361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor.

361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors

361 Capital Weekly Research Briefing

July 30, 2012

Timely perspectives from the 361 Capital research & portfolio management team

Written by Blaine Rollins, CFA

“So much time and so little to do. Wait a minute. Strike that. Reverse it.”

(Gene Wilder ‘Willy Wonka & the Chocolate Factory’ 1971)

It’s all about saving Spain and Italy having so little time and the ECB having too much to do…

- ECB President Mario Draghi said that officials are ready to act to keep the euro alive and would work to lower surging bond yields that are pressuring members like Italy and Spain. “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro,” Draghi said. “And believe me, it will be enough.”

- German Chancellor Angela Merkel and French President Francois Hollande issued a joint statement saying that they will do anything to protect the Euro region.

- Flashback: “If you have a bazooka in your pocket and people know it, you probably won’t have to use it.” (Hank Paulson, U.S. Secretary of Treasury, August 2008)

- Earlier in the week, spreads in Spain widened out to a record high of 633 basis points as the 10-year Spanish yield rose to 7.57%. In Italy, spreads saw an even bigger move, albeit off a lower base, rising to 535 bps and a yield of 6.57%.

- *SPANISH UNEMPLOYMENT RATE RISES TO 24.6%, HIGHEST ON RECORD. (and for under 25 yrs old it is 53%!)

- Stress has returned to Europe, but the stakes are higher. Spain (let alone Italy) is not Greece: its economic size, the cost of a rescue, and the increased market skepticism about temporary fixes suggest that the policy response needs to include some of the political and institutional reforms that prior crises have not changed. Conditions will likely worsen in the near term. (Morgan Stanley’s Global Cross-Asset Strategy Team)

So after Mario’s tough talk, bond yields responded. Time now to deliver or else…

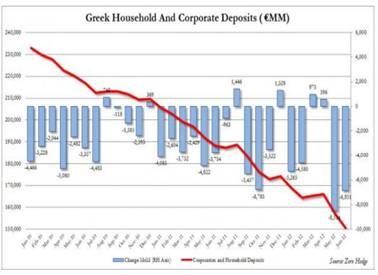

Meanwhile, depositors continue to flee Greece…

(ZeroHedge)

And Citigroup moves to 90% chance of a Grexit…

We now believe the probability that Greece will leave EMU in the next 12-18 months is about 90%, up from our previous 50-75% estimate, and believe the most likely date is in the next 2-3 quarters. As before, for the sake of argument, we assume that “Grexit” occurs on 1 January 2013, but we stress this is an assumption rather than a forecast of the precise date. Even with the Spanish bank bailout, we continue to expect that both Spain and Italy are likely to enter some form of Troika bailout for the sovereign by the end of 2012. (Willem Buiter, Citigroup)

German taxpayers still not happy about bailing out Club Med countries…

The prospect of Europe’s biggest economy losing its cherished AAA credit status has unsettled Germans, already angry about footing the bill for bailouts, and triggered calls for an even tougher stance on Greece and other euro zone laggards. While politicians and economists were at pains to argue that Moody’s downward revision to Germany’s credit rating outlook would have little immediate impact on borrowing costs, ordinary Germans said they were worried. “If things pan out the way Moody’s have predicted then we will have problems here with unemployment, if we lose confidence that things will get better, it’ll mean big problems for the economy,” said Memet Dogan, a 45-year-old transport worker near Berlin’s Brandenburg Gate. (CNBC)

@lindayueh: 10 countries rated AAA by S&P, Moody’s +Fitch: Australia, Canada, Denmark, Finland, Germany, Netherlands, Singapore, Sweden, Switzerland, UK.

Calls for Greece to start paying its own share… in Drachmas

“With Greece we have reached the end of the road. There must not be any further aid. A country which does not have the will to fulfill the conditions, or is not able to do so, must get a chance outside the euro,” Dobrindt told the daily Die Welt… “Greece should start to pay half of its civil service wages, pensions and other expenditures in drachmas now,” Dobrindt added. “A soft return to the old currency is better for Greece than a drastic move. Having the drachma as a parallel currency would allow the chance for economic growth to develop.” (Reuters)

Fact of the Week…Sicily has 17x the number of forest rangers as British Columbia

But many critics say Italy — and Sicily in particular — has been driven into dire financial straits not by austerity but by the rampant public spending of the past, the product of an entrenched jobs-for-votes system that helped keep Italian governments in power and Sicilians employed. Today, Sicily’s regional government has 1,800 employees — more than the British Cabinet Office — and the island employs 26,000 auxiliary forest rangers; in the vast forestlands of British Columbia, there are fewer than 1,500. Out of a population of five million people in Sicily, the state directly or indirectly employs more than 100,000 of them and pays pensions to many more. It changed its pension system eight years after the rest of Italy. (one retired politician recently won a case to keep an annual pension of 480,000 euros, about $584,000). “Of course that’s too many,” Mr. Lombardo said of the forest rangers. But he said it was difficult to cut back because state workers have job protection. “We have to wait for them to retire.” (NYTimes.com)

More positive economic surprises last week, but some big misses in Richmond Fed and New Home Sales…

@PIMCO: Gross: Richmond Fed Survey this AM was disastrous – implies GDP inching close to 0%.

Mortgage Rates continue to find new lows, but home sales are slowing… Mortgage buyer Freddie Mac said Thursday that the average rate on the 30-year loan dropped to 3.49% from 3.53% last week. The loans are the lowest since long-term mortgages began in the 1950s. The average rate on the 15-year fixed mortgage, a popular refinancing option, dipped to 2.80%. That’s below last week’s previous record of 2.83%. The rate on the 30-year loan has fallen to or matched record lows 13 of the past 14 weeks. (USAToday)

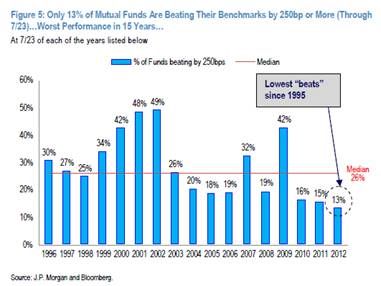

Equity Managers having their worst performance in 15 years…

…which explains why ETFs are being bought and held by individual investors.

ETFs are often touted for their tradability relative to mostly buy-and-hold mutual funds, but it seems investors by and large are not buying ETFs to trade them, but rather to hold them for the longer term, Charles Schwab said. While fixed-income ETFs represented 37% of year-to-date ETF flows at Schwab, they captured only 14% of total trades in that time period, the report said. The numbers are a bit better for U.S. equities ETFs—they snagged 25% of trading activity so far this year. But the bottom line is that relatively low trading volume seems to refute the notion that ETFs are too often used as trading vehicles. “Most investors are not day-trading ETFs,” Beth Flynn, a Schwab vice president and its head of ETF Platform Management, told IndexUniverse in an interview. “By and large, clients are using ETFs as longer-term additions to portfolios.” (IndexUniverse)

When interest rates are near 0%, it is uncomfortable to be on the wrong side of the trade…

Treasury bond prices last week declined -1.6% as yields increased +15bp from 1.39% to 1.54%, wiping out the coupon payment for the next year. At the same time, the S&P increased +1.7%. Relative performance, and in turn perceptions, can change quickly. (ISI Group)

Then again, IBM loves interest rates near zero…

IBM on Wednesday sold $1 billion in 10-year debt with a coupon of 1.875%, the lowest interest rate for bonds of that maturity sold in the U.S., according to Dealogic, the data tracker. The sale beat the previous record low of 2% in 10-year notes set by 3M in June… IBM debt was priced at less than half a percentage point over that of the benchmark U.S. 10-year Treasury note. (FT)

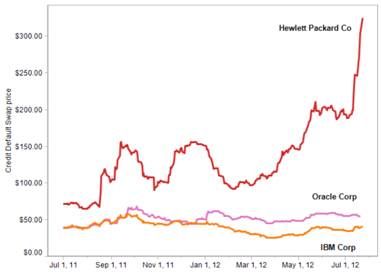

But at HPQ, bond investors are more concerned with return of capital, not return on capital…

(AllThingsD)

Have your 6 year old draw the next market move…

(Bespoke)

As for the markets this week, here were the most interesting movers:

- Spain/EWP +8.0% (thank you Mario Draghi)

- Italy/EWI +5.3%

- Semis/SMH +5.0%

- Biotech/IBB +3.8% (now +32% YTD!)

- Financial/XLF +2.8%

- Gold/GLD +2.7% (massive ECB and Fed stimulus on the horizon?)

- Euro/FXE +1.7%

- Large Cap/SPY +1.7% > Nasdaq100/QQQ +1.1% > Small Cap/IWM +0.6%

- Materials/XLB -0.8%

- China 25/FXI -1.0%

- 20+ Yr Treasury/TLT -1.7%

- Oil/USO -1.9%

- Apple/AAPL -3.2% (earnings light)

- Facebook/ FB -17% (little to get excited about)

- Ugly basket of growth stocks (ZNGA -30%, NFLX -31%, CMG -28%)

@drewber: The company that made a game that allows you to farm fake digital vegetables isn’t turning a profit. I, for one, did not see that coming.

Still think the markets are efficient?

BP is one of the world’s leading international oil and gas companies, with over 80,000 employees and $375 billion in annual revenues. BP’s market capitalization is $125 billion. During one day of trading last week, starting at 10:20:04.750AM and lasting just 2.25 seconds, the stock of BP rocketed 3% in value. It stayed there for about a half a second, then promptly dropped 2% over the next 2.25 seconds. Almost 600,000 shares traded during the rally and about 200,000 shares traded during the drop that followed. Based on the high participation of ISO orders (both up and down), this looks like a case of HFT algos spinning out of control, just 11 minutes before the crude inventory report. Just how out of control was this 2.25 second 3% rally? Over the last 2 years BP’s trading range over the entire day (23,400 seconds) averaged 1.8%. And on 92% of those days, BP’s daily high-low range was less than what HFT achieved in 2.25 seconds.

Earnings comments last week skewed negative:

- UPS – “economies around the world are showing signs of weakening and our customers are increasingly nervous. In the U.S., uncertainty stemming from this year’s elections and the looming fiscal cliff are constraining the ability of businesses to make important decisions such as hiring new employees, making capital investments, and restocking inventories. This will further restrict economic growth. In fact, this is already evident as June’s manufacturing ISM and growth in retail sales numbers were the worst we have seen since 2009.”

- Dow Chemical warned that it saw marked deterioration in global economic activity throughout the second quarter.

- Caterpillar – The U.S. Federal Reserve’s balance sheet expansion in the first half of 2010 benefited the economy, but those gains seem to be slowing. Banks are expanding credit at a moderate rate, but money growth is slowing. We have not detected much benefit to economic growth from the central bank’s policy of lengthening the maturity of its securities…Eventually, we expect the U.S. Federal Reserve will resume expanding its balance sheet, but not soon enough to benefit growth in 2012. We believe modest recovery will continue in the United States, with economic growth slowing to slightly more than 2% in 2012.

- Ford says it will cut 2012 capital spending to ~$5B from $5.5-$6B.

- Apple CEO Tim Cook explaining why overall iPhone sales were so disappointing… In terms of what we see happening in the different geographies, the U.S. was very strong, running at 47% [year over year growth], Japan was strong at 45%. I’ve already mentioned Greater China was up 66%, but Mainland China was over double as I said before, it’s over 100% up. The geography that did not perform well was Europe. Europe was essentially flat, slightly positive year-on-year and that really hampered our total results. The U.K. was relatively solid at 30% growth, but France and Greece and Italy were particularly poor, and Germany was ultimately a single-digit positive growth for the quarter.

- Texas Instruments – “Although we believe customers and distributors have low inventory levels, the global economic environment is causing both to become increasingly cautious in placing new orders. Our backlog grew last quarter but orders slowed in the month of June and our backlog coverage for September is lower than normal. As a result of this increased uncertainty, we currently estimate that our revenue in the third quarter will be about even with last quarter and below our seasonal average growth rate”

- Starbucks – “We did see slowing in June amid a weakening consumer environment. Traffic trends are noticeably down in many areas across the U.S. and the traffic trends have continued in July… it was ‘really broad based, there were no specific individual parts of the business or geography across the U.S. that we could point to. There was just a very overarching change.” CEO Howard Schultz said: “I’m on the phone talking to many other heads of companies that are in the consumer/retail space and we’re comparing notes about what’s going on. I think what we’re all experiencing with very few exceptions, Whole Foods being one of them, that most of everyone that we’re talking to has almost a similar pattern that mirrors what we just explained in June and July. So this is not a Starbucks issue. This is a macro problem.”

- Whole Foods – “In an economic environment that is proving to be difficult for many retailers, we are thriving and pleased to report another quarter of strong growth and excellent results for our stakeholders.” (reported Same Store Sales +8%)

- “Amazon Prime is now the best bargain in the history of shopping – that is not hyperbole.”

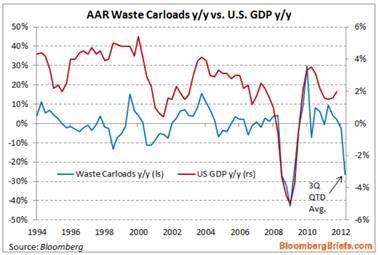

Railroad Waste Carloads often give a direction of economic moves…

(@M_McDonough)

Economic thoughts from top performing hedge fund firm, Bridgewater…

Global growth has slowed to about 1.9% “in the past few months” from around 3.3% as Europe deleverages and China’s economy is cooling, the Westport, Connecticut-based firm estimated in its second-quarter report, a copy of which was obtained by Bloomberg News. Bridgewater also said the European debt crisis has been poorly managed, bringing Europe closer to a “debt implosion” or a currency collapse. “The breadth of this slowdown creates a dangerous dynamic because, given the inter-connectedness of economies and capital flows, one country’s decline tends to reinforce another’s, making a self-reinforcing global decline more likely and a reversal more difficult to produce,” Bridgewater said in the report. (Bloomberg)

And now from John Paulson…

Billionaire hedge-fund manager John Paulson told clients he sees a 50% chance the euro will unravel, said an investor who listened to the comments. An event causing a breakup may happen in three months to two years, Paulson said on a conference call today reviewing second-quarter performance, according to the investor, who asked not to be named because the call was private. Paulson, who runs Paulson & Co., said he expects sovereign yield spreads to widen. Paulson, who posted a 16% loss from one of his largest funds in the first half of the year, told clients in February that Greece may default by the end of this March, and said the European currency is “structurally flawed and will likely eventually unravel.” (Bloomberg)

“Extraordinary low yield levels cannot meet the long-term return expectations for anyone.”

Blackrock CEO, Larry Fink (FT)

Retiree’s investment income has been hurt by falling rates, but now is looking to get punched by higher taxes…

If Congress fails to act, tax rates for investment income will soar beginning Jan. 1, 2013. The top tax rate on capital gains will jump to 23.8% from 15% and the top rate on dividends will nearly triple to 43.4% from 15%. The House of Representatives is considering legislation to extend the current 15% tax rate on investment income for one year. But the Senate plan, scheduled for a vote this Wednesday, would raise the top tax rate on capital gains and dividend income to 23.8% for individuals making more than $200,000 per year and joint filers earning more than $250,000. (WSJ)

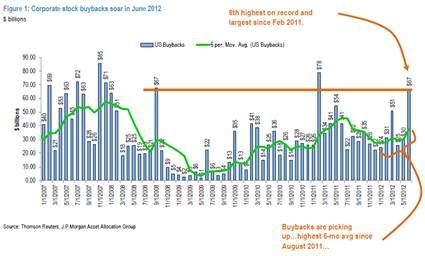

While retail investors have pulled $40b YTD out of equities, corporations have bought $226b YTD…

The market size of wealth assets in America = $58 trillion…

$ 38,000,000,000,000 Private wealth, North America

$ 16,080,000,000,000 Public and private U.S pensions

$ 600,000,000,000 U.S. foundation assets

$ 408,000,000,000 U.S. endowment assets

$ 500,000,000,000 Misc U.S. tax-exempt institutions, health systems, unions

$ 2,560,000,000,000 U.S. public charities

$ 58,148,000,000,000 Grand total U.S. investable wealth

(AllAboutAlpha)

Old Movie Quote of the week:

“You wasted $150,000 on an education you coulda got for $1.50 in late fees at the library.” –Matt Damon ‘Good Will Hunting’ 1997

Tweets of the week:

- @PIMCO: Gross: Citi’s Weill now prefers to break up big banks. Well done Sandy – “C” trades at 10 cents on your 1998 merger dollar.

- @GSElevator: MD#1: Hey, go ask Sandy Weill what was a better taxpayer investment, Goldman Sachs or General Motors?

- @jack: “I fear not the man who has practiced 10,000 kicks once, but I fear the man who had practiced one kick 10,000 times.”―Bruce Lee

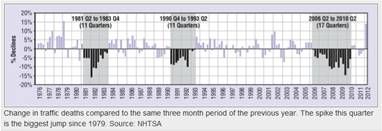

Big jump in traffic deaths due to mobile devices? Or just a random spike?

(DC Streetsblog)

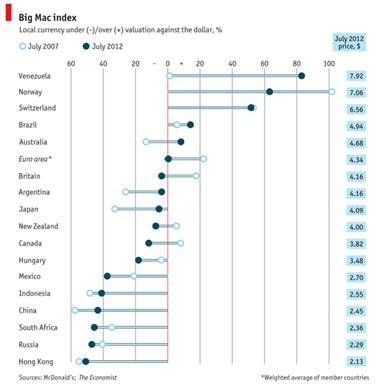

Go Long Big Macs in S. Africa and Russia. Short Big Macs in Switzerland.

(Economist)

Wall Street going long residential rental homes…

Kenneth Rosen, a UC Berkeley professor who has a consulting firm that advises real estate investors, says he knows of two dozen investment funds in the process of buying up single family homes, a number of which are hoping to own as much as 10,000 homes around the country. He predicts there could be as many as a dozen public REITs in the next few years that are devoted to single family homes… The funds aren’t betting on home prices shooting up. The hope is to buy foreclosed homes at a discount, fix them up, and then rent them for a profit. But Blackstone’s Gray says his firm’s plan is to eventually sell the houses for a profit when the economy improves to the point where those who have become renters can afford to buy again, or when the banks really start lending again. (Fortune/CNN)

40% of the corn crop goes to ethanol production. Gas tanks > Stomachs?

“Beef is simply going to be too expensive to eat. Pork is not going to be too far behind. Chicken is catching up fast,” said Larry Pope, chief executive of Smithfield Foods. “Are we going to really take protein away from Americans?”… “I’ll use the word catastrophe – that’s my definition,” Mr. Pope told the Financial Times in an interview… “I thought that $6 corn was end of the world,” said Mr. Pope, who has worked at Smithfield more than three decades. “I never could have realized that I would be thankful to be buying it at $7.” (FT)

Tough news for iPhone customers looking to upgrade, but great news for accessory makers…

The iPhone 5, Apple’s next generation iPhone expected to go on sale around October, will come with a 19-pin connector port at the bottom instead of the proprietary 30-pin port “to make room for the earphone moving to the bottom”, two sources familiar with the matter told Reuters. That would mean the new phone would not connect with the myriad of accessories such as speakers and power chargers that form part of the ecosystem around iPods, iPads, and iPhones, without an adaptor. (Reuters)

And you will be surprised at how little electricity your i-devices consume…

Consumers who fully charge their iPad tablet every other day can expect to pay $1.36 for the electricity needed annually to power the device, according to an assessment by the Electric Power Research Institute (EPRI)…The EPRI analysis shows that the Apple iPhone 3G consumes 2.2 kWh of electricity each year, which results in a power cost of $.25 annually…

Other products that were included in the analysis were laptop PCs, which consume 72.3 kWh of electricity each year and cost consumers $8.31 and 60W CFL light bulbs which consume approximately 14 kWh of electricity and cost consumers $1.61 a year. (EPRI)

Oftentimes Mr. Fix-It doesn’t win the popularity award…

When Mr. Romney arrived, the Games were running $387 million short of reaching their planned budget of $1.45 billion… Rather than treating the committee board to their customary lunches, Mr. Romney sold them Domino’s pizza at $1 a slice, Mr. Bullock recalled. Games sponsor Coca-Cola supplied unlimited free soda, but Mr. Romney sold the drinks at 25 cents a can. “Every line item in the budget was classified as ‘must’ or ‘nice to have,’ ” Mr. Bullock said, and “nice to have” was chopped. Mr. Romney instead identified twin areas of focus: the needs of athletes and making sure the Games were widely televised. The Games ended up with a $100 million surplus, a number that included $65 million in cash and contributions of computers and food that were distributed to the community… The Romney approach turned off some Utahns, said former Utah Sen. Bob Bennett, a Republican. “After it was all over, a few people complained that Mitt and his team were a little heavy-handed, a little pushy, but given the circumstances, you take charge and you get it done,” Mr. Bennett said. (WSJ)

@jowyang: Branding War: Fedex 1, UPS 0

@SteveMartinToGo: There’s a new reality show on NBC called “The Olympics.” The judges need to bicker more and berate the contestants.

(AP Photo/Markus Schreiber)

Biggest story of the Olympics so far is…Twitter

Sports fans attending the London Olympics were told by Olympic bosses on Sunday to avoid sending non-urgent text messages and tweets during events because an overloaded network was affecting television coverage. Coverage of the men’s road cycling race on Saturday left many viewers in the dark at times, including details on how far back the chasing pack was from the leaders. Commentators were unable to get timing information due to issues surrounding the communications network of the GPS satellite navigation system. It was particularly annoying for the home crowd, who had tuned in to watch what had been billed as one of Britain’s best chances of winning an early gold medal with sprint king Mark Cavendish. (Reuters)

But, 80 Heroes waiting to be born…

Of 204 countries attending the 2012 Olympics, 80 have never won any medal. Of six Central American countries lying between Mexico and Panama, only one (Costa Rica) has won even a single medal. Albania, Yemen, Bolivia, Jordan, Cambodia, Fiji, Nepal, Somalia and the two Congos have never medaled either. And it’s not for lack of trying. One or more Congos have competed at the Olympics since 1964; Bolivia has been going to the Games since 1936. (WSJ)

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

361 Capital Research Briefing Archive

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/07/31/361-capital-weekly-research-briefing-8/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2012/07/31/361-capital-weekly-research-briefing-8/ […]

… [Trackback]

[…] Here you can find 13904 additional Information on that Topic: thereformedbroker.com/2012/07/31/361-capital-weekly-research-briefing-8/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/07/31/361-capital-weekly-research-briefing-8/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/07/31/361-capital-weekly-research-briefing-8/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2012/07/31/361-capital-weekly-research-briefing-8/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/07/31/361-capital-weekly-research-briefing-8/ […]

… [Trackback]

[…] Read More Info here to that Topic: thereformedbroker.com/2012/07/31/361-capital-weekly-research-briefing-8/ […]

generic cialis 20 mg tadalafil

USA delivery

buy cialis in miami

Health