361 Capital portfolio manager, Blaine Rollins, CFA, previously manager of the Janus Fund, writes a weekly update looking back on major moves, macro-trends and economic data points. The 361 Capital Weekly Research Briefing summarizes the latest market news along with some interesting facts and a touch of humor.

361 Capital is a provider of alternative investment mutual funds, separate accounts, and limited partnerships to institutions, financial intermediaries, and high-net-worth investors.

***

May, 28 2012

By: Blaine Rollins, CFA

It was a good week for the markets, so let’s look right at the top concern…

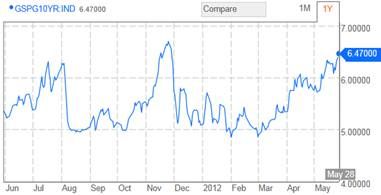

This is a chart of the Spanish 10 year bond yield. As it headed toward 6.0% in April, the global markets sold off. Now as it nears 6.5%, the markets will be looking for immediate moves in Spain and the EU for a plan to fix the Spanish banking system. Several things are currently in the works, but the market needs action soon.

Meanwhile, even more talk and worries about a Grexit…

- Greece will leave the euro zone next year and the country’s new currency will “immediately fall by 60 percent,” according to Citi chief economist Willem Buiter. “The elections (on June 17th) will not produce a viable government that can follow the troika plan, leading to a stalemate between the Greek government and official creditors, and to the suspension of EFSF-IMF funding,” Buiter wrote in Citi’s latest Global Economic Outlook. (CNBC)

- “Income within Europe is shifting. It’s being redistributed. It’s being redistributed from the financial creditors, think the banks. And let’s keep it local like Germany. The trade really, is you want to be short the financial sector and you want be long the export sector. Because I think we all agree that where we’re heading for is probably euro parity with the dollar if not going below that, which is a profound economic advantage to what are already super competitive businesses. And of course that only happens if we get more financial anarchy, and of course that’s going to help your short position.” (Hugh Hendry at the Milken Conference)

…which is having a punishing effect on Greek tourism…

For the last couple of weeks, the phone at Tasos Ioannidis’s five-star hotel on the breezy island of Mykonos has been ringing steadily, but not with the types of inquiries he wants to field. “People are saying they don’t want to confirm a stay or make deposits,” said Mr. Ioannidis, who owns the luxurious Belvedere Hotel, perched on a cliff over the Aegean Sea. “They are afraid of what could happen to their money if Greece leaves the euro and returns to the drachma.”…“A return to the drachma would be a nightmare,” said Mr. Ioannidis, whose bookings began to trail off a few months ago and slumped badly after the election. “It would create a panic for businesses and also for people wanting to do business with Greece.” (NYTimes)

Christine Lagarde will find it difficult to find a good meal in Athens after these comments…

“Do you know what? As far as Athens is concerned, I also think about all those people who are trying to escape tax all the time. All these people in Greece who are trying to escape tax.” She says she thinks “equally” about Greeks deprived of public services and Greek citizens not paying their tax. “I think they should also help themselves collectively.” Asked how, she replies: “By all paying their tax.”…”I think more of the little kids from a school in a little village in Niger who get teaching two hours a day, sharing one chair for three of them, and who are very keen to get an education. I have them in my mind all the time. Because I think they need even more help than the people in Athens.” (Guardian)

PALM

PALM

And then there was the other big story of the week and month…

For the Wall Street Journal alone, Facebook has been featured in front page (A1) headlines and/or pictures on 11 of the 22 issues so far this month. In fact, Friday was the first day since May 15th that the company was not featured on the cover, ending a streak of nine straight issues. We’re not even sure if Lehman was featured that many days in a row back in September 2008! (Bespoke)

But with all the negativity, one billionaire stepped up and bought 150,000 shares…

“It’s a trade, not an investment,” Cuban says. “Kind of like buying a Mickey Mantle, a Hank Aaron and a Barry Bonds rookie card knowing there is a card show in town next week.” (BlogMaverick)

And new data shows that Facebook has been a boom to the industry of divorce…

More than a third of divorce filings last year contained the word Facebook, according to a U.K. survey by Divorce Online, a legal services firm. And over 80% of U.S. divorce attorneys say they’ve seen a rise in the number of cases using social networking, according to the American Academy of Matrimonial Lawyers. “I see Facebook issues breaking up marriages all the time,” says Gary Traystman, a divorce attorney in New London, Conn. Of the 15 cases he handles per year where computer history, texts and emails are admitted as evidence, 60% exclusively involve Facebook. (SmartMoney)

Some big RISK-ON bounces in the ETFs last week:

- Gold Miners/GDX +7.9%

- Home Builders/XHB +6.5% (data points continue to grow positive)

- Apple/AAPL +6.0%

- Dow Transports/IYT +4.4% (positive Dow Theory sign)

- Biotech/IBB +3.9%

- Retail/XRT +3.9%

- Materials/XLB +3.8%

- Small Cap/IWM +2.6% > Nasdaq/QQQ +2.0% > Large Cap/SPY +1.8%

- 20+ Yr U.S. Treasury Bond/TLT -0.9%

- Oil/USO -1.0%

- Gold/GLD -1.3%

- Euro/FXE -1.7%

- Spain/EWP -2.3%

- Thailand/THD -3.9%

- Natural Gas/UNG -6.9%

Interesting to note that the election year market trend looks to be close on track…

(Bespoke)

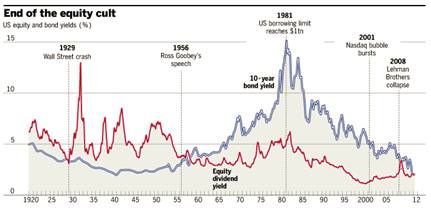

Meanwhile, more reports of the Death of Equities…

Allianz, with a total of about €1.7tn under management, has only 6 percent of its insurance portfolio in equities, while 90 percent is in bonds. A decade ago, 20 percent was in equities. It is far from alone: institutional investors, from pension funds to mutual funds sold directly to the public, have slashed holdings in the past decade. Stocks have not been so far out of favor for half a century. Many declare the “cult of the equity” dead. (FT)

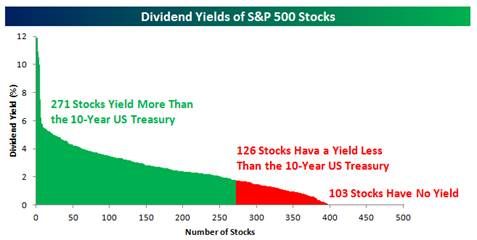

Plenty of stocks to buy that now yield more than the 10 year U.S. Treasury…

Bespoke

If you look at the price of DELL, you would think that the casket has been ordered…

By my calculations, DELL is trading at less than 4 times Free Cash Flow. Either the PC business is dead forever or there is a private equity investment about to be made. (2014 estimates: Revs = $60b, Net Income = $3.5b, FCF = $4.4b, Net Cash = $5b, Shares Out = 1.75b. So at $12.50 per share, DELL trades < 4x FCF.)

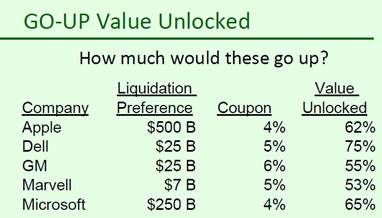

David Einhorn sees the same large FCF in large cap tech and is suggesting they issue preferred stock to unlock the value…

(GreenlightCapital)

Investors continue to leave Equity Funds and are now starting to pull back on Bond Funds, especially High Yield…

Net outflow resumed from U.S. focus equity funds this week, as the equity markets continued to fall. Plugging in official ICI flow data for March, and including our estimates for April and May, brings YTD outflow to $31.9 billion. This is currently running more than double the net outflow recorded near the end of May 2009. A majority of YTD outflow is coming from Large Cap Index funds, which have seen $35.2 billion in outflows so far in 2012. Aggressive and Small Cap funds are also seeing net outflow to a lesser extent YTD. Foreign equity funds, on the other hand, have an estimated $17.3 billion of net inflow YTD. Bond mutual funds experienced a weekly net outflow for the first time in 2012. (Leuthold Group)

Wellington is a great, employee owned asset manager. They just closed their High Yield Fund. Take notice…

“Due to a sharp increase in cash flow into Vanguard High-Yield Corporate Fund—more than $2 billion in the last six months alone—we’ve closed the Fund to most new investors. While issuance of high-yield securities remains strong (the first quarter of 2012 saw the highest amount on record), we remain sensitive to the potential liquidity challenges that can arise in the market. Because of this potential, we’ve determined that limiting cash flow into the Fund is in the best interest of its existing investors.” (Vanguard)

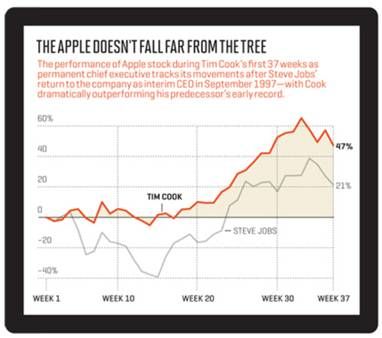

New CEO of Apple actually outperforming his predecessor…

(Fortune)

Housing continues to improve as Toll Brothers told us last week via a +47% increase in unit orders…

“It appears that the housing market has moved into a new and stronger phase of recovery as we have experienced broad-based improvement across most of our regions over the past six months. The spring selling season has been the most robust and sustained since the downturn began. Even now, for the first three weeks of May, our non-binding reservation deposits, a leading indicator of future contracts, are running 39% ahead on a gross basis, and 23% ahead on a per-community basis, compared to last year’s same May period.”…“In some locations, it is no longer a buyer’s market; in a few locations it’s even a seller’s market”. (Douglas Yearley, Jr., Toll Brothers’ CEO)

Even Las Vegas is building homes as fast as they can find workers…

Las Vegas homebuilders can’t build houses fast enough these days to keep up with buyers’ demand. Yes, you read that right. The valley’s new home market is booming. Developers say they haven’t built, or sold, so many houses in years…Applications for new home permits in Henderson, North Las Vegas, Las Vegas and Clark County have increased 40 percent from last year, according to Home Builders Research. Prices have risen 6 percent to an average of $201,000, and sales have jumped 20 percent. By June, experts expect to see 500 new-home closings a month…A shrinking inventory of existing homes in the valley is forcing buyers who might typically prefer older homes to buy new. There are 20 percent fewer single-family homes available on the Multiple Listing Service today than last year. There are 30 percent fewer condos and townhouses. Properties that a year ago would have sat on the market for weeks or months are now getting as many as 15 offers, Kelley said. List prices have become minimums. Most existing homes are selling for thousands more…Perhaps the biggest winners in the revived housing market are construction workers, particularly specialists. Framers, for example, are in high demand. Many left the state when the housing market deflated, and the ones who stayed took jobs in other fields. Now, homebuilders are entering bidding wars to hire those who are left. (VegasInc)

As natural gas production grows and prices fall, U.S. air quality is getting healthier…

The shale gas boom in the U.S. has led to a big drop in its carbon emissions, as power generators switch from coal to cheap gas. According to the International Energy Agency, U.S. energy-related emissions of carbon dioxide, the main greenhouse gas, fell by 450m tonnes over the past five years – the largest drop among all countries surveyed. Fatih Birol, IEA chief economist, attributed the fall to improvements in fuel efficiency in the transport sector and a “major shift” from coal to gas in the power sector. “This is a success story based on a combination of policy and technology – policy driving greater efficiency and technology making shale gas production viable,” Mr. Birol told the Financial Times. (FT)

…And dying, rural towns are seeing an economic resurgence…

It doesn’t feel like we’re in Kansas anymore. Oil rigs are springing up in farmer’s fields. “No vacancy” signs hang in the windows of local motels, and a steady stream of trucks barrel through Main Streets. Along the state’s southern border, the once-quiet farm towns are quickly transforming into boomtowns. Hundreds of workers seeking high-paying jobs are flocking to places like Harper County, which had resorted to paying people to live there because of its declining population. Businesses are coming back from the dead and a housing shortage has caused rents to triple…”[The oil companies] aren’t hitting any dry spots,” said Mike Lanie, economic development director of Harper County. “This is looking like it could be the largest economic impact in the state’s history, and for many people in these small towns, this will be a blessing.” (Money)

What, no Herman Melville?

J.P. Morgan is pleased to offer you these 10 hand-picked books, chosen by colleagues across the globe for their inspirational messages, thought-provoking content and stunning detail. We invite you to explore and enjoy a few of this year’s most exciting titles. (JPMorgan Summer Reading List)

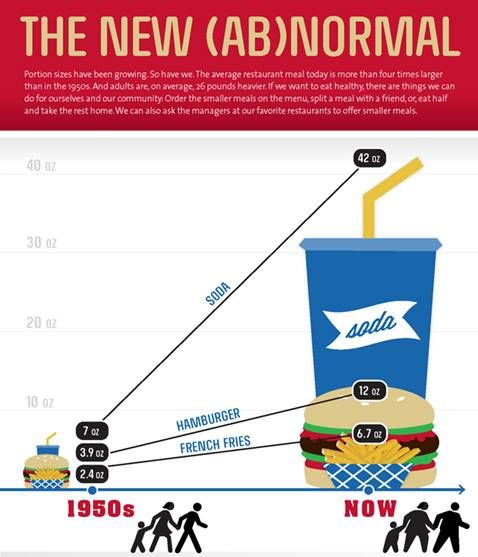

A chart to consider while you are stopping for food on those summer driving trips…

(http://makinghealtheasier.

Interesting tweets from the week…

- @Kurt_Vonnegut: Those who believe in telekinetics, raise my hand.

- @jack_welch: Just met my new friend Slash before going on Piers Morgan. Notice the resemblance?

Tiger poachers in India just had their heart rate elevated 25 beats per minute…

A state in western India has declared war on animal poaching by allowing forest guards to shoot hunters on sight in an effort to curb rampant attacks on tigers and other wildlife. The government in Maharashtra says injuring or killing suspected poachers will no longer be considered a crime. (NPR)

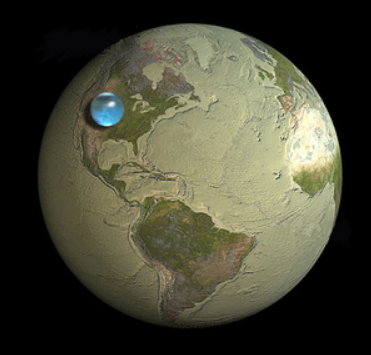

If you collected all of Earth’s water into a sphere, how big would it be?…Not that big…

(io9) w/hat tip to Brad

Blaine Rollins, CFA, is managing director, senior portfolio manager and a member of the Investment Committee at 361 Capital. He is responsible for manager due-diligence, investment research, portfolio construction, hedging and trading strategies. Previously Mr. Rollins served as Executive Vice President at Janus Capital Corporation and portfolio manager of the Janus Fund, Janus Balanced Fund, Janus Equity Income Fund, Janus Aspen Growth Portfolio, Janus Advisor Large Cap Growth Fund, and the Janus Triton Fund. A frequent industry speaker, Mr. Rollins earned a Bachelor’s degree in Finance from the University of Colorado, and he is a Chartered Financial Analyst.

In the event that you missed a past Research Briefing, here is the archive…

(http://361capital.com/

… [Trackback]

[…] Read More Information here to that Topic: thereformedbroker.com/2012/05/29/361-capital-weekly-research-briefing/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2012/05/29/361-capital-weekly-research-briefing/ […]

… [Trackback]

[…] Find More Information here on that Topic: thereformedbroker.com/2012/05/29/361-capital-weekly-research-briefing/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2012/05/29/361-capital-weekly-research-briefing/ […]

… [Trackback]

[…] Find More on to that Topic: thereformedbroker.com/2012/05/29/361-capital-weekly-research-briefing/ […]