361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor.

361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

August 6, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

@SoberLook: This book needs to be written – soon.

Another highly volatile week for equities and bonds with the key input being Europe.

While the S&P500 and Nasdaq100 have put in 2 months of higher highs and higher lows, the financial markets remain in a defensive position with Small Caps and the Dow Transports being left behind. Both the U.S. and European markets are being led by the defensive sectors of Health Care and Consumer Staples. Just not something that instills confidence in any equity investor. But U.S. equities are looking to be the safe haven for global investors as the Fed continues to saber rattle on all weak economic data.

Wednesday’s FOMC saber rattling…

“The committee will closely monitor incoming information on economic and financial developments and will provide additional accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions in a context of price stability,” said the FOMC’s statement. In contrast to the Fed’s previous statement that the economy had been expanding moderately, it said that “economic activity decelerated somewhat over the first half of this year,” and that “growth in employment has been slow in recent months”. (FT)

Of course the U.S. still has future hurdles to jump…

“The Fed’s attempt to overcome its policy dilemma has little chance of succeeding given the degree of political dysfunction in Washington. It is only a matter of weeks until, once again, Fed officials will feel compelled to act, and despite full knowledge that their measures will have limited effectiveness in delivering desired outcomes.” (Mohamed El-Erian, PIMCO)

One help to equities has been the tick up in the Citi Surprise Index…

And more fuel for rising stock prices is that Wall Street hates stocks…

“After triggering a Buy signal in May, our measure of Wall Street bullishness on stocks has continued to decline, marking the tenth time in the past year that the indicator has fallen. This month’s 5.5ppt decline pushed the indicator down to 43.9, the lowest level in the history of our data going back to 1985, suggesting that sell side strategists are now more bearish on equities than they were at any point in the last 27 years. Given the contrarian nature of this indicator, we are encouraged by Wall Street’s lack of optimism and the fact that strategists are recommending that investors significantly underweight equities vs. a traditional long-term average benchmark weighting of 60-65%.” (BofA/Merrill Lynch)

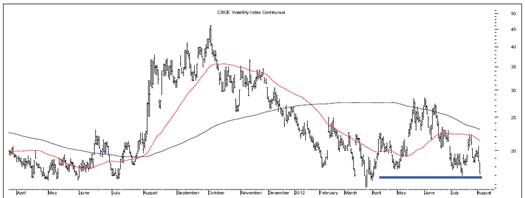

But the VIX is showing some complacency settling into equities…

(RenMac)

As for the markets this week, here were the most interesting movers:

- Apple/AAPL +5.2% (+52% YTD)

- Italy/EWI +3.6%

- France/EWQ +2.4%

- Germany/EWG +2.3%

- Nasdaq100/QQQ +1.1% > Large Cap/SPY +0.4% > Small Cap/IWM -0.9%

- Junk Bonds/HYG or JNK +0.9% (flight to riskier yields continue)

- Financials/XLF +0.5%

- Industrials/XLI +0.4%

- Gold/GLD -1.0%

- Natural Gas/UNG -4.6%

The world’s largest bond manager caused quite a stir last week…

“The legitimate question that market analysts, government forecasters and pension consultants should answer is how that 6.6% real return can possibly be duplicated in the future given today’s initial conditions which historically have never been more favorable for corporate profits. If labor and indeed government must demand some recompense for the four decade’s long downward tilting teeter-totter of wealth creation, and if GDP growth itself is slowing significantly due to deleveraging in a New Normal economy, then how can stocks appreciate at 6.6% real? They cannot, absent a productivity miracle that resembles Apple’s wizardry.”…“The commonsensical conclusion is clear: If financial assets no longer work for you at a rate far and above the rate of true wealth creation, then you must work longer for your money, suffer a haircut on your existing holdings and entitlements, or both.” (Bill Gross, PIMCO)

@ReformedBroker: The man who invents a vehicle guaranteeing 8% a year to pension managers could raise a trillion dollars in a day.

Indiana is no longer waiting for an 8% return and is now planning on 6.75%…

Indiana Public Retirement System, Indianapolis, adopted the lowest investment return assumption of any major public pension plan, lowering it to 6.75% from 7%, according to a statement the fund released last night. The state also plans to transfer $360 million from its $2 billion in reserve assets to bolster the pension plans the $25.6 billion INPRS oversees. That transfer is in addition to expected pension contributions of $2.3 billion in the current fiscal year. INPRS is the first among the 126 largest public retirement systems to drop its assumed rate below 7%, said Keith Brainard, research director of the National Association of State Retirement Administrators. On the rate cut, Steve Russo, INPRS executive director, said in the statement, “This is a prudent move by our board to recognize potential long-term global market realities. The risks and consequences of assuming a too high rate of return justify a conservative approach to this and other actuarial assumptions.” (PIOnline)

As alpha and absolute returns remain difficult to achieve, investors are flooding to ETFs…

Investors steered an estimated $17.1 billion into exchange-traded funds and notes in July, bringing their total investment in the products to $93 billion for the year, according to the latest data from the ETF Industry Association. The $93 billion represents a 31% increase from the $71.1 billion that ETFs and ETNs posted in inflows in the first seven months of 2011. (Financial-Planning)

@SallieKrawcheck: Asset managers w/ poor performance are very difficult to turn around & very difficult to kill: profitable zombies

Even the former giant is jumping into the ETF business…

Fidelity Investments, the asset manager that watched from the sidelines as exchange-traded funds went from zero to $1.5 trillion over the past 20 years, is finally preparing to jump into the business, according to a person familiar with the matter. Fidelity, based in Boston, aims to become the first major mutual-fund company to introduce ETFs run by active stock pickers by opening a series of products based on its “Select” line of industry-focused equity funds, said a person who asked not to be named because the plan isn’t public. The Denver- based unit that would run the ETFs is headed by Anthony Rochte, who was hired from State Street Corp. in March, the person said. (Businessweek)

Meanwhile, an investing legend decides to return capital to investors…

Louis Moore Bacon plans to give back $2 billion, or 25% of his main hedge fund, to investors, saying it may be too big for him to achieve past returns as “liquidity and opportunities have become more constrained. […]Unfortunately, as the amount and percentage of the assets I manage have increased these last several years, the markets have been trickier and less liquid,” Bacon, who is based in New York, wrote in his eight-page letter. “The ‘risk on/risk off’ environment appears to be an abiding presence that has kept my market engagement low.[…]“Markets are increasingly distorted by central banks’ attempts to squeeze drops of growth from an over-indebted private sector across much of the developed world,” Bacon wrote… The U.S. markets are hindered by “a caustic political environment and an anti-business administration,” he said. (NYPost)

Maybe the most interesting item from the Q2, Berkshire cut its exposure to muni risks in half…

Warren Buffett’s Berkshire Hathaway Inc.recently terminated about half of a big wager on the health of municipal debt, amid a worsening outlook for states, cities, and municipalities across the country. Berkshire said Friday in its second-quarter financial filing with regulators that it reached an agreement to terminate contracts with a notional value of $8.25 billion, or about half the total outstanding. It didn’t name the party on the other side of the deal or say when it reached the agreement, other than to say it came after June 30. The move effectively reduces Berkshire’s exposure to defaults by state and local governments, many of which have been under intense budget pressure at a time of weak employment and soft housing prices, which have hit tax collections. (WSJ)

Happy 100th Milton…

“If you put the federal government in charge of the Sahara Desert, in 5 years there’d be a shortage of sand” (Milton Friedman)

Peter Orszag channels Milton’s quote in recommending a full privatization of the USPS…

Those who believe in the usefulness of government must be vigilant about making sure all its activities are vital ones, since the unnecessary ones undermine public confidence. With this in mind, Congress should now privatize the U.S. Postal Service… The Postal Service faces three problems – First, Congress has not given it the permission it needs to cut costs and raise revenue — and lawmakers seem unable to approve even modest reforms. Second, its market has been declining for years, as e- mail, electronic payment, and other alternatives to traditional mail have grown. Third, the economic slump has caused a further drop-off in mail volumes… As the Cato Institute (hardly a bastion of support for government operations) has noted, a decade ago sorting 35,000 letters an hour required 70 employees. Today, it takes only two. Over the past six years, the number of career Postal Service workers has declined by more than 20% … Of the roughly 32,000 local post offices across the country, fewer than 7,000 generate enough revenue to cover their costs. (Bloomberg.com)

“Governor Brown, Jon Stewart is on line 1 with a quick question…

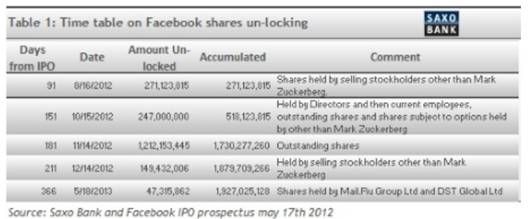

Gov. Jerry Brown and state lawmakers in June approved a $91 billion budget that included $1.9 billion in expected tax revenue from Facebook employees striking it rich — a rare projection that helped stave off cuts to schools and programs for the sick, poor, and disabled. But Facebook’s stock price dipped below $20 a share for the first time Thursday before closing at $20.04, the latest in a shocking fall from the company’s initial stock price of $38 in May. At the same time, the Legislative Analyst’s Office reported this week that a big chunk of the extra state revenue resulting from the IPO won’t materialize unless the stock turns around soon… The expected “Facebook Effect” on the state budget is unique since no other company has had such a massive, tightly scheduled public offering that allowed finance officials to pencil-in so much tax revenue ahead of time. While officials expected the Facebook revenue to make up less than 2% of California’s general fund budget, the money is enough to pay the salaries of 28,000 public school teachers… “I’m really hoping we don’t have to go there,” said state Sen. Elaine Alquist, D-Santa Clara, a member of the Senate Budget Committee. “We were counting on so many dollars from Facebook — and the whole public was, the whole world was. The whole world was shocked with what happened.” (MercuryNews)

The good news for California is that their FB capital gain tax revenues cannot go negative…

(TradingFloor)

Well, at least it wasn’t the Greek Prime Minister…

A political row has erupted in Athens after the former head of a big Greek state bank admitted to transferring € 8m of personal savings abroad to buy a London property months before his Agricultural Bank headed towards insolvency. Theodoros Pantalakis, former chief executive of Greece’s Agricultural Bank (ATEbank), strongly denied any wrongdoing, telling Realnews, a Greek website, that he had declared the transaction to authorities in 2011 and had paid tax on the amount transferred. “I’m on holiday and I don’t plan to say anything more until I come back to Athens,” Mr. Pantalakis told the FT from his villa on the Aegean island of Paros. (FT)

It was a GREAT week for Science…

@MarsCuriosity: No photo or it didn’t happen? Well lookee here, I’m casting a shadow on the ground in Mars’ Gale crater #MSL

@Bill_Gross: The accuracy of landing on Mars is like hitting a golf ball from Los Angeles & hitting a hole-in-1 in Scotland. (TheIndependent)

@felixsalmon: Gold medal for NASA in the 563 billion meters

3 weeks left of summer to be the coolest Mom or Dad on the beach…

As they reveal in a paper published this week in Scientific Reports, the key is to use sand with only 1% water by volume. Wet sand has grains coated with a thin layer of water. Owing to water’s surface tension this thin coat acts like skin stretched over many grains, holding them together by creating bridges between the grains. The strength of these bridges is enough to fight Earth’s gravity and prevent the structures from buckling under their own weight…According to calculations, using ideally moist sand; a column with a three inch diameter could rise as high as two meters. (Economist)

While 361 Capital was not a sponsor of the North Korean weightlifting team, they sure have the best looking logo that we have seen at the XXX Summer Games…

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Weekly Research Briefing Archive

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Here you will find 22321 more Info on that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Find More on that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2012/08/07/361-capital-weekly-research-briefing-9/ […]