I’ll be appearing live on the New York Times website, talking about the LIBOR Scandal with Peter Lattman, at 10am. You’ll be able to watch it live here:

http://www.nytimes.com/pages/business/index.html

In the meantime, I want to just crystallize what I believe to be the two reasons this all matters and then the one reason why, in the end, it will probably not.

1. This is perhaps the biggest case of market manipulation in world history. The WSJ has calculated that LIBOR rates affect some $800 trillion in loans, agreements, financings and other financial transactions around the globe. Eighteen of the world’s largest banks (including Citi, BAC and JPM) submit numbers that go into the LIBOR rate calculation and then billions of people, governments, municipalities and corporations directly or indirectly transact business based on that (ie: Yes, Mr. Jones, we can lend you the money at LIBOR + 3%). In other words, the systemic quicksand the world’s financial system rests upon is still in force when such a small group of people can mess with a rate that affects so many.

2. The culture of unmitigated greed and deceitfulness is alive and well, no one has learned anything. There were two types of manipulation and potential fraud happening with LIBOR:

The first involved individual traders, at Barclays for example, asking the bank’s rate information submitters to fudge the numbers in order to reap immediate gains in whichever particular investment strategy or holding they were working with at the moment – and it was brazen, the emails contained collegial “done for you, big boy” backslaps and promises like “I’m opening a bottle of Bollinger for you” from the traders to the submitters. Nice.

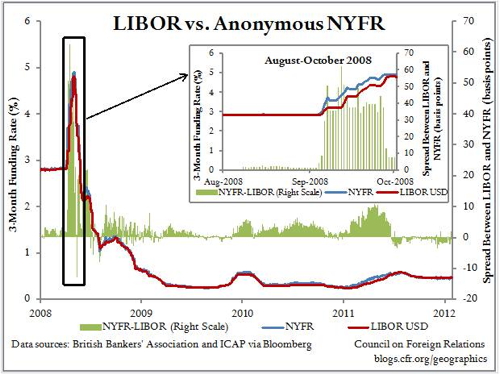

The second type of manipulation is significantly more shocking and it has already brought down three top executives at Barclays. It involves the bank knowingly manipulating the rate so as to create the appearance that the institution was healthier than current interbank lending activity would actually display during the dark days of 2007 and 2008. LIBOR, unlike the NYFR version in New York, is not anonymously submitted – so it behooves the banks to manipulate it lower in times of stress because the higher the rate, the more unwilling to lend the banks appear to be. The most disturbing part of this is that there are emails from politicians and regulators turning up in which it is hinted that Whitehall (the British government) would like to see Barclays not quite report in such a way as to make rates look too high. Matt Taibbi in Rolling Stone likens these requests to a proper British gentleman attempting to secure the services of a prostitute without actually using any dirty words. And if the British government and banking/regulatory authorities were winking toward this activity by Barclays in the heat of the maelstrom, how likely is it that our banks and their overseers weren’t doing the exact same thing?

OK, so that’s why this is a very big deal. Now let me tell you why it probably won’t mean anything:

3. It may not be going anywhere after all.

Barclays may have been the worst offender and it has already acccepted decapitation (Diamond resigned), disgorgement (Diamond walked with $3 million instead of his owed $31 million bonus) and penalty (Barclays paid $450 million to settle with authorities). In other words, the regulators may have already gotten their big fish after only a few years of investigation.

Also, everyone was probably doing this amongst the big banks to varying degrees. How do we know? The smoking gun is this chart from the Washington Post:

The chart above shows the difference between the anonymous rate setting done by the NYFR versus the dressed-up version being carried out at LIBOR, in which banks BS their way to lower rates during the crisis. WaPo calls it a smoking gun and I agree.

Also, there is a great deal of evidence that by manipulating rates lower, the big banks may have inadvertently did everyone a huge favor by keeping the borrowing costs of municipalities, home buyers, students and commercial interests artificially low. How ferociously will they be prosecuted for that in the court of public opinion? Exactly – it’s manipulation but “the good kind” so let’s let sleeping dogs lie. That way Americans can go back to their Kardashian Sundaes with whipped cream and Bieber sprinkles on top.

Mark Gongloff makes the case that the furor over LIBOR is so subdued because understanding it involves math, and people hate that shit. I think he’s right.

Anyway, join me at the NY Times site at 10 am for my rant.

… [Trackback]

[…] Here you can find 12021 more Information to that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] Find More here on that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] Information to that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] Find More Information here to that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] Read More on on that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] There you will find 71952 more Info on that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] Here you can find 17486 additional Info to that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

… [Trackback]

[…] Read More here on that Topic: thereformedbroker.com/2012/07/12/two-reasons-the-libor-scandal-matters-and-one-reason-it-doesnt/ […]

buy cialis very cheap prices fast delivery

SPA

cialis in europe

American health