Having lunch with Barry the other day (not salads) we got to talking about why it seems so hard for people to accept that the economic and stock market picture has grown darker over the last few weeks. What’s so bad about a correction or a consolidation period? What’s the harm in admitting that the Recovery is backsliding?

I always just assumed that the talking heads were perma-bullish for the money – most of them don’t get paid unless you’re fully invested (which is why there’s a “let’s put some money to work” bias in the asset management game). But Barry explained that it goes beyond that.

For starters, people have trouble saying one thing and then coming around and admitting that things have changed. There is a disconnect in the way our brains work which leads us to believe, on some level, that having new opinions is somehow a betrayal of our old opinions, even in the presence of fresh evidence. This is doubly true of those who predict and prognosticate in public for a living – they feel the need to be consistent lest they lose the role they’ve been cast in (perma-bull, doomsayer, wacky next-door neighbor etc).

In some cases, there’s a political angle to it as well. I had clients who said they would never buy a stock as long as Obama was president…I wonder how they’re doing these days. There are pundits who are funded by think tanks who pretend to be in the business of analysis but are really engaged in the art of slant and spin – positive or negative depending on who the paymaster is. There’s a regular guest in Kudlow’s menagerie who both cheerleaded the Bush stock market right off the cliff in 2007 only to predict the next Great Depression at the market’s lows early in Obama’s term.

But the main reason why so many people have such trouble reconciling improving or deteriorating economic data and stock market conditions is the Recency Effect. Barry says that because the wounds of 2008 are still so raw, people see the next 2008 in every setback. They forget that if we have a double-dip recession, it can be just a garden-variety recession. It doesn’t have to be another apocalyptic, world-stopping calamity.

Let’s say we do fall into a double dip as all that spent stimulus wears off, a regular recession without all the fireworks and institutional failures of the last one is not only possible, it is more likely.

In other words, think 1938 and not necessarily 2008.

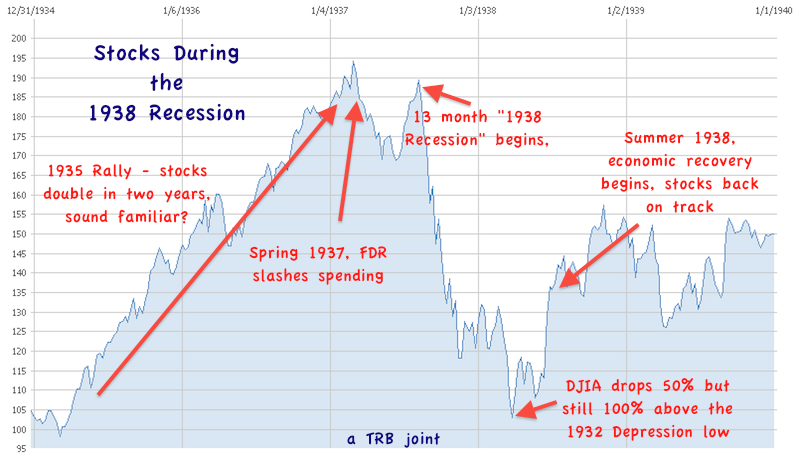

Here’s a killer annotated chart of the Dow Jones Industrial Average during the late 1930’s I whipped up for you guys…

Without having the ancient economist battle of what caused the US economy to recede in 1937-1938 (Keynesians say the cessation of Federal spending, Monetarists say the Fed tightened too soon), we can all agree that FDR did pull back on the two main programs (Works Progress Administration and Public Works Administration) in the spring of 1937 and that the Fed was hawkish.

The stock market had been steadily recovering from the depths of 1932 (the Dow had hit 56 that year) and from early 1935 through 1937 it staged a furious two-year rally that took the average from 102 to 186, a double (sound familiar?). When the first signs of a slowdown hit, there was a brief sell-off, followed by a sharp recovery in stocks – and then as the data worsened and the Fed sat on its hands, off the cliff the markets went.

But it wasn’t the end of the world, just a retracement of half the gains from the 1932 lows (but not all of them) and within 13 months, the economy regained its footing into the 1940’s (with a little help from Hitler and that sonofabitch Tojo).

The point is, the 1938 recession wasn’t pleasant (unemployment jumped from 14.3% up to 19% that year) and the stock market certainly felt it, but then life went on. Most of the spectacular corporate failures and life-altering, forced migrations had already occurred in the early part of that decade, 1938 was a mere shadow of that.

It’s too early to call a double dip recession as being imminent or inevitable, but it’s never too early to mentally prepare for one.

My advice is to stop thinking 2008 and instead start thinking 1938 or 1953 or 1969 or 1981, you get the drift. Not every slowdown is a crash and we are in a secular bear market after all.

… [Trackback]

[…] Find More to that Topic: thereformedbroker.com/2011/08/04/think-1938-not-2008/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2011/08/04/think-1938-not-2008/ […]

… [Trackback]

[…] Find More Info here on that Topic: thereformedbroker.com/2011/08/04/think-1938-not-2008/ […]

… [Trackback]

[…] Info on that Topic: thereformedbroker.com/2011/08/04/think-1938-not-2008/ […]

… [Trackback]

[…] Read More on that Topic: thereformedbroker.com/2011/08/04/think-1938-not-2008/ […]

… [Trackback]

[…] Read More on to that Topic: thereformedbroker.com/2011/08/04/think-1938-not-2008/ […]

… [Trackback]

[…] Info to that Topic: thereformedbroker.com/2011/08/04/think-1938-not-2008/ […]

… [Trackback]

[…] Information on that Topic: thereformedbroker.com/2011/08/04/think-1938-not-2008/ […]