I like stocks here.

I have no idea what the stock market is going to do in the second half of this year. Neither do you. I have no S&P 500 target that means anything other than a guess. If you’re in search of pretended clairvoyance, there are no shortage of people who will give it to you.

But I have something more valuable than that nonsense for you. I have a reasoned, mature, rational list of ten reasons I prefer owning stocks to not owning stocks for the second half of this year. I am not saying I hold nothing else besides stocks nor am I inferring that I’m all in. I could easily lay out ten reasons to avoid stocks (because I read and have a pulse) but I feel the case to be long is more compelling. Here’s why:

10. Pessimism is now the base case scenario. This means that any positive news, from any quarter, should have an outsized effect on asset prices. Take housing for example – a more important cog in the wealth effect wheel than any other facet of the economy (housing is 10X more important to American confidence, employment and spending than the price of the Dow Jones Average). Anyway, the housing market is alive. It’s good not great, but it’s on the upswing and no one believes it. What happens when they do?

9. The negatives are more well-known than ever. My dad can quote the debt levels of several sovereign countries and his secretary can tell you the yields on their bonds. Remember that civilians become experts in things at major inflection points – often just before the turn. Think about the conversations you find yourself having with non-market people about how bad things are about to get.

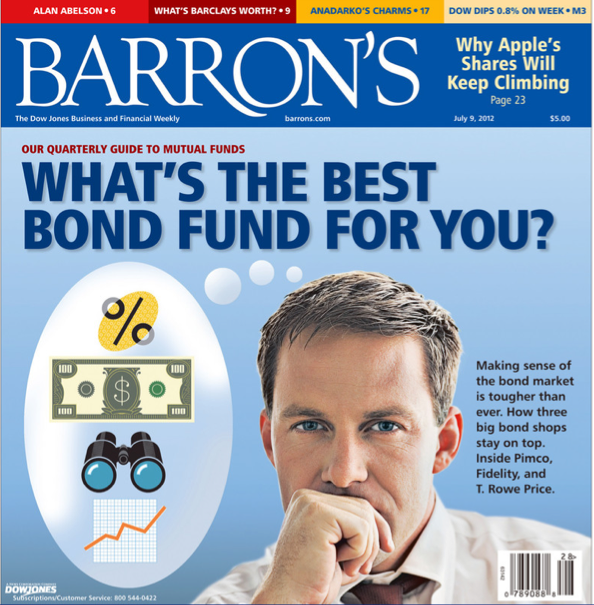

8. The fetishization of bond funds is rounding the corner, headed down the home stretch. In the second quarter just ended, the iShares investment grade corporate bond fund ($LQD) had the highest of all ETF inflows at $2.5 billion, the runner-up was Vanguard’s total bond index ETF ($BND) with $2 billion. Here’s the cover of Barron’s this week, after a year of record outflows from equity mutual funds and record inflows for bond funds:

7. $100 in S&P earnings doesn’t feel like a major stretch. And if we can do it, we’re talking about a 12 or 13 multiple on those numbers, nothing special. Please spare me the stuff about peak profit margins. We get it. But with weakening commodities keeping costs low and cheap, available labor capacity, there’s no reason to expect margins to nosedive off a cliff.

6. Central banks around the world are no longer debating inflation vs deflation and whether or not to ease up. The new debate is whether or not to cut to zero or to some negative integer below zero. The punch bowl has been dumped out, rinsed clean and filled with GHB and hits of ecstasy. This isn’t your father’s central banking activity and these guys aren’t playing around.

5. What about Europe? Fuck Europe.

4. No seriously, what about Europe? I want you to look at Ireland. They are back in the debt market as of last week and proving that there is life after death – they are raising capital at a lower interest rate than Spain. This is happening very soon after the November 2010 wipeout/bailout of $85 billion. It’s quite a comeback story and could serve as a road map for countries like Spain and Portugal. No one is talking about it, but this is of immense symbolic importance.

3. Wall Street strategists hate stocks more than at any time in my career. From BAML:

After triggering a Buy signal in May, our measure of Wall Street bullishness on stocks declined again, marking the ninth time in eleven months that the indicator has fallen. The 0.8ppt decline pushed the indicator down to 49.3, the first time below 50 in nearly 15 years, suggesting that sell side strategists are now more bearish on equities than they were at any point during the collapse of the Tech Bubble or the recent Financial Crisis.

Have you heard this stat before in the past week? Good, it’s an important one. This is a highly contrarian signal, I know these guys and they’re idiot savants. They get the numbers right but always miss the meaning.

2. What about China? Wake up, it’s already crashed. Have you seen the Shanghai Comp lately? The other indexes have begun teasing it on the playground at recess, calling it “New Low Joe.” I’m more worried about China than most people and have been vocal about the risks emanating from the People’s Republic of Madoff for years now. But China has more levers to pull in the short-term and the pessimism surrounding it may be at a short to intermediate term peak.

1. Now here’s where market mechanics and enthusiasm take away your nerf football and run it back past the parked cars for a TD. Apple is coming back in the second half with one of its biggest product cycles ever – the iPhone 5, the iPad Mini and more details about how they’re going to save/revolutionize television. Plus, the real push into you-know-where with the help of China Mobile (which has, oh, I don’t know, a billion subs?). Apple is a huge chunk of 2 of our 3 most important indexes and it is a market mood ring. You don’t want to sleep on a tape that features a resurgent leader like $AAAAAAAAAAAAPL tearing shit up once again.

So yeah, I know how much everything sucks, I eat, sleep and breathe the it on this blog for you guys 7 days a week (I’m writing this post at 2 o’clock in the morning, FYI). But I think the negatives have now become accepted and obvious, though I dare not say “priced in.” And while I have no idea where the whole market is going, I have stocks/sectors on my screen taking bad news in stride and creeping up past new year highs ($BRK-B), decade highs ($WMT) and all-time highs ($XBI).

So I’m sticking around to see what happens next.

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2012/07/09/ten-reasons-i-like-stocks-for-the-second-half/ […]

… [Trackback]

[…] Here you will find 60272 more Information on that Topic: thereformedbroker.com/2012/07/09/ten-reasons-i-like-stocks-for-the-second-half/ […]

… [Trackback]

[…] Read More to that Topic: thereformedbroker.com/2012/07/09/ten-reasons-i-like-stocks-for-the-second-half/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/07/09/ten-reasons-i-like-stocks-for-the-second-half/ […]

… [Trackback]

[…] Find More here to that Topic: thereformedbroker.com/2012/07/09/ten-reasons-i-like-stocks-for-the-second-half/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2012/07/09/ten-reasons-i-like-stocks-for-the-second-half/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2012/07/09/ten-reasons-i-like-stocks-for-the-second-half/ […]

… [Trackback]

[…] Read More Information here on that Topic: thereformedbroker.com/2012/07/09/ten-reasons-i-like-stocks-for-the-second-half/ […]

… [Trackback]

[…] Find More Info here to that Topic: thereformedbroker.com/2012/07/09/ten-reasons-i-like-stocks-for-the-second-half/ […]