to trough and we manage money for people’s retirements. A phone call from us to one of our client households to apologize for a 30% drawdown would simply be unacceptable.

So we get defensive and allow things to develop. We get a bit more liquid with the expectations of better entries.

Because the evidence piling up is now too weighty for us to do otherwise.

[…] LINK HERE to the essay […]

… [Trackback]

[…] Here you will find 64790 additional Information on that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Here you can find 62282 more Information to that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Find More on on that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Here you will find 27358 more Information on that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/11/07/fire-in-the-disco/ […]